Personal Property Document With No Intrinsic Value Called In Pennsylvania

Description

Form popularity

FAQ

Tangible property is physical assets such as collectible coins, jewelry, military medals, stamps, antiques, savings bonds or other physical items.

Must be age 60 or older, or, if married, either spouse must be age 60; or be a widow or widower age 50 to 60 years; or permanently disabled and age 18 to 60 years. The applicant must meet the required age by end of the year of application.

“Personal property” means goods and chattels, including fixtures and buildings ed by the tenant and which he has the right to remove, agricultural crops, whether harvested or growing, and livestock and poultry.

“Tangible personal property” exists physically (i.e., you can touch it) and can be used or consumed. Clothing, vehicles, jewelry, and business equipment are examples of tangible personal property.

In general, tangible personal property consists of items such as jewelry, personal property, personal effects, family heirlooms, and other physical items. Intangible property generally includes assets located in an account, monies, and items which are not physical.

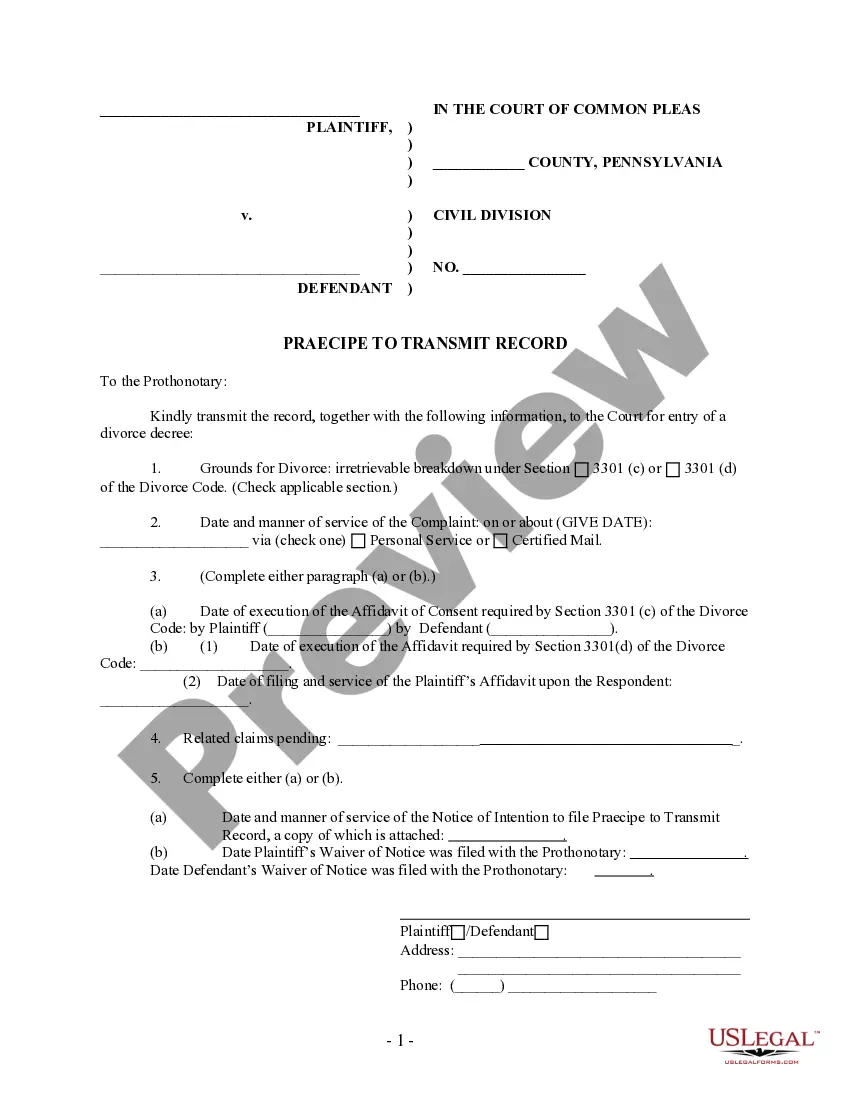

Pennsylvania is known as an equitable distribution state and not a community property state. Our courts divide marital property and debts based on the principles of equity.

Overall, Pennsylvania has property tax rates that are higher than the national averages. In fact, the state carries a 1.41% average effective property tax rate in comparison to the 0.90% national average. Effective property tax rates on a county basis range from 0.83% to 2.05%.

All mobile homes or manufactured homes which are subject to taxation as real estate as provided in this chapter shall be assessed and taxed in the name of the owner.

Tangible property is physical assets such as collectible coins, jewelry, military medals, stamps, antiques, savings bonds or other physical items.

Real property includes any land and related outbuildings needed to operate the home. Real property that is recorded under a separate deed is considered a separate piece of property even though it is bordering the resident property.