Property Personal Selling With Example In California

Description

Form popularity

FAQ

You can't deduct capital losses on the sale of personal use property. A personal use asset that is sold at a loss generally isn't reported on your tax return unless it was reported to you on a 1099-K and you can't get a corrected version from the issuer of the form.

California (CA) State Withholding Tax Laws Non-California residents, including U.S. citizens who are residents of other states, are subject to State income tax withholding of 7% of gross if the total payments excel $1,500 during the calendar year.

Under Article XIII, Section I of the California Constitution, all property is taxable unless it is exempt. Each year Personal Property is reassessed as of lien date, January 1st. Personal Property is all property except real estate and can include business equipment, vessels, aircraft, vehicles and manufactured homes.

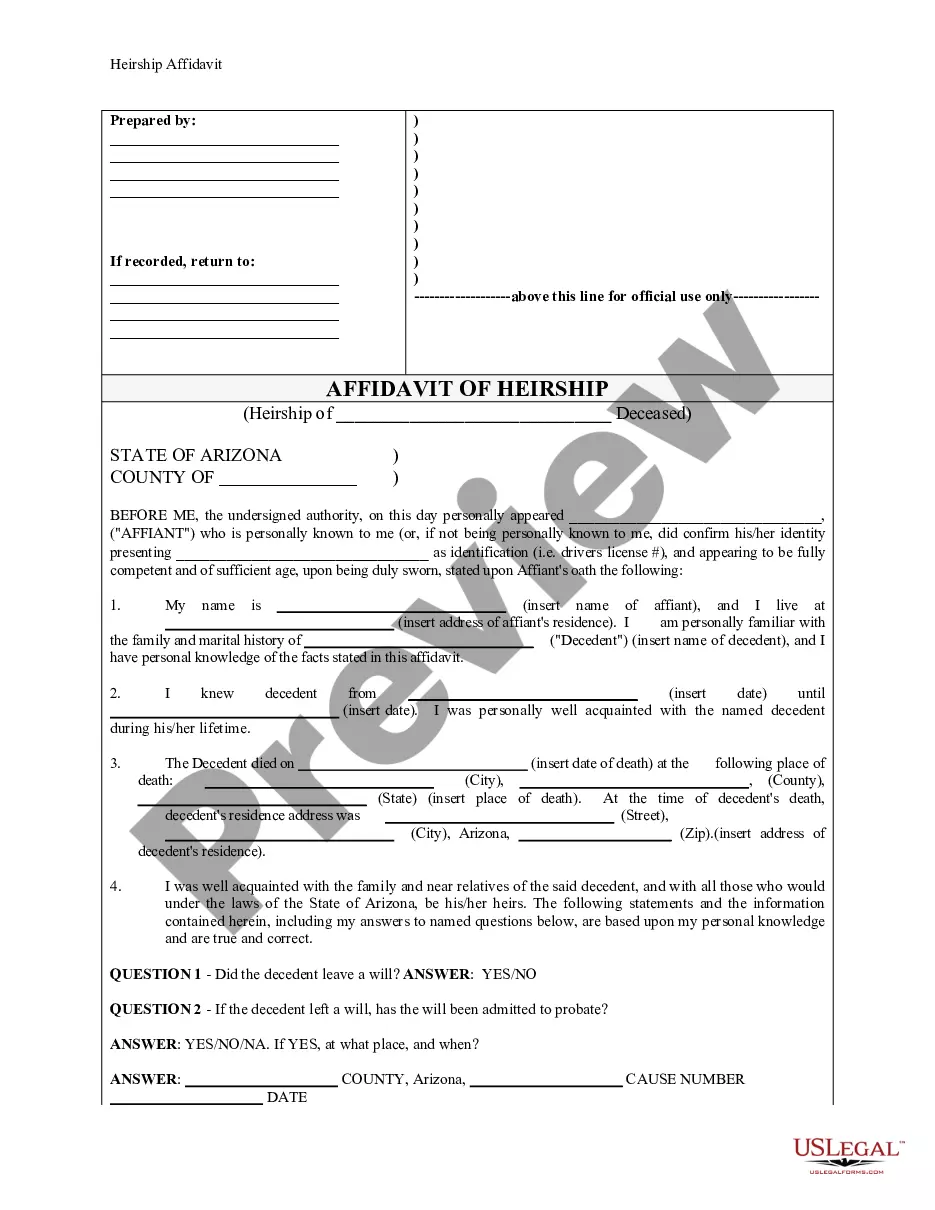

Seller/Transferor and Buyer/Transferee must complete the perjury statement, sign and date on Side 3 of Form 593 when the initial sale occurs. For the remaining installment payments, the Buyer/Transferee must sign all subsequent Form 593s.

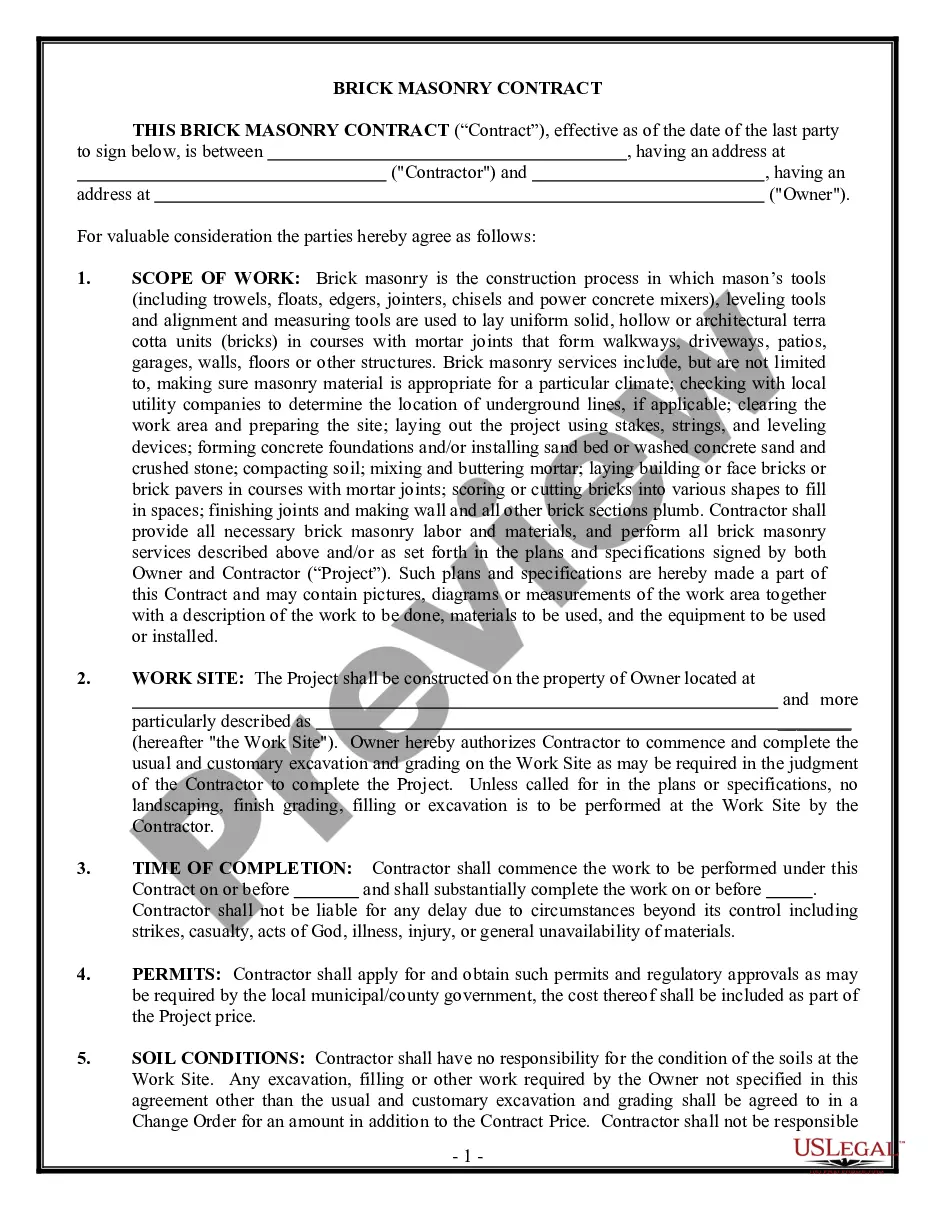

Withholding Requirement As the buyer, California law requires you to withhold on the sale of California real estate, unless a QI is involved in a deferred like-kind exchange.

Currently California Forms 593 and 593V are used to report and remit withholding. The seller will receive needed copies of the forms for their tax returns from the party handling the withholding.

Types of personal property include: Furniture - Items such as sofas, chairs, tables, and beds that can be easily moved from one location to another. Appliances - Freestanding appliances like refrigerators, washers, dryers, and microwaves that are not built into the home's structure.

Examples of tangible personal property include vehicles, furniture, boats, and collectibles. Digital assets, patents, and intellectual property are intangible personal property. Just as some loans—mortgages, for example—are secured by real property like a house, some loans are secured by personal property.

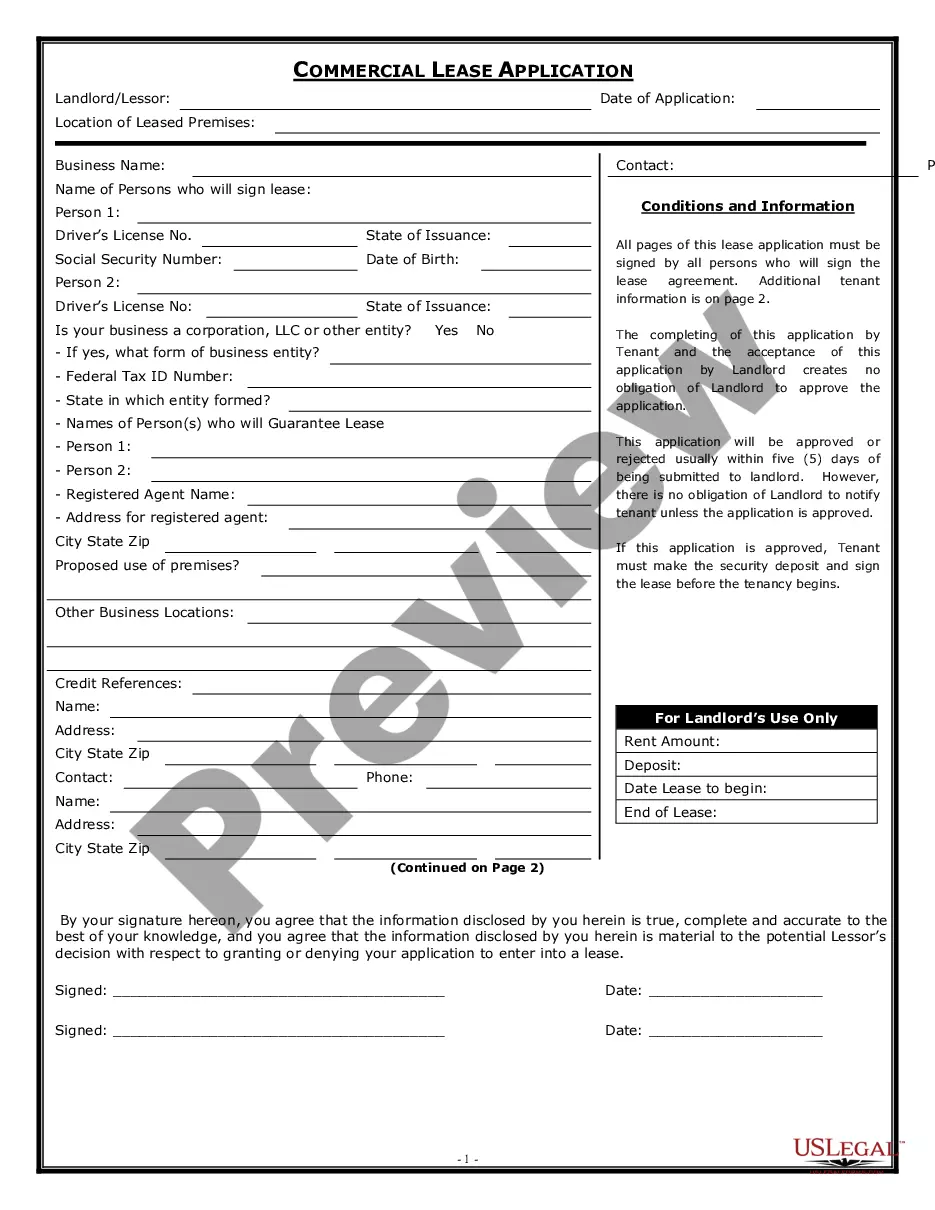

Most seller property disclosures are required for residential properties and vacant land. This means that when selling a residential property, the seller is legally obligated to disclose any known defects or issues with the property to potential buyers.