This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Bill Personal Property Form For Sale In Arizona

Description

Form popularity

FAQ

Your documents notarized faster than a greased… Fortunately, Arizona does not mandate notarization for this document, making the process more straightforward and less time-consuming. However, while it's not necessary, having the bill of sale notarized is still highly recommended for added protection.

Get a bill of sale from a regulatory agency. Many government agencies, like the Department of Motor Vehicles, for instance, offer bill of sale forms for public use. Using a form directly from a government agency ensures that you have all of the information required for your state.

A bill of sale functions as a legal record of the ownership transfer, but in most cases, notarizing this document is optional. There are, however, some exceptions: Motor vehicle sales prior to October 2022: Before recent changes in the law, the title needed to be signed by both parties in the presence of a notary.

While it is common to present a bill of sale in a digital format, you can also create a handwritten bill of sale. What's most important is to include all of the pertinent details in the bill of sale in order to protect both parties.

While a bill of sale isn't a requirement to transfer the ownership of most property in Arizona, it can help protect both buyers and sellers during high-value transactions.

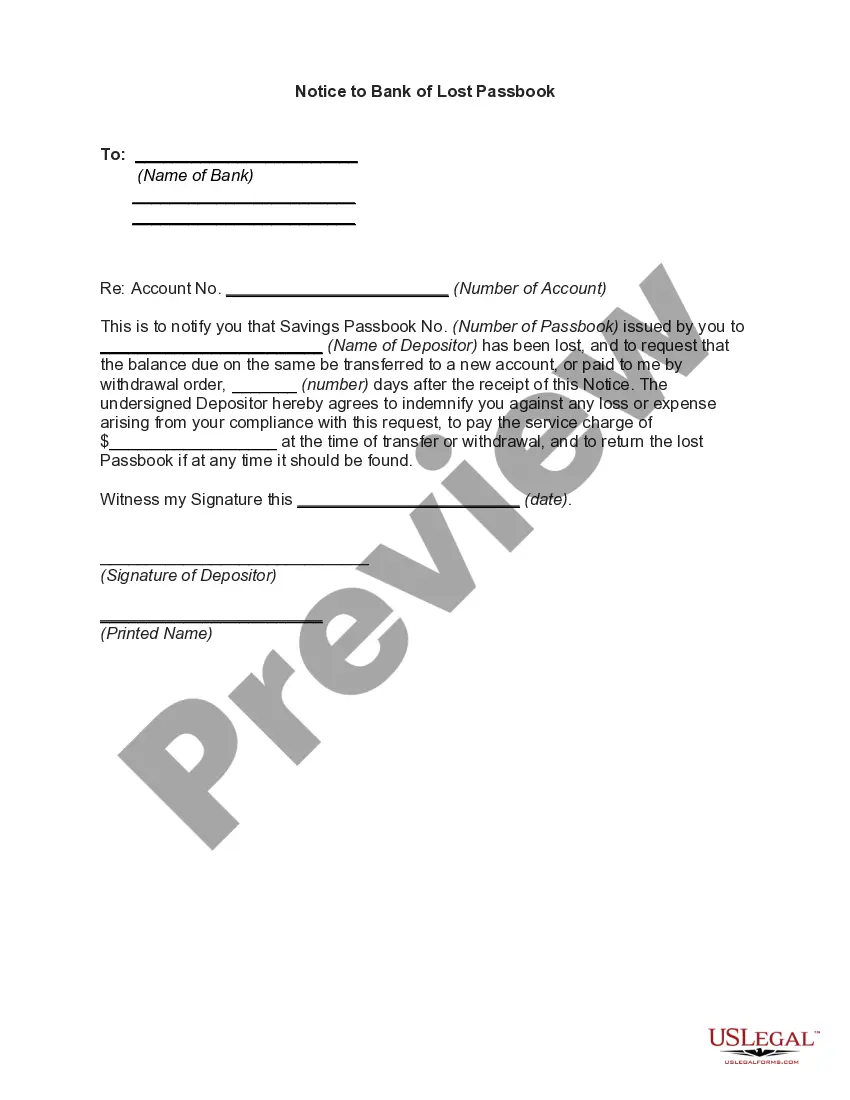

A Bill of Sale is a form a seller uses to document the sale of an item, such as a car, to a buyer. The main purpose of a Bill of Sale is to record the transfer of ownership from the seller to the buyer. Both parties should retain a copy of the signed Bill of Sale as proof that the transaction took place.

Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income. Use Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale.

You can't deduct capital losses on the sale of personal use property. A personal use asset that is sold at a loss generally isn't reported on your tax return unless it was reported to you on a 1099-K and you can't get a corrected version from the issuer of the form.