This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Personal Use Property Vs Listed Personal Property In Montgomery

Description

Form popularity

FAQ

In the State of Alabama the assessment level is 20% for personal property. To illustrate: A property with a fair market value of $5,000 is to be taxed.

The consumers use tax is imposed on tangible personal property brought into Alabama for storage, use, or consumption in the state when the seller did not collect seller's use tax on the sale of the property.

If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. County taxes may still be due. Please contact your local taxing official to claim your homestead exemption.

Current Use is a valuation of agricultural property at a rate less than market value based on its potential income. Any owner of agricultural land may apply to have their property assessed at its “Current Use” for tax purposes. To be considered agricultural land, it must be used as row crop, pasture, or timber land.

Personal property is considered Class II property and is taxed at 20 percent of market value. Market value multiplied by 20 percent equals the assessment value, which is then multiplied by the appropriate jurisdiction's millage rates to determine the amount of tax due.

Taxpayers interested in obtaining current use valuation must make an application with the county assessing official between October 1 and January 1 of any given year. The application requires a description of the property and a general description of the use to which the property will be put.

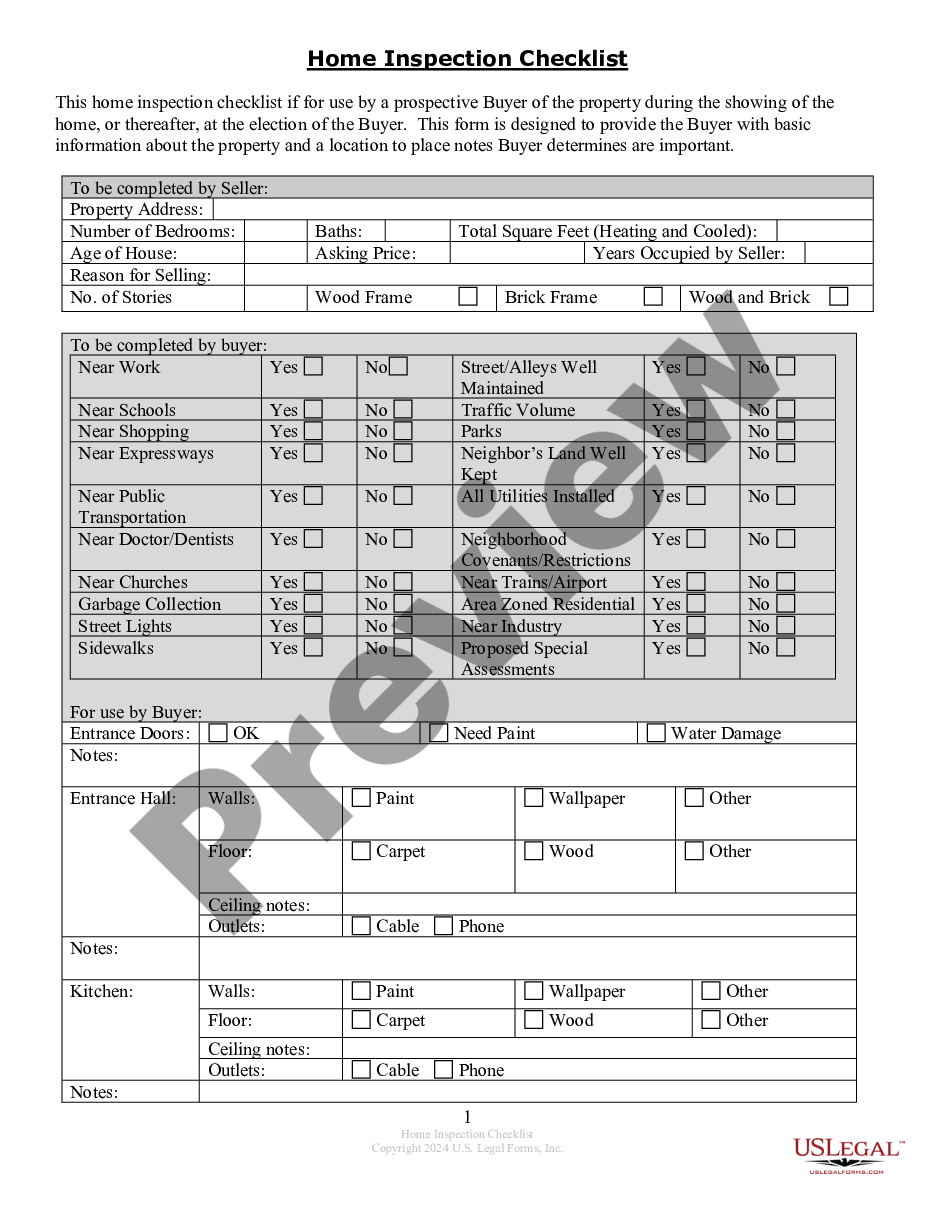

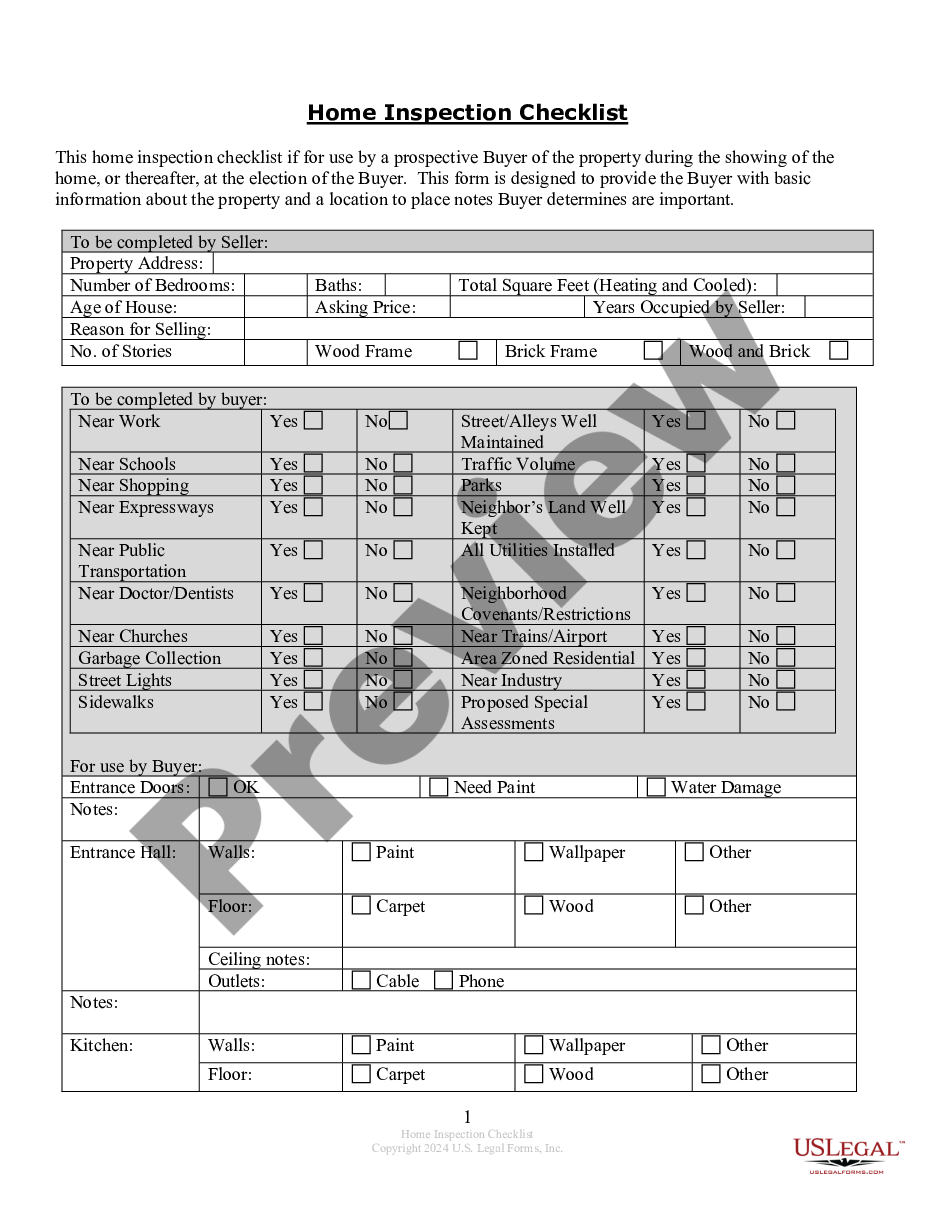

Standard categories include furniture, clothing, entertainment and tech, jewelry, and collectibles. Tailor the categories to suit your needs and consider adding a “miscellaneous” group. Record an estimated value with each item. Keep in mind that assets can appreciate or depreciate in value over time.

Personal Property is property not permanently affixed to or part of the real property, such as furniture, fixtures, and/or equipment. Everything that is not real estate is personal property.

Personal property can be broken down into two categories: chattels and intangibles. Chattels refers to all type of property. Often, individuals use it regarding the tangible property such as a purse or clothing. Some chattels are attached to land and can become a part of real property, which are known as fixtures.

Generally speaking, properties are classified as either Class A, Class B, or Class C properties. This is true across all real estate asset classes, regardless of whether you're referring to office buildings, retail centers, apartment buildings, or industrial and warehouse facilities.