Corporation First Meeting With Senior Management In Sacramento

Description

Form popularity

FAQ

What Should Be Included in Meeting Minutes? Date and time of the meeting. Names of the meeting participants and those unable to attend (e.g., “regrets”) Acceptance or corrections/amendments to previous meeting minutes. Decisions made about each agenda item, for example: Actions taken or agreed to be taken. Next steps.

Meeting minutes are a written record of meeting details, such as discussion topics, decisions, and next steps. They include key details, like the time and attendees, so employees can quickly gain context on each session.

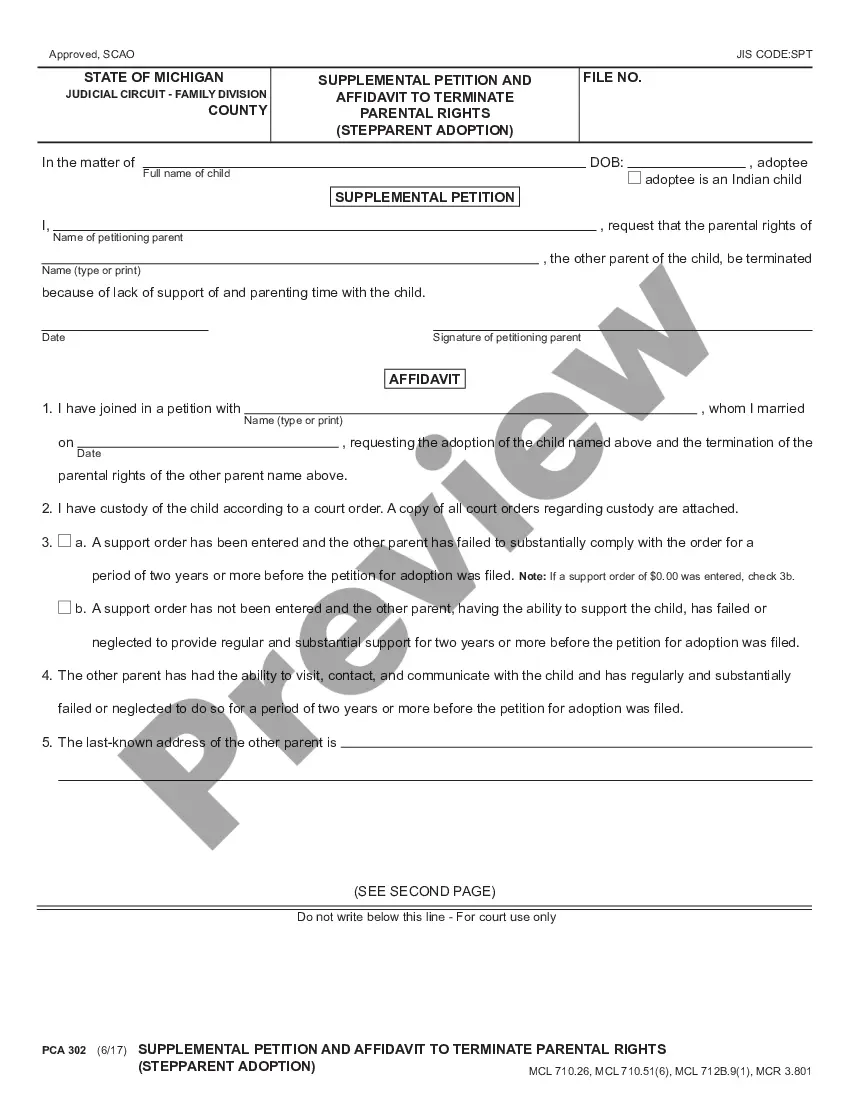

This document needs to be signed by: or another person who is authorized to take minutes and/or record official corporate action. There is no requirement that the signature be witnessed or notarized.

How to write meeting minutes Organization name. Meeting purpose. Start and end times. Date and location. List of attendees and absentees, if necessary. Space for important information like motions passed or deadlines given. Space for your signature and the meeting leader's signature.

An important first step when starting a corporation is selecting a business name. In most states, you'll need to include a corporate designation or a word that identifies your business as a corporation.

What should board of directors first meeting minutes include? Your corporation's first directors meeting typically focuses on initial organizational tasks, including electing officers, setting their salaries, resolving to open a bank account, and ratifying bylaws and actions of the incorporators.

Corporate meeting minutes typically include: The meeting's date, time and location. A list of attendees and absentees, including any present board members or officers. Agenda items.

LLC: Not required. You can legally operate as a sole proprietor.

If you have a substantial amount of personal assets (such as real estate, investments, and savings accounts), you might want to consider forming an LLC in the early stages of your business to ensure you are protected.

You may also need to register your business with your city, which can come with its own requirements and fees. You can do the process yourself, or hire a company to help you prepare and file the paperwork. However, forming an LLC isn't a requirement if you want to run a business.