Arrendamiento Bienes Formulario In Pennsylvania

Description

Form popularity

FAQ

The program's recent expansion became effective on January 16, 2024, when the new claim season opened. The rebate program is open to eligible Pennsylvanians age 65 and older, widows and widowers age 50 and older, and individuals with disabilities age 18 and older.

You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld. NOTE: Do not include copies of Form(s) 1099-DIV and 1099-INT, unless the forms show PA income tax withheld.

Yes! the Pennsylvania Department of Revenue mandates the filing of Form W-2 provided there is a state withholding tax.

Older adults and people with disabilities 18 and older in Pennsylvania may be eligible to receive up to $1,000 in rebates.

Steps to file your federal tax return These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business costs; and other tax-deductible expenses if you are itemizing your return.

Photocopies of your Form(s) W-2 (be sure the information is legible), or your actual Form(s) W-2. Include a statement to list and total your other taxable compensation. You must submit photocopies of your Form(s) 1099-R, 1099-MISC, 1099-NEC and other statements that show other compensation and any PA tax withheld.

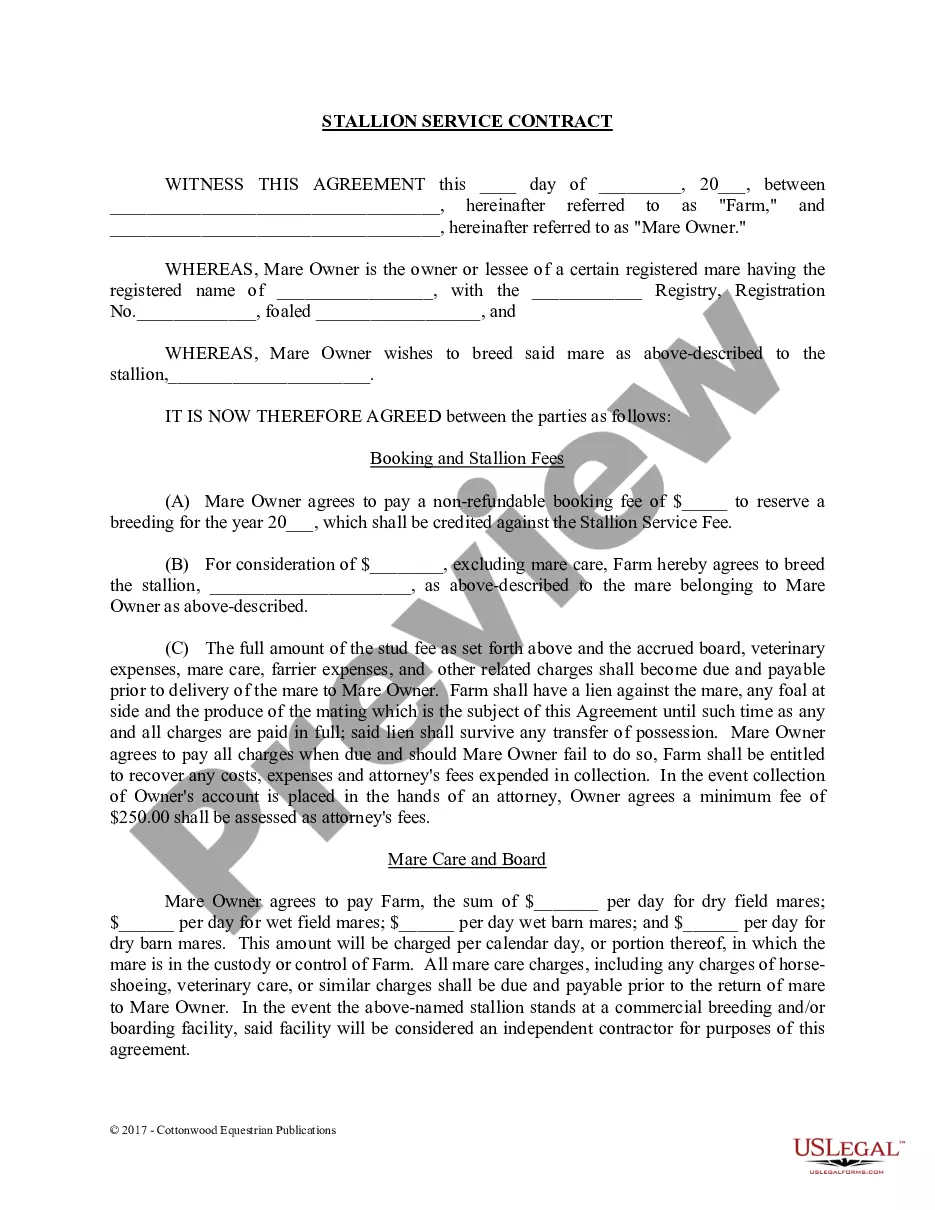

No. Commercial leases don't have to be notarized in this state to be legally valid. However, either party (or both) might request this service if they wish.

Ing to Pennsylvania Law, 68 P.S 250.505a, if you have vacated the premises or an eviction was executed by an order of possessions, you have 10 days from the postmark date of the notice to retrieve your property, or to request your property be stored for an additional period not exceeding 30 days from the date of ...

"Abandoned vehicle." (i) The vehicle is physically inoperable and is left unattended on a highway or other public property for more than 48 hours. (ii) The vehicle has remained illegally on a highway or other public property for a period of more than 48 hours.

Pennsylvania law mandates that landlords provide tenants with a habitable property that meets basic health and safety standards. This includes providing essential services like heat, water, and electricity and maintaining the property in a safe and livable condition.