Personal Property Statement With No Intrinsic Value Called In Michigan

Description

Form popularity

FAQ

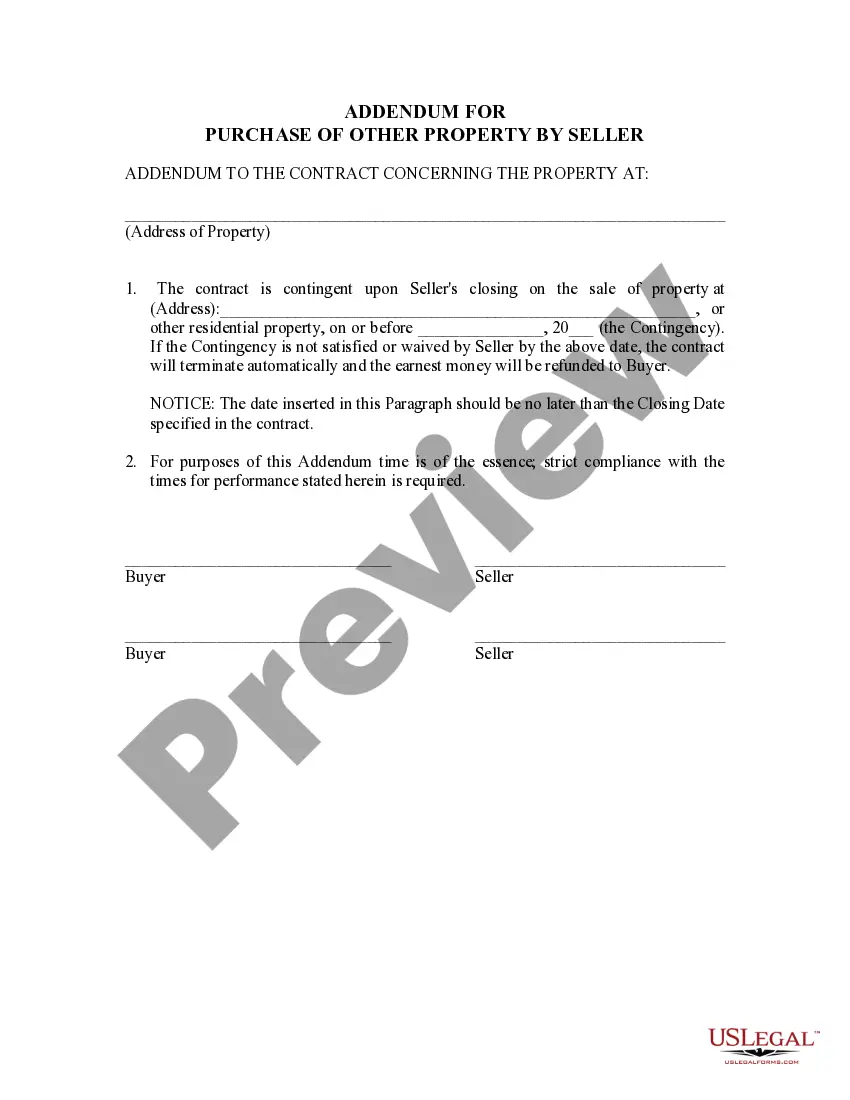

The completed Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL. 4. Location of Real Estate (Check appropriate field and enter name in the space below.)

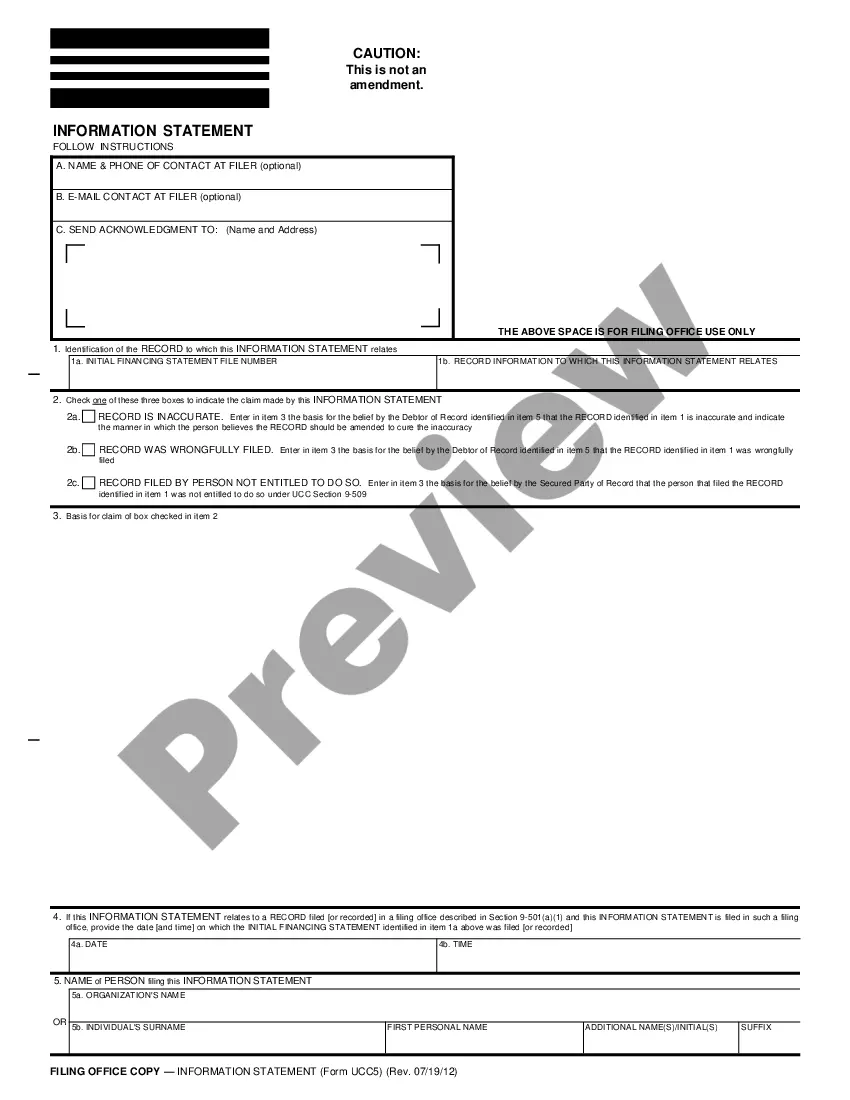

Form L-4175 is used for the purpose of obtaining a statement of assessable personal property for use in making a personal property assessment. Michigan law provides that the assessor must send form L-4175 to any person or entity that may possess assessable personal property.

(4) Other definitions For purposes of this subsection— (A) Depreciable personal property The term “depreciable personal property” means any personal property if the adjusted basis of such property includes depreciation adjustments.

If you have gotten behind on your property taxes and/or are facing a forfeiture auction or sale, you can immediately and legally stop the sale by filing a Chapter 13 reorganization plan. This is a legal means of creating structured repayment terms with your creditors.

The difference between and homestead taxes and non homestead taxes is about 30%. So if you buy a investment property or second home you are going to be paying about 30% more than somebody that would be living in the property.

Tangible personal property includes equipment, supplies, and any other property (including information technology systems) other than that is defined as an intangible property. It does not include copyrights, patents, and other intellectual property that is generated or developed (rather than acquired) under an award.

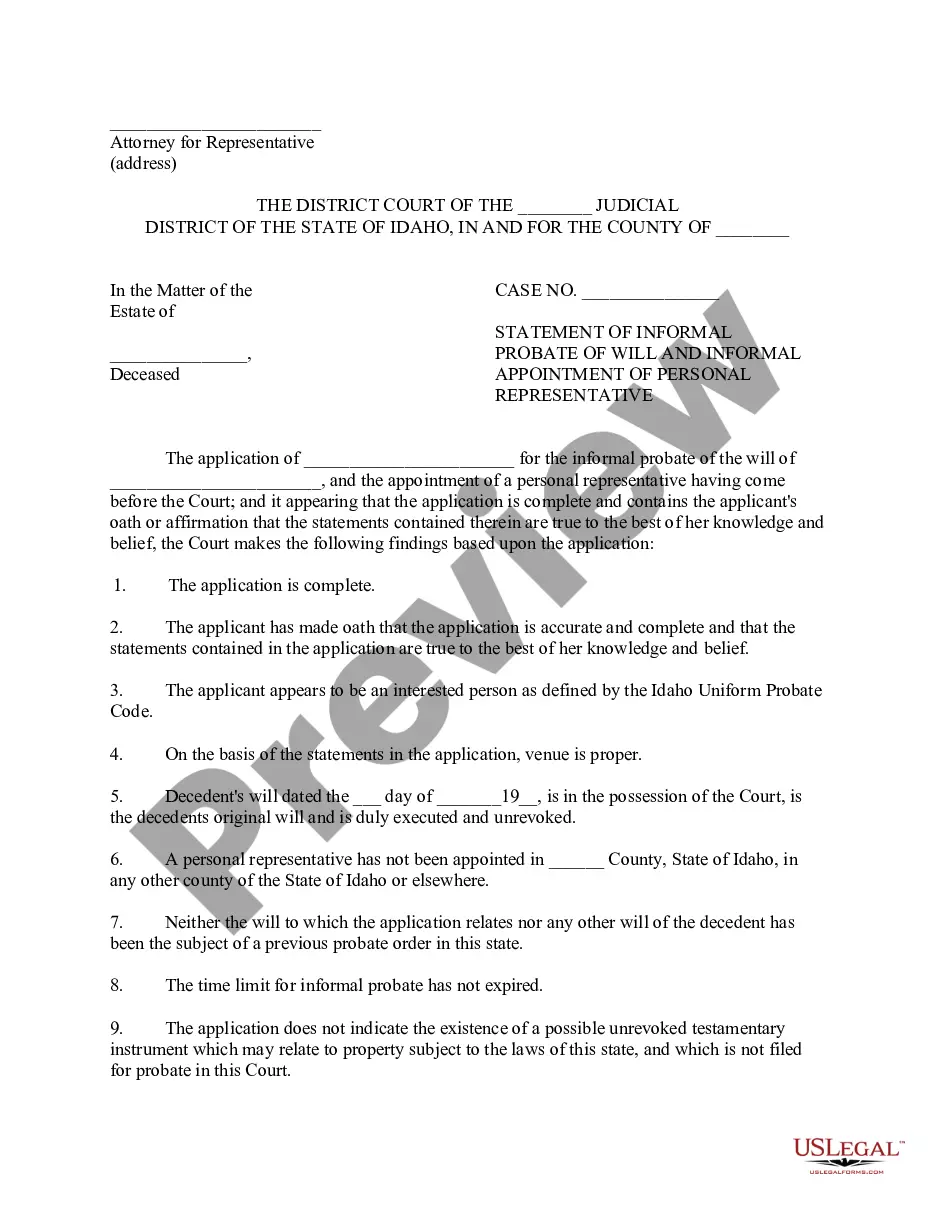

In Michigan, the assessed value is typically equal to 50% of the home's market value. For example, a home that sold for $250,000 is assessed on the basis of $125,000. Assessed value typically increases over time. Michigan state law limits increases in property taxes to 5% each year.

To claim this exemption, the business must file Form 5076, Affidavit of Owner of Eligible Personal Property Claiming Exemption from Collection of Taxes.

Assessed value is the dollar value assigned to a home or other property for tax purposes. It takes into consideration comparable home sales, location, and other factors. Assessed value is not the same as fair market value (what the property could sell for) but is often calculated as a percentage of it.

The taxable value of property in Michigan can increase by no more than 5% from one year to the next. This means that even when home values are surging upwards, taxes will remain relatively steady.