Examples Of Business Personal Property In Bronx

Description

Form popularity

FAQ

• All businesses are required by law to file the Business Personal Property. • Tax Return (PT-50P) to the Tax Assessor's Office by April 1st of each year. • Personal property includes machinery, equipment, furniture, fixtures, inventory, supplies, and construction in progress.

A rendition is a form that allows you to self-report your business personal property to the County Appraisal District. The County uses this information to help estimate the market value of your property for taxation purposes.

A Business Personal Property (BPP) rendition is a mandatory state form that property owners or their representatives must complete, detailing the business assets used to generate revenue. These assets include furniture, fixtures, computers, manufacturing equipment, vehicles, inventory, and more.

Classifications Intangible. Tangible. Other distinctions.

Business personal property is all property owned or leased by a business except real property.

Personal property renditions (aka, personal property returns) require you to take a detailed inventory of your assets — everything from laptops and lamps to heavy machinery — across every location. As a result, one location can easily have tens of thousands of assets.

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

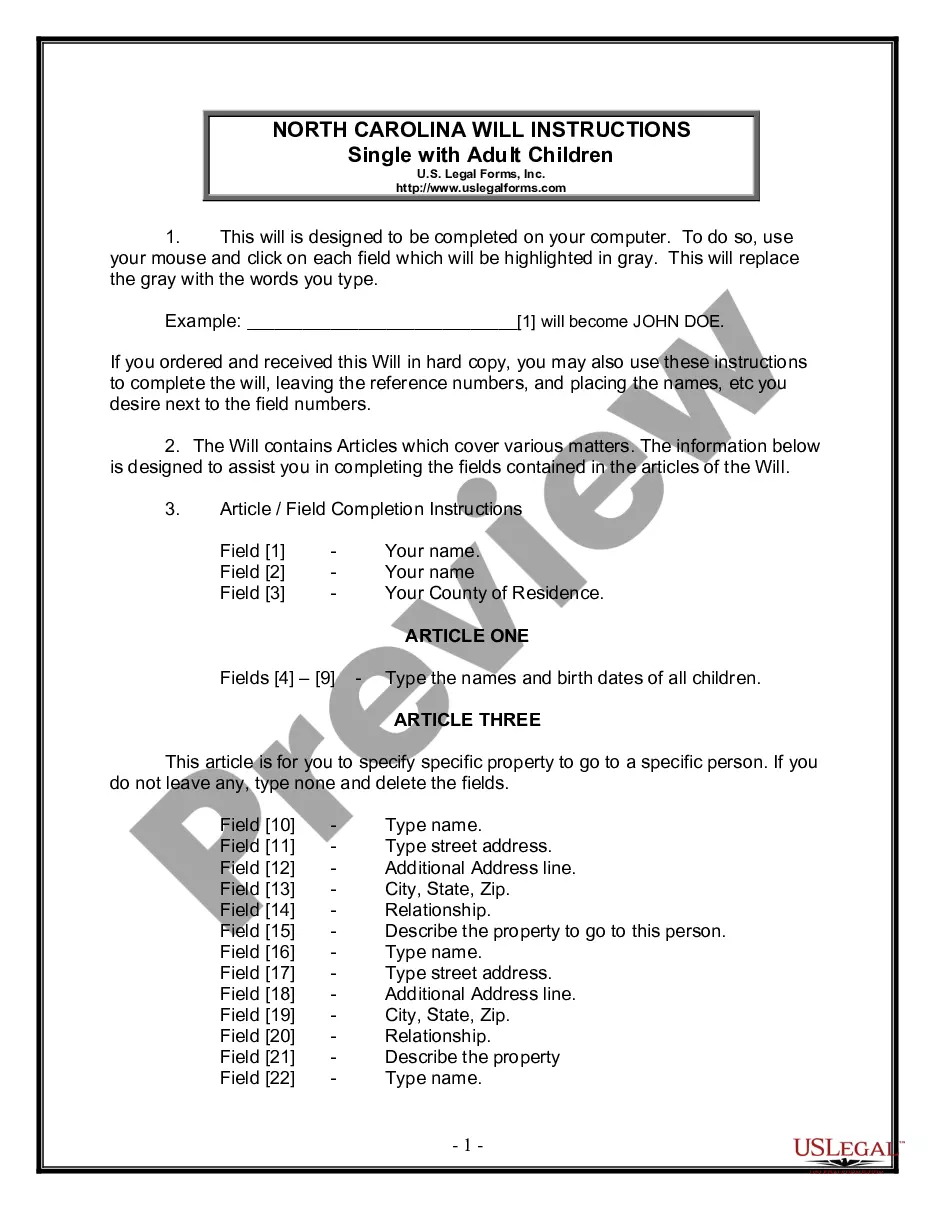

How to fill out the Business Personal Property Rendition Tax Form 50-144? Collect all necessary business and property details. Determine the market value of your property. Complete the required sections of the form. Review all information for accuracy. Submit the form to the appropriate appraisal district.

In general, business personal property is all property owned, possessed, controlled, or leased by a business except real property and inventory items. Business personal property includes, but is not limited to: Machinery. Computers. Equipment (e.g. FAX machines, photocopiers)

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.