Bill Personal Property Form With Insurance In Massachusetts

Description

Form popularity

FAQ

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings. These are considered to be real property.

In New York State, there is no personal property tax (a tax on personal items, such as cars and jewelry) on real property. What kinds of property are assessed? Every parcel of real property in an assessing unit, no matter how big or how small, is assessed.

The tax is calculated by multiplying the assessed value of the property by the personal property tax rate of the city or town. Personal property is assessed separately from real estate where it is located.

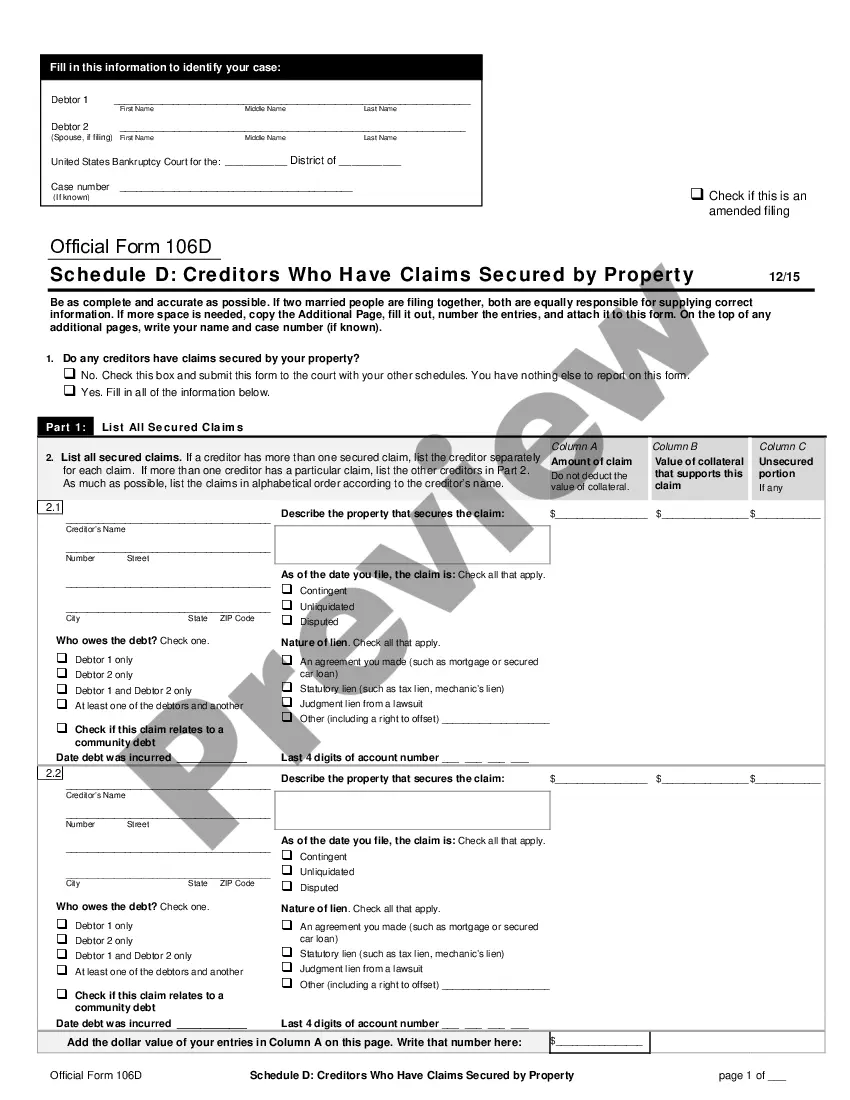

This Form of List (State Tax Form 2) must be filed each year by all individuals, partnerships, associations, trusts, corporations, limited liability companies and other legal entities that own or hold taxable personal property on January 1 unless required to file another local or central valuation personal property ...

Massachusetts levies an excise on each vehicle at the rate of $25 per $1,000 of valuation.

To be eligible for SCHE, you must be 65 or older, earn no more than $58,399 for the last calendar year, and the property must be your primary residence. The exemption must be renewed every two years. Learn more and get answers to frequently asked questions.

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property. Just as some loans—mortgages, for example—are secured by real property like a house, some loans are secured by personal property.

Mailing Addresses ReturnsExtension PaymentPayment Voucher Form 2: Mass. DOR, PO Box 7018, Boston, MA 02204 Form 2G: Mass. DOR, PO Box 7017, Boston, MA 02204 Form M-8736: Mass. DOR, PO Box 419544, Boston, MA 02241-9544 Form 2-PV: Mass. DOR, PO Box 419544, Boston, MA 02241-9544

What is considered personal property for local property tax purposes? Personal property generally includes tangible items that are not firmly attached to land or buildings and are not specially designed for or of such a size and bulk to be considered part of the real estate.