Personal Property Statement With No Class Life In Orange

Description

Form popularity

FAQ

To qualify for an exemption that begins on July 1, you must be 65 or older by the following December 31. If you co-own your property with a spouse or sibling, only one of you needs to be 65 or older. For other co-ownerships such as a parent and children, all owners must be 65 or older.

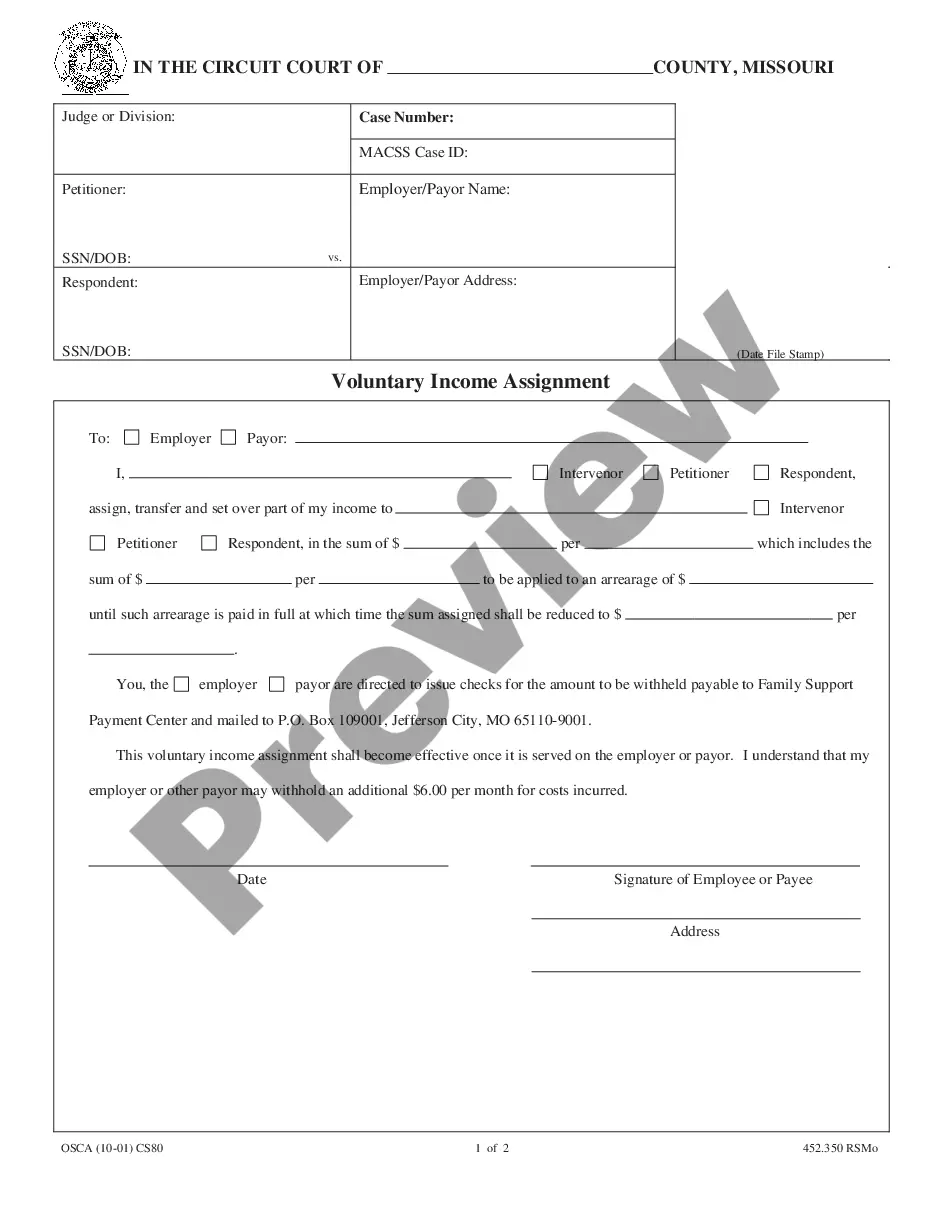

Business Personal Property includes all supplies, equipment and any fixtures used in the operation of a business. Exempt from reporting are business inventory, application software and licensed vehicles (except Special Equipment (SE) tagged and off-road vehicles).

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

Orange County levies a personal property tax on the following types of personal property: Automobiles. Trucks. Motor homes.

Personal Property Personal belongings such as clothing and jewelry. Household items such as furniture, some appliances, and artwork. Vehicles such as cars, trucks, and boats. Bank accounts and investments such as stocks, bonds, and insurance policies.

Real property is land and anything attached to it, while personal property refers to movable items. For example, a house on a plot of land is real property, while the furniture inside is personal property.

DEFINITION of 'Personal Use Property' A type of property that an individual does not use for business purposes or hold as an investment.

Personal use property is used for personal enjoyment as opposed to business or investment purposes. These may include personally-owned cars, homes, appliances, apparel, food items, and so on.