Arrendamiento Bienes Without In Washington

Description

Form popularity

FAQ

There are two common property management licenses that landlords will need before they can legally rent a property: Certificate of Occupancy – Local building or zoning regulatory authorities issue Certificates of Occupancy stating that a property is built and maintained to accommodate occupants.

Advertise the property availability for overnight accommodations through online marketplaces, newspapers, or other publications. Hire a property manager to handle the rental of the property. Engage in any short-term rental contracts (less than 30 days in a row per consumer).

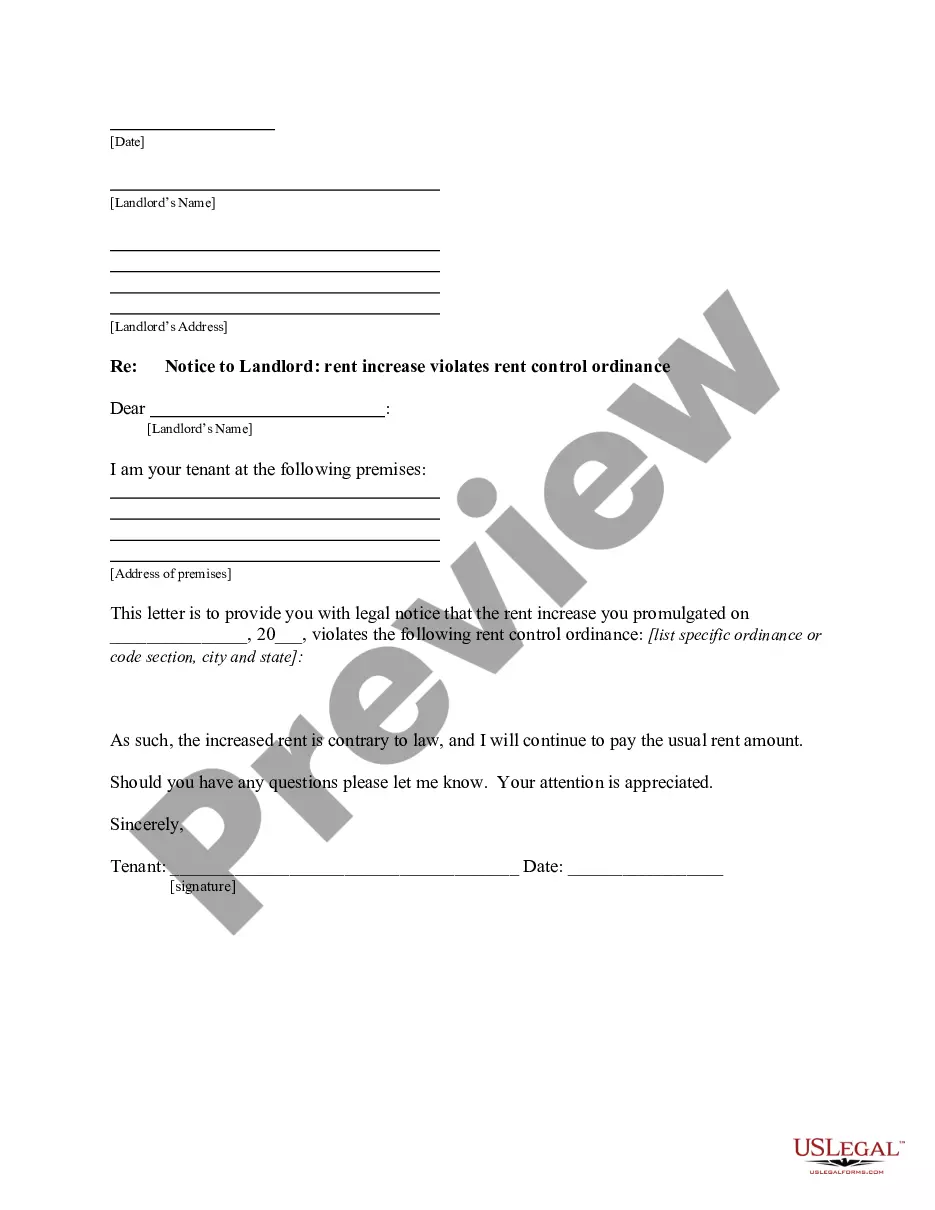

Except in the case of emergency or if it is impracticable to do so, the landlord shall give the tenant at least two days' written notice of his or her intent to enter and shall enter only at reasonable times.

While Washington state doesn't impose a general business license requirement for rental properties, most cities do. Your location and the structure of your rental property largely determine whether you need a City Business License or a Washington State Business License.

It's a common misconception that Washington state requires all landlords to have a business license. While Washington state doesn't impose a general business license requirement for rental properties, most cities do.

Yes. If the law does not make the landlord give you a “good” reason, the landlord must still give you a 60-Day Notice that they want to stop renting to you.

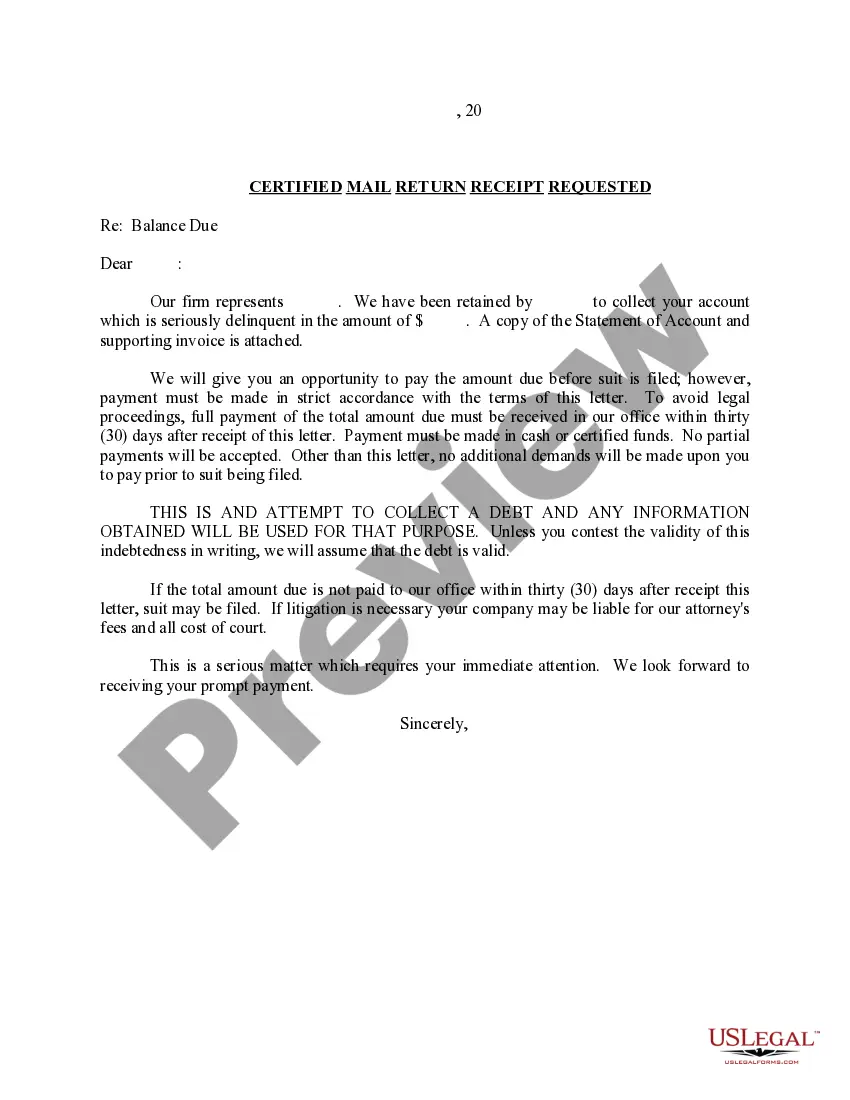

Here are some key things to know about evictions in Washington State: Your landlord cannot evict you from your unit without going through a court process (RCW 59.18. 290, RCW 59.18. 300).

Except in the case of emergency or if it is impracticable to do so, the landlord shall give the tenant at least two days' written notice of his or her intent to enter and shall enter only at reasonable times.

A financial declaration should include detailed information about a person's income, expenses, debts, and assets. It should provide an accurate snapshot of their financial situation to enable a fair evaluation of their eligibility for financial support.

III. Tips for Writing a Winning Declaration. Don't Use the Subjoined Fill-In-The-Blank Declaration Forms. Be Thorough. Tell a Story. Show Rather Than Tell. Declarations Should Contain Firsthand Knowledge, Not Secondhand. Submit 3rd Party Supporting Declarations. Be Concise. Gather Lots of Supporting Documents.