Personal Property Document With No Intrinsic Value Called In Virginia

Description

Form popularity

FAQ

Classifications Intangible. Tangible. Other distinctions.

Personal Property Personal belongings such as clothing and jewelry. Household items such as furniture, some appliances, and artwork. Vehicles such as cars, trucks, and boats. Bank accounts and investments such as stocks, bonds, and insurance policies.

Tangible personal property, or TPP as it is sometimes called, includes items such as furniture, machinery, cell phones, computers, and collectibles. Intangibles, on the other hand, consist of things that cannot be seen or touched like patents and copyrights.

The three fundamental types of property are real property, personal property, and intellectual property, and they are as follows: The real property comprises land or immovable property, improvements on land that may be legally owned and utilized, such as harvests, houses, equipment, and roadways.

Intangible Personal Property-Property that has no physical existence beyond merely. representational, nor any extrinsic value; includes rights over tangible real and personal. property but not rights of use and possession. Its value lies chiefly in what it represents.

Classifications Intangible. Tangible. Other distinctions.

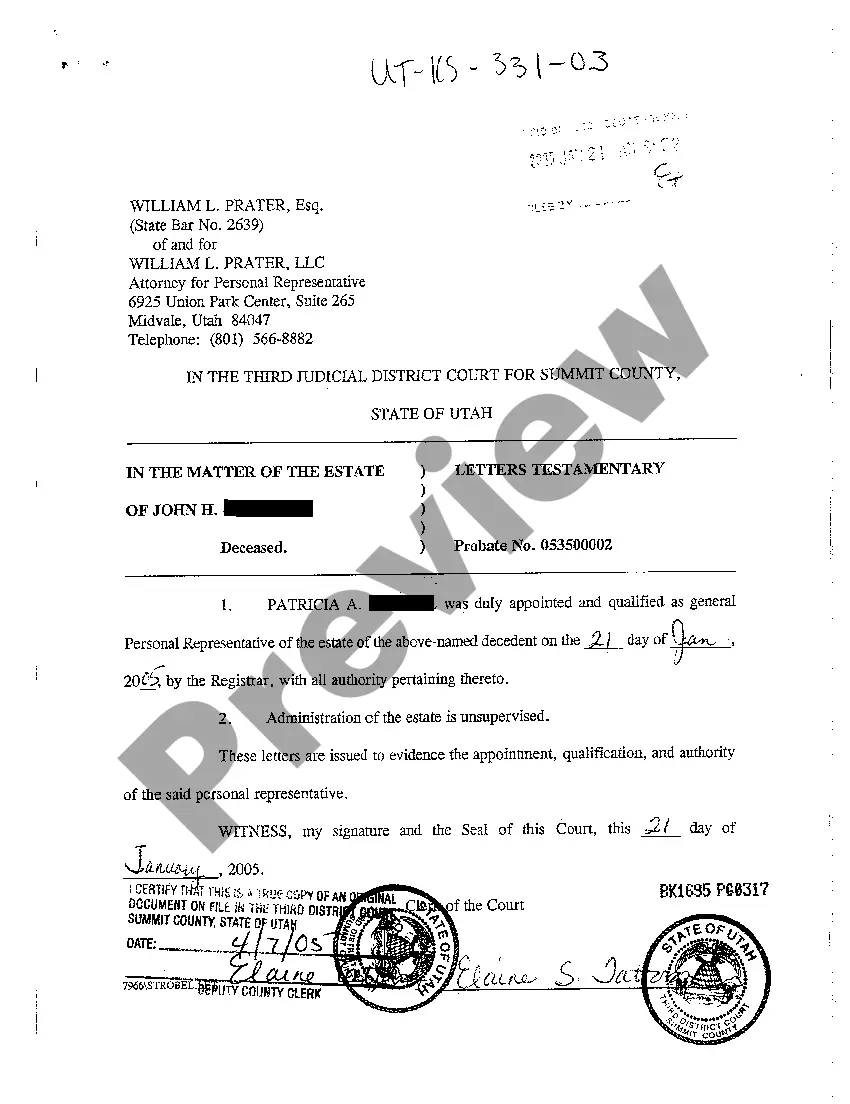

The Virginia Small Estate Affidavit is a legal document used for managing estates valued at $50,000 or less. It expedites the distribution of small estates and allows direct transition of assets without formal probate.

Ing to the IRS, tangible personal property is any sort of property that can be touched or moved. It includes all personal property that isn't considered real property or intangible property such as patents, copyrights, bonds or stocks.

Qualify for Personal Property Tax Relief Per the Code of Virginia §58.1-3524, personal property tax relief (PPTR) gives tax relief on the taxes due for the first $20,000 in assessed value on qualified personal vehicles. No relief is given on any assessment amounts over $20,000.

Tangible personal property can be subject to ad valorem taxes, meaning the amount of tax payable depends on each item's fair market value. In most states, a business that owned tangible property on January 1 must file a tax return form with the property appraisal office no later than April 1 in the same year.