Personal Property In Purchase Contract In Clark

Description

Form popularity

FAQ

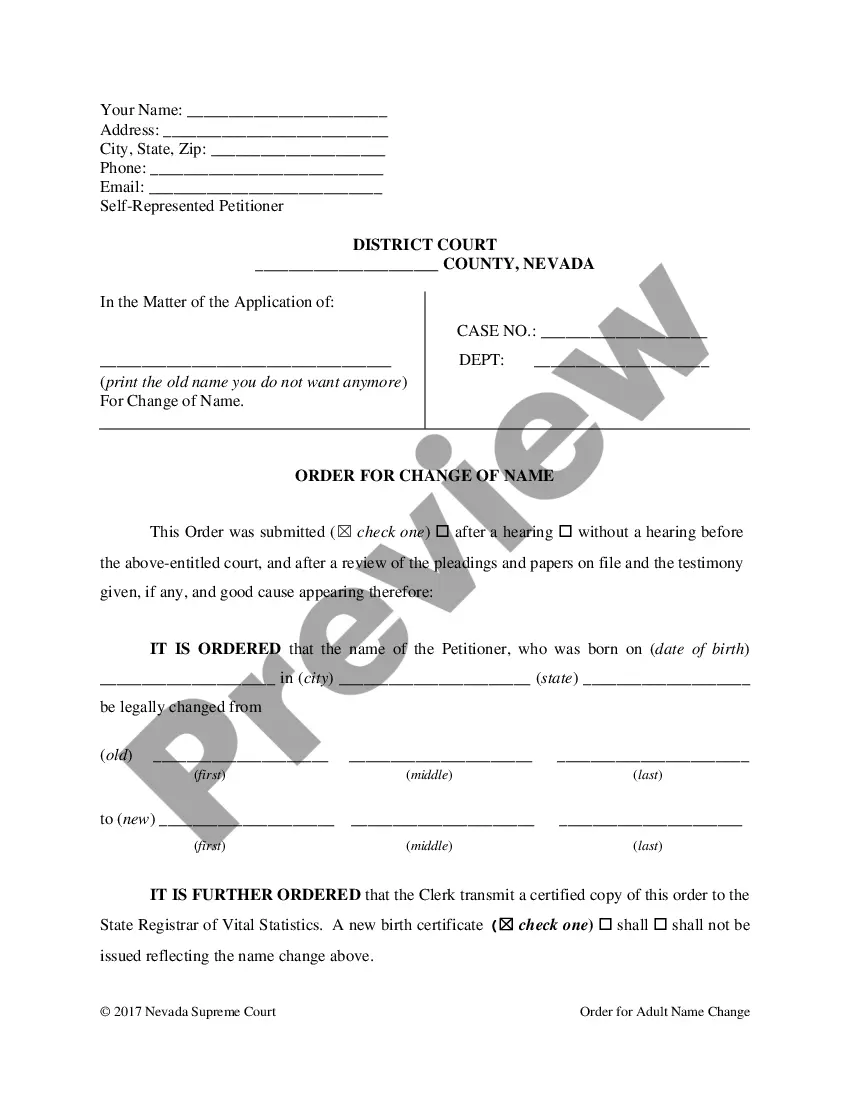

As a buyer, you put an offer on a house that's under contract just as you would if you were the first interested party, negotiating until you reach terms and a contract with the seller. If the first deal falls through for any reason, you're next in line to get the house.

If you're using a real estate agent: Interview agents until you find the one you want to use. Find a property. Consult with the agent on what to offer and what terms to request. The agent submits the contract. If the other party/parties sign the contract, you've now put the property under contract.

Classifications Intangible. Tangible. Other distinctions.

Ing to Nevada Revised Statutes, all property that is not defined or taxed as "real estate" or "real property" is considered to be "personal property." Taxable personal property includes manufactured homes, aircraft, and all property used in conjunction with a business.

Personal property may not be included as additional security for any mortgage on a one-unit property unless otherwise specified by Fannie Mae. For example, certain personal property is pledged when the Multistate Rider and Addenda ( Form 3170) is used.

A personal property tax is imposed by state or local governments on certain assets that can be touched and moved such as cars, livestock, or equipment. Personal property includes assets other than land or permanent structures such as buildings.

Personal use property is used for personal enjoyment as opposed to business or investment purposes. These may include personally-owned cars, homes, appliances, apparel, food items, and so on.

Personal Property Personal belongings such as clothing and jewelry. Household items such as furniture, some appliances, and artwork. Vehicles such as cars, trucks, and boats. Bank accounts and investments such as stocks, bonds, and insurance policies.

Motor vehicles required to be registered with the Nevada Department of Motor Vehicles and Public Safety are exempt from the property tax, though subject to a governmental service tax.

Ing to Nevada Revised Statutes, all property that is not defined or taxed as "real estate" or "real property" is considered to be "personal property."