Movable Property Form For Central Government Employees In Texas

Description

Form popularity

FAQ

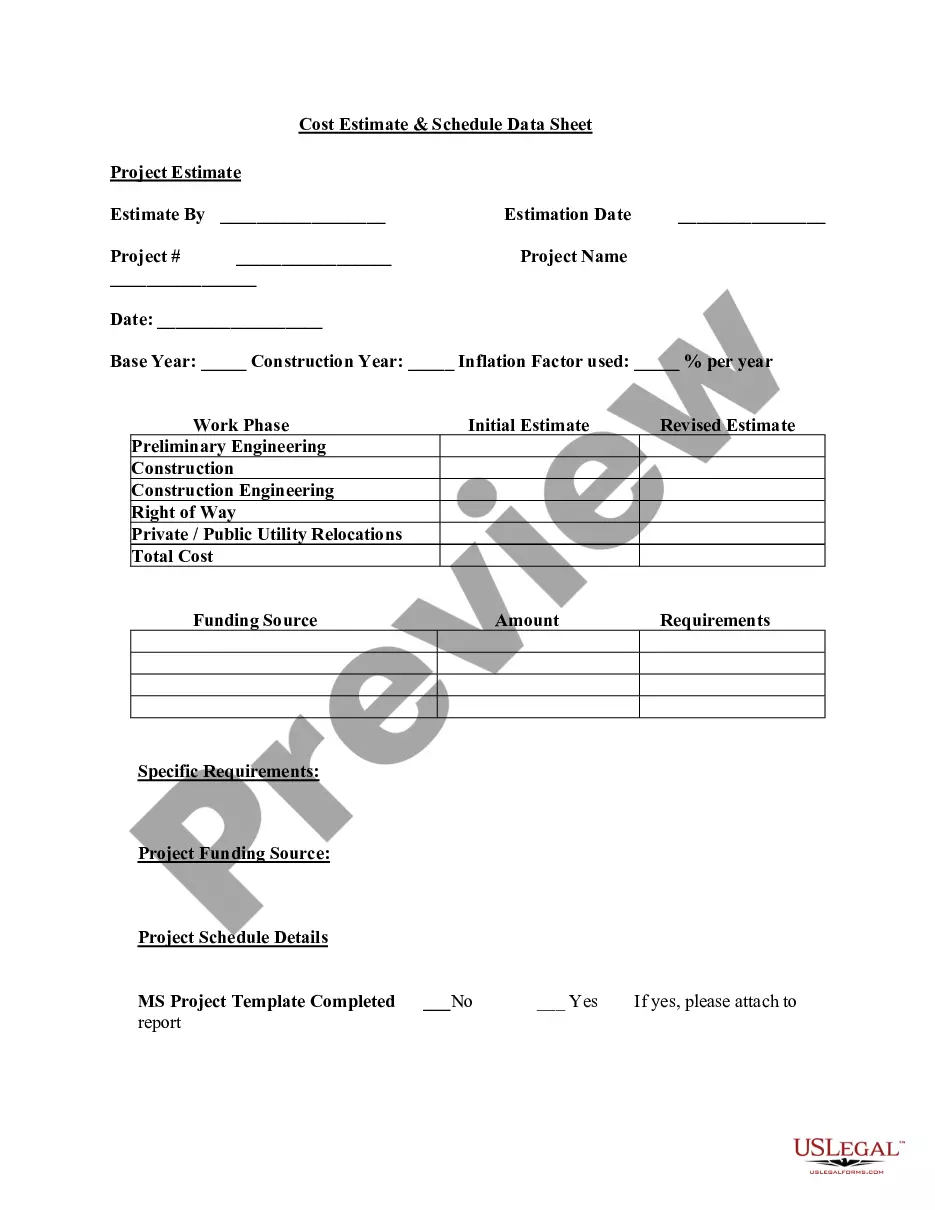

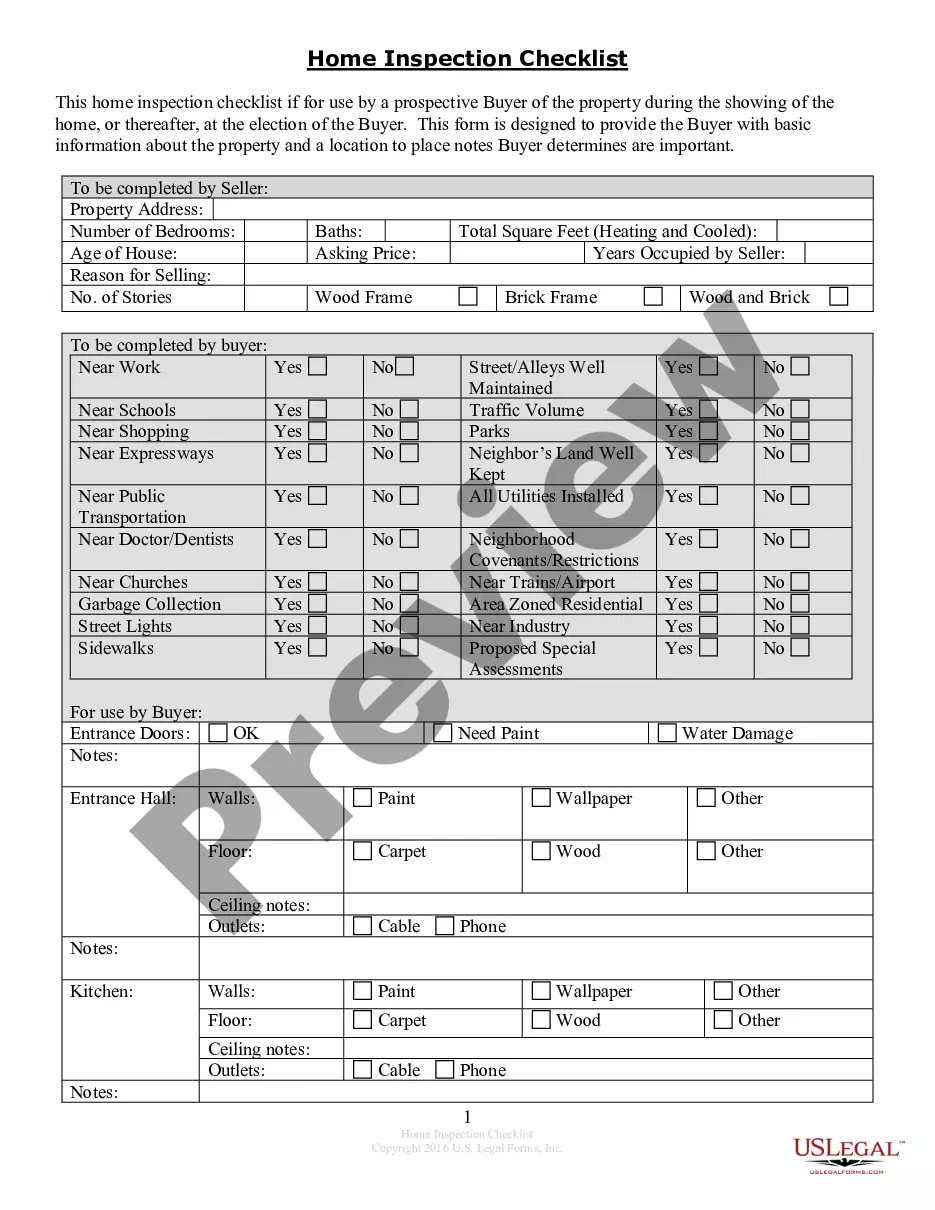

This form is designed to report tangible personal property that is owned or managed for income production. Ensure you provide accurate information as required by law. Complete the necessary sections to submit your rendition for the current tax year.

Fill in the business start date, sales tax permit number, and check any boxes that apply. If sold, please fill in the New Owners name. If moved, please fill in the new location address. Please check the box with the value that describes the property owned and used by the business.

You may use Comptroller Form 50-132, Property Appraisal - Notice of Protest, to file your written request for an ARB hearing. Prior to your hearing, you may request a copy of the evidence the appraisal district plans to introduce at the hearing to establish any matter at issue.

Who Must File? Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

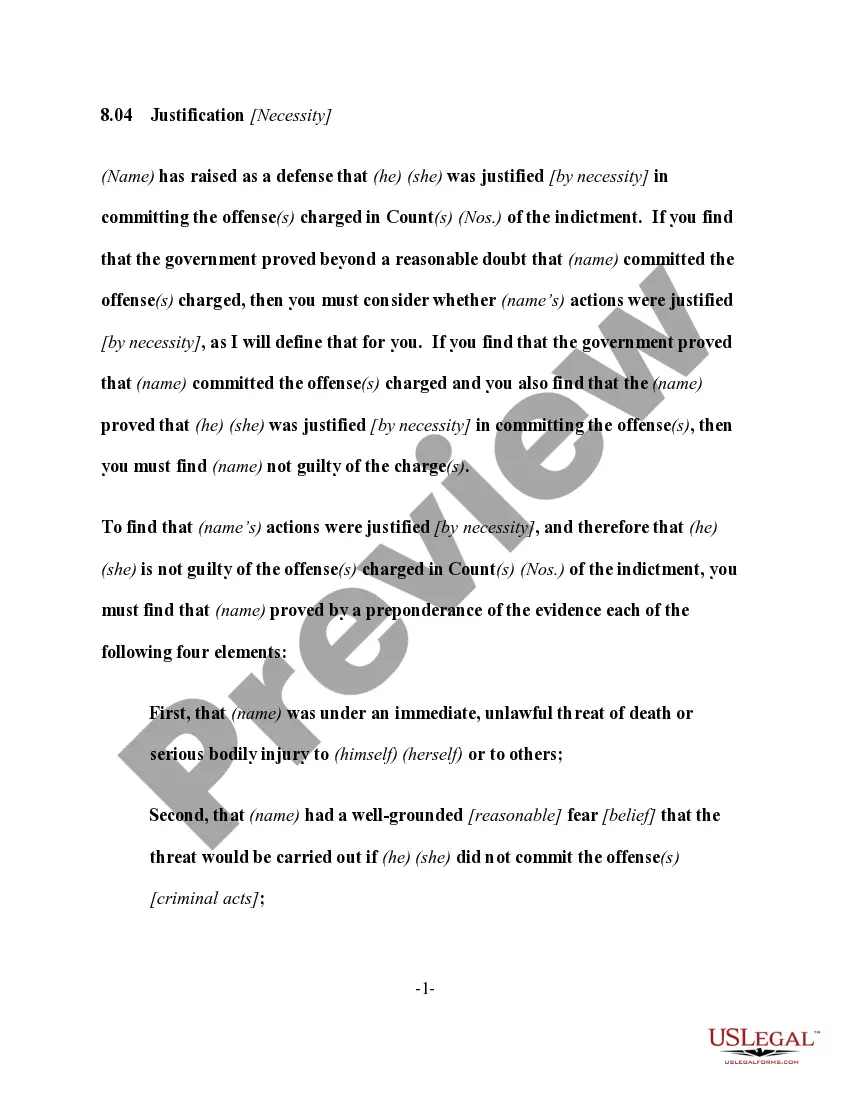

Protesting property taxes in Texas can lead to significant tax savings. When you successfully challenge your property's assessed value, you can lower your tax liability.

A person is entitled to an exemption from taxation of the tangible personal property that is held or used for the production of income if it has less than $2,500 of taxable value (Tax Code Section 11.145).

You must own your home. To qualify for a general or disabled homestead exemption you must own your home on January 1. If you are 65 years of age or older you need not own your home on January 1. You will qualify for the over 65 exemption as soon as you turn 65, own the home and live in it as your principal residence.

(1) An entity that believes it is exempt from franchise tax must furnish to the comptroller sufficient evidence to establish its exempt status. The entity claiming the exemption bears the burden to establish its entitlement to exempt status and any doubts will result in a denial of the application for exemption.