Personal Property Document With Iphone In Los Angeles

Description

Form popularity

FAQ

You can search online through the county website or a third-party tool or visit your local county recorder's office to find owner information on a specific property. You may see the owner's name, address, phone, and other details about them.

Property ownership information can be requested from the County Registrar-Recorder/County Clerk. For more information, please visit their website to Request a Real Estate Record.

You can obtain a copy of your Grant Deed directly from your County Registrar-Recorder/County Clerk with no third party assistance needed. The County Registrar-Recorder mails the original Grant Deed document to the homeowner after it is recorded. Therefore, you should already have your origi- nal Grant Deed.

To ensure that assessments are equitable, the assessed value of the property and the amount of property tax are public records. Deeds and liens are placed on public record so that anyone can check the ownership of property or the financial status of a person or corporation.

For instance, a property owner needs a deed in order to transfer the title or sell the asset to someone else. Deeds must be signed and notarized and must be filed with the local government. As such, they are considered public records and can be accessed by anyone. They are filed and kept with the register of deeds.

A real estate agent can also potentially help you find a property's owner. Real estate agents have access to not only public property data that you could access yourself but also a database called the multiple listing service (MLS).

Business Personal Property includes items like machinery, equipment, fixtures, and leasehold improvements possessed or used in connection with a trade or business. Unlike Real Property, Business Personal Property taxes are based on information provided annually by business owners to the Los Angeles County Assessor.

WHICH STATES DO NOT TAX BUSINESS PERSONAL PROPERTY? North Dakota. South Dakota. Ohio. Pennsylvania. New Jersey. New York. New Hampshire. Hawaii.

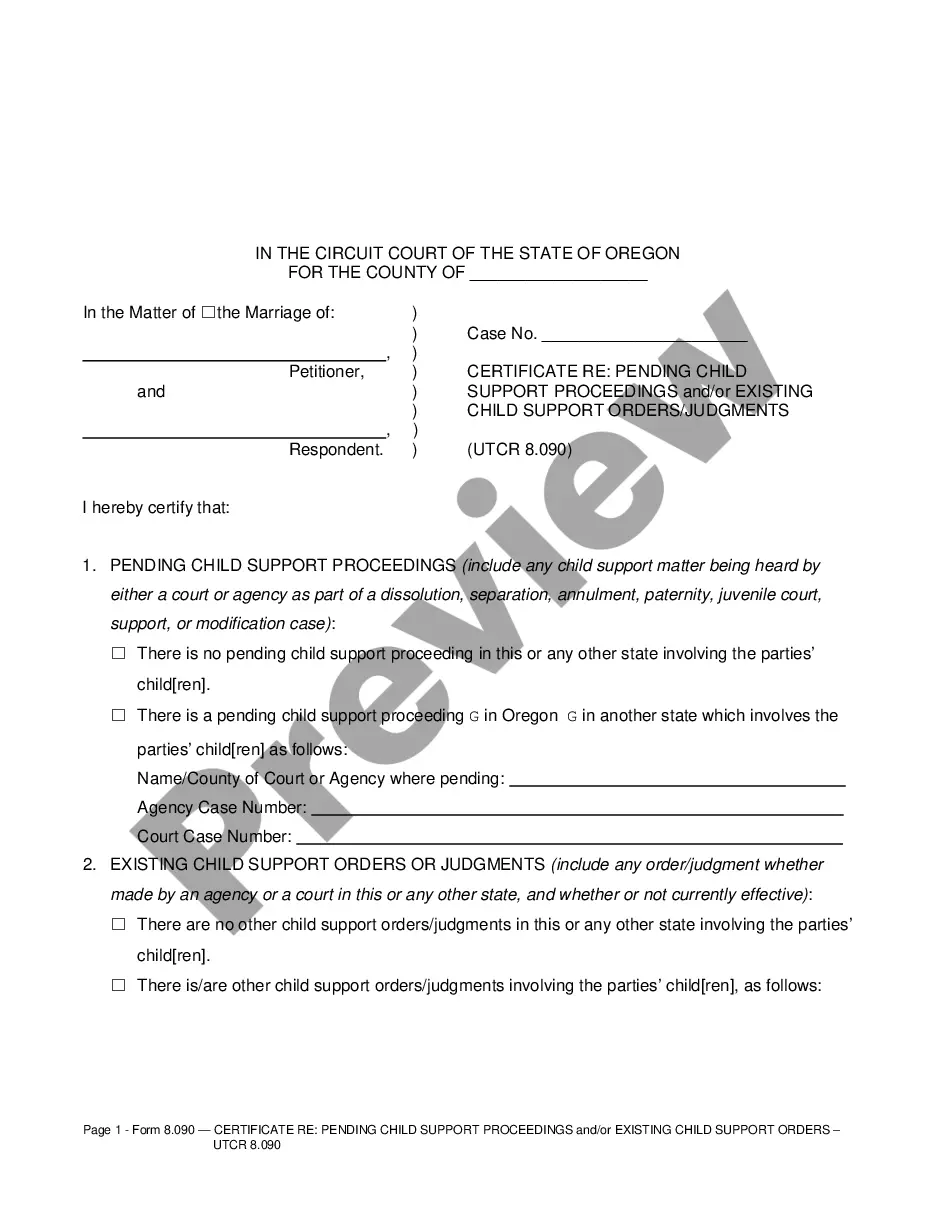

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

California Constitution Article XIII and Revenue and Taxation Code section 201 state that all property is taxable unless it is stated that it is exempt. Business personal property is not exempt.