This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Property Sale Our For Nri In Maricopa

Description

Form popularity

FAQ

Property classified as Legal Class 4.1 is not listed as a registered rental but still does not receive the State Aid to Education Tax Credit. An example of a property in Legal Class 4.1 is a secondary home.

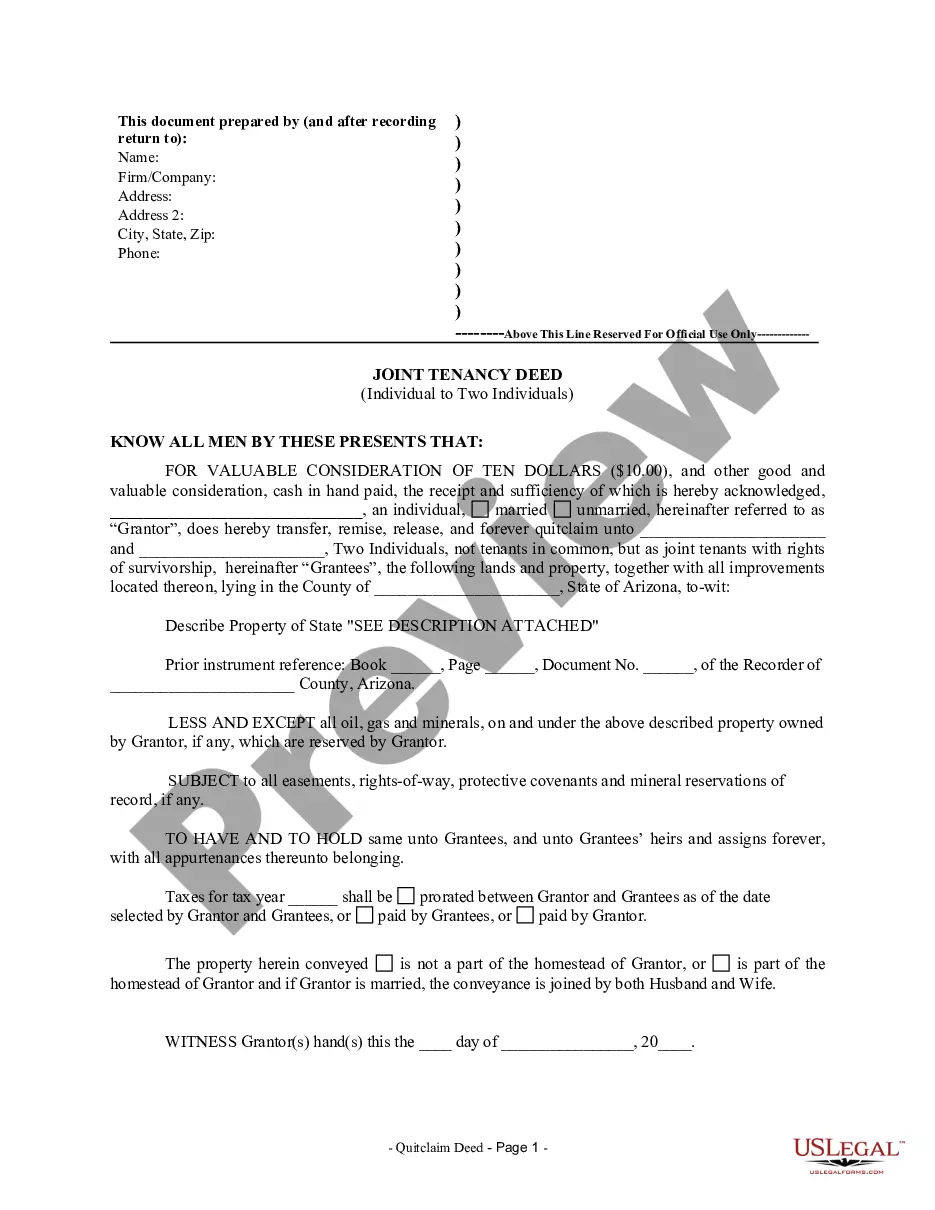

In Maricopa County, over 90% of documents are recorded digitally. Prior to submitting documents for digital recording, a customer must open an account with the Recorder's Office and sign a Memorandum of Understanding specifying how digital documents are to be submitted.

To qualify you must meet certain criteria: 1. Property owner (applicant) must be 65 years of age or older. 2.

Living in Maricopa offers residents a rural feel and most residents own their homes. In Maricopa there are a lot of parks. Many families and young professionals live in Maricopa and residents tend to have moderate political views. The public schools in Maricopa are above average.

Documents required by NRI for selling property in India: Passport- It serves as proof of identity for the person involved in the transaction. PAN Card- It is required if one plans to apply for a tax exemption certificate after the sale of the property.

To sell property in India, essential documents include the Sale Deed, Sanctioned Plans, Society Documents, Encumbrance Certificate, and Sale Agreement.

PUBLIC SERVICE ANNOUNCEMENT "If you have owned a home in Maricopa County between 2015 - 2021 tax years, the treasurer's office is mailing settlement checks for the tax lawsuit, one for each year you owned the home in that range.

After three (3) years from the date of the sale, the purchaser of your taxes can foreclose on the lien and acquire your property.

Maricopa County class action lawsuit. The Qasimyar decision found that starting in 2015, Maricopa County incorrectly classified certain residences for tax purposes, resulting in substantial errors in how the County assessed property taxes.