Business Tangible Personal Property Form For St. Louis In Fulton

Description

Form popularity

FAQ

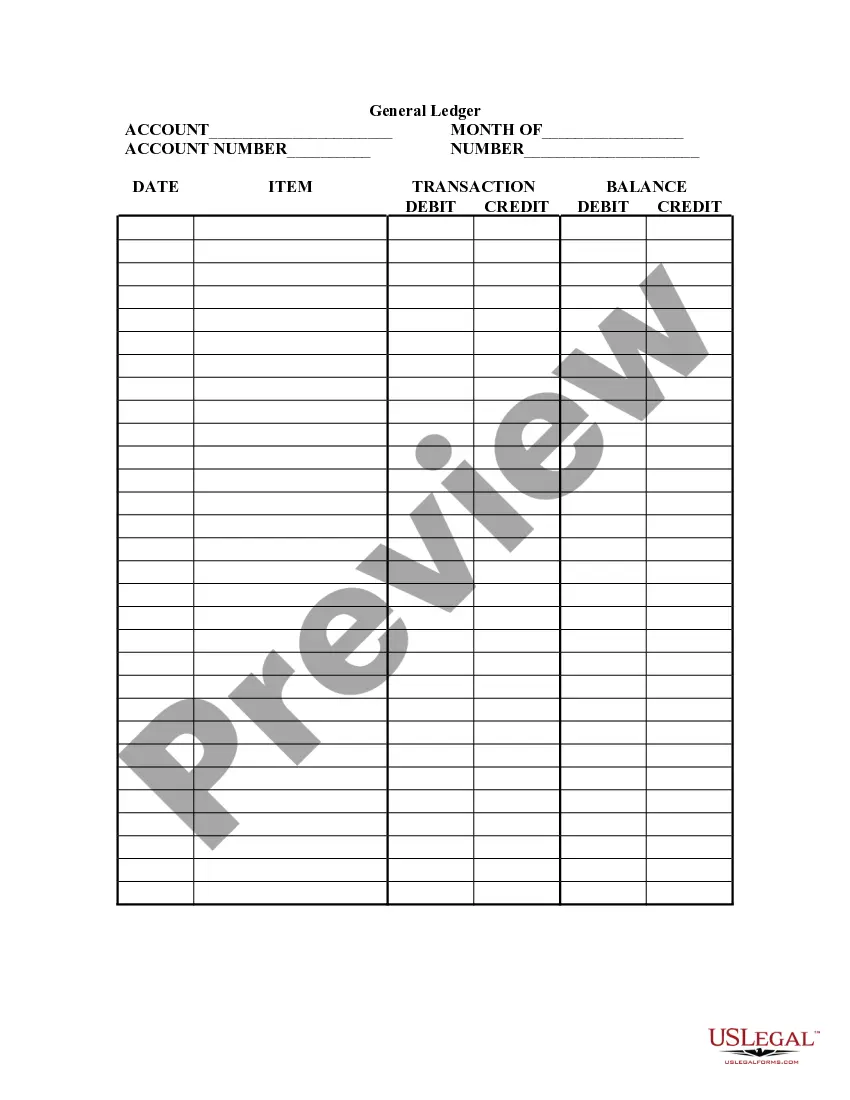

How is tangible personal property taxed? Personal property tax assessments are typically based on fair market value. Business owners file a tax return form with a property appraiser, who then values the property. The property value multiplied by the jurisdictional tax rate determines the tax amount due.

Subject Tax Day – The subject tax day is January 1st of the year in which the disputed assessments were made. Tangible Personal Property – Tangible personal property includes such things as automobiles, farm implements and boats which are movable and are not permanently attached to the land.

Personal property is assessed at 33 and one-third percent (one third) of its value. Taxes are imposed on the assessed value. Vehicle values are based on the average trade-in value as published by the National Automobile Dealers Association (RSMo 137.115.

Declarations are mailed to property owners with an active individual, business, or manufacturing personal property account as of January 1 each year. Property owners who have an existing account can easily file their declaration online. You can also file your declaration by mail or in person.

Primary tabs. Tangible personal property is mainly a tax term which is used to describe personal property that can be felt or touched, and can be physically relocated. For example: cars, furniture, jewelry, household goods and appliances, business equipment.

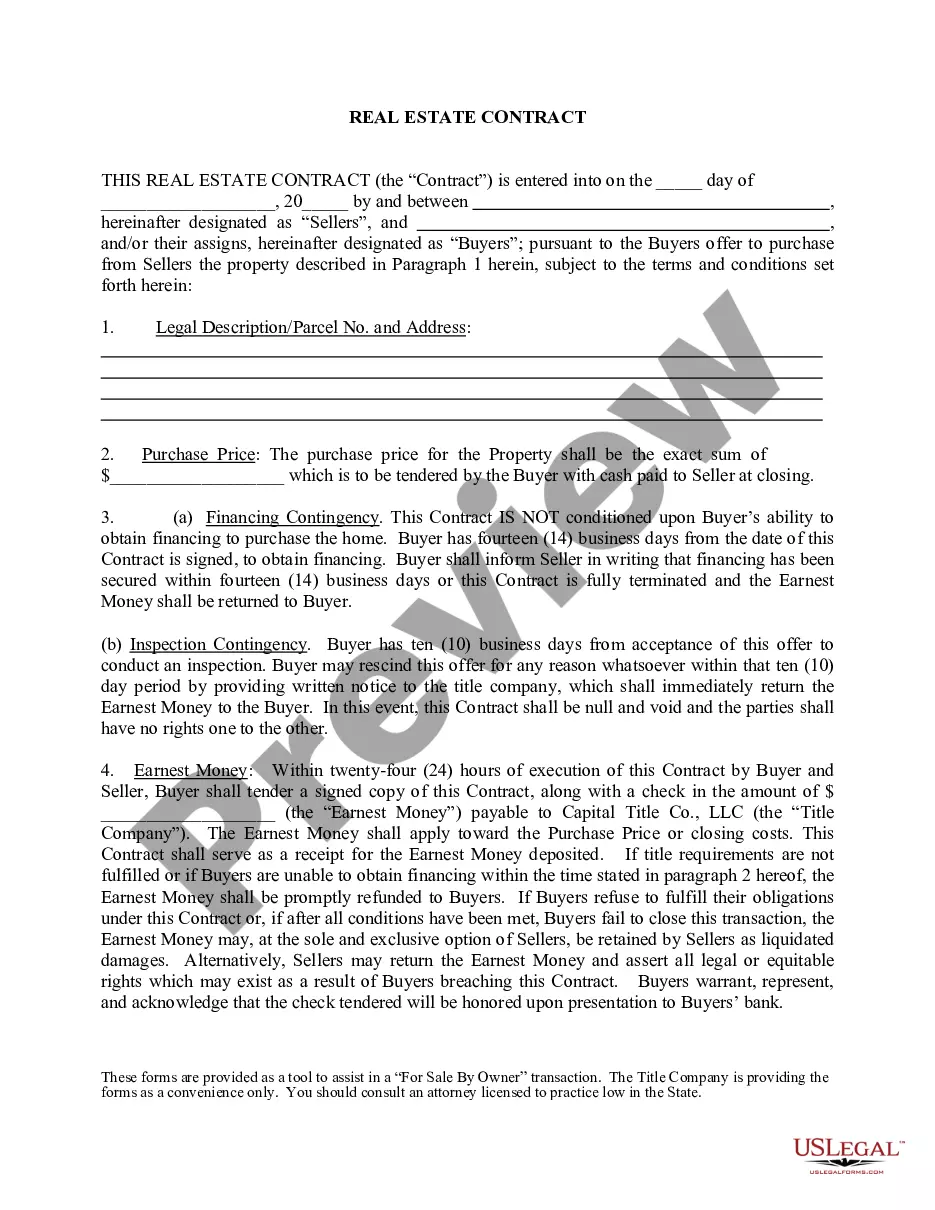

The Assessor is required by Missouri Statutes to value all business personal property each year. Personal property includes vehicles, machinery, equipment, furniture, computers, signs, supplies, etc., which are used for the operation of the business on January 1 of the current year.

Tangible personal property can be subject to ad valorem taxes, meaning the amount of tax payable depends on each item's fair market value. In most states, a business that owned tangible property on January 1 must file a tax return form with the property appraisal office no later than April 1 in the same year.

What must be declared on the Personal Property Declaration? All personal property items used in the conduct of operating the business including items donated, given to you or owned prior to starting your business, unregistered motor vehicle(s), etc.