Movable Property With Example In Salt Lake

Description

Form popularity

FAQ

Recorder Rashelle Hobbs | Salt Lake County.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings.

The Utah State Tax Commission defines tangible personal property as material items such as watercraft, aircraft, motor vehicles, furniture and fixtures, machinery and equipment, tools, dies, patterns, outdoor advertising structures, and manufactured homes.

Finding your property tax ID number is easier than you might think. If you already own the property, you can find this number on property tax bills, deeds, or title reports. However, for those who do not own the property or need a different approach, many local government websites provide online databases.

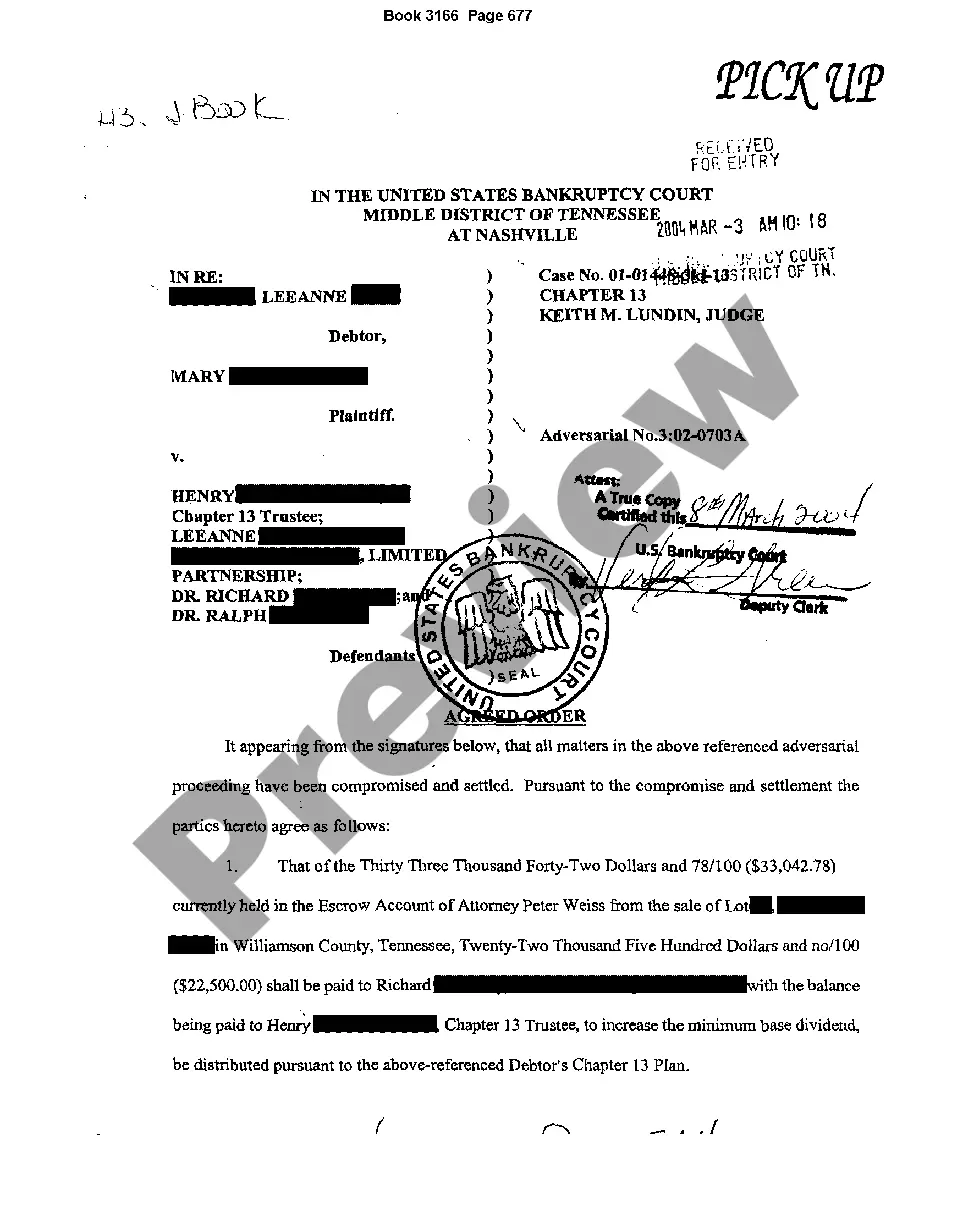

You can do a title search on our website by Searching Utah County Records, or contact a title company to perform one for you. You should be aware that there may be other liens and judgments or encumbrances affecting your property that will not be found in the Recorder's records.

Each county in Utah has a county recorder's office. These offices record and maintain property records and documents pertaining to real property. They also maintain maps, plats, surveys, and related data.

If you prefer an in-person. Visit you can go to the Salt Lake County Clerk's Office the office isMoreIf you prefer an in-person. Visit you can go to the Salt Lake County Clerk's Office the office is located at 2001 South State Street Sweet S100 Salt Lake City Utah.

Tangible personal property refers to physical and movable possessions owned by individuals. Examples of personal property include clothing, furniture, electronics, and vehicles. Intangible property, on the other hand, covers valuable assets that you can't see or touch, such as bonds, franchises, and stocks.

While there is no state in the U.S. that doesn't have property taxes on real estate, some have much lower property tax rates than others. Here's how property taxes are calculated. The effective property tax rate is used to determine the places with the lowest and highest property taxes in the nation.