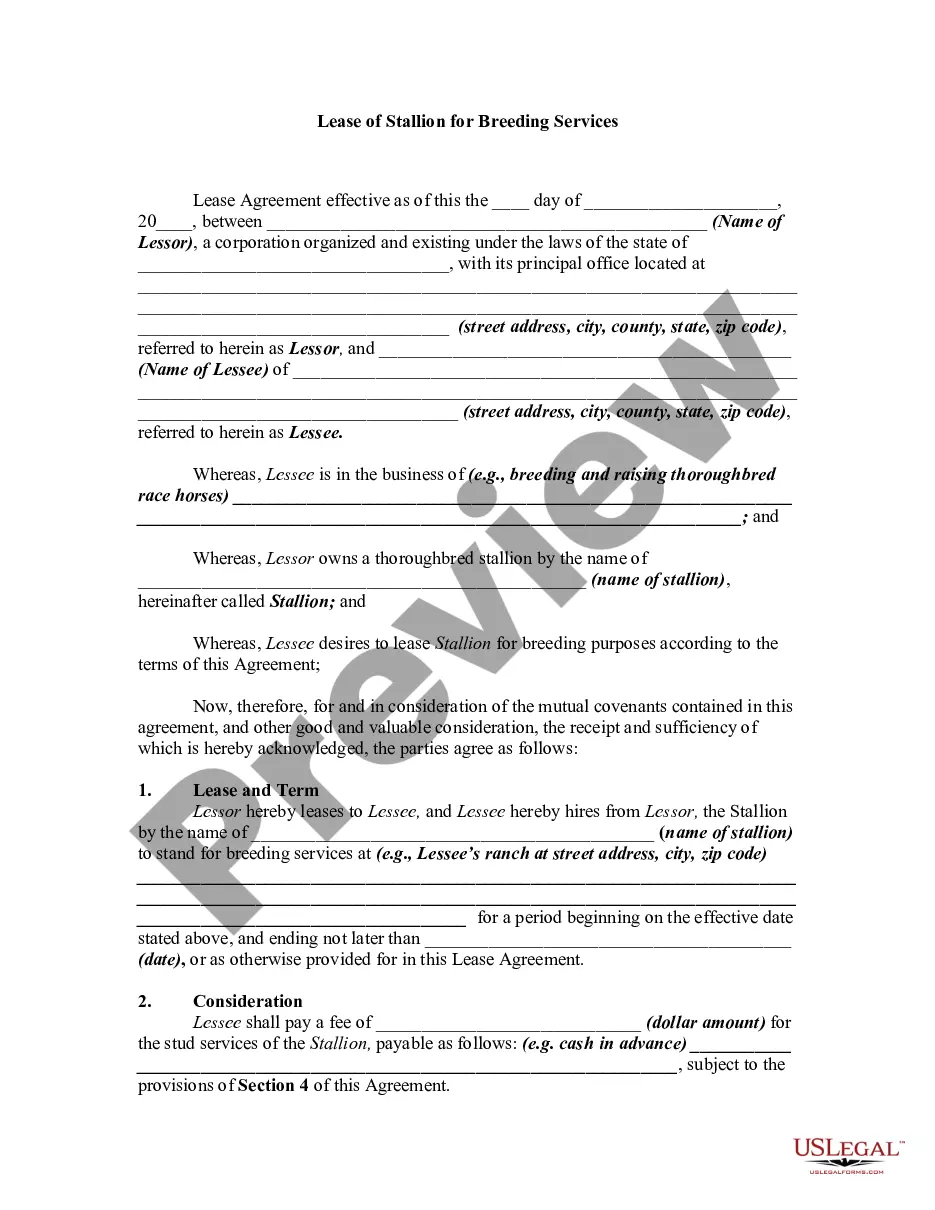

This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Property For Sale In Nevada

Description

Form popularity

FAQ

Ing to Nevada Revised Statutes, all property that is not defined or taxed as "real estate" or "real property" is considered to be "personal property." Taxable personal property includes manufactured homes, aircraft, and all property used in conjunction with a business.

Yes, in addition to Title 40 of the U.S. Code the sale of Federal personal property is governed by other statutory requirements, such as the Debt Collection Improvement Act of 1996 (Public Law 104-134, sec. 31001, 110 Stat. 1321-358) and antitrust requirements that are discussed in §102-38.325.

Generally, all gains are taxable. Going back to the previous example, you purchased a car for $25,000. Then you sell the car later for $30,000. The result is a $5,000 taxable gain.

Taxpayers who don't qualify to exclude all of the taxable gain from their income must report the gain from the sale of their home when they file their tax return. Anyone who chooses not to claim the exclusion must report the taxable gain on their tax return.

You can't deduct capital losses on the sale of personal use property. A personal use asset that is sold at a loss generally isn't reported on your tax return unless it was reported to you on a 1099-K and you can't get a corrected version from the issuer of the form.

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state income taxes, while New Hampshire doesn't tax earned wages. States with no income tax often make up the lost revenue with other taxes or reduced services.

You may sell personal property as the holding agency or on behalf of another agency when so requested, or have the General Services Administration, a contractor, or another Federal agency conduct the sale for you, provided that only Federal officials authorized by your agency approve the sale and bind the United States ...

While there is no state in the U.S. that doesn't have property taxes on real estate, some have much lower property tax rates than others. Here's how property taxes are calculated. The effective property tax rate is used to determine the places with the lowest and highest property taxes in the nation.

What must be declared on the Personal Property Declaration? All personal property items used in the conduct of operating the business including items donated, given to you or owned prior to starting your business, unregistered motor vehicle(s), etc.