Publication 783 With Irs In Santa Clara

Description

Form popularity

FAQ

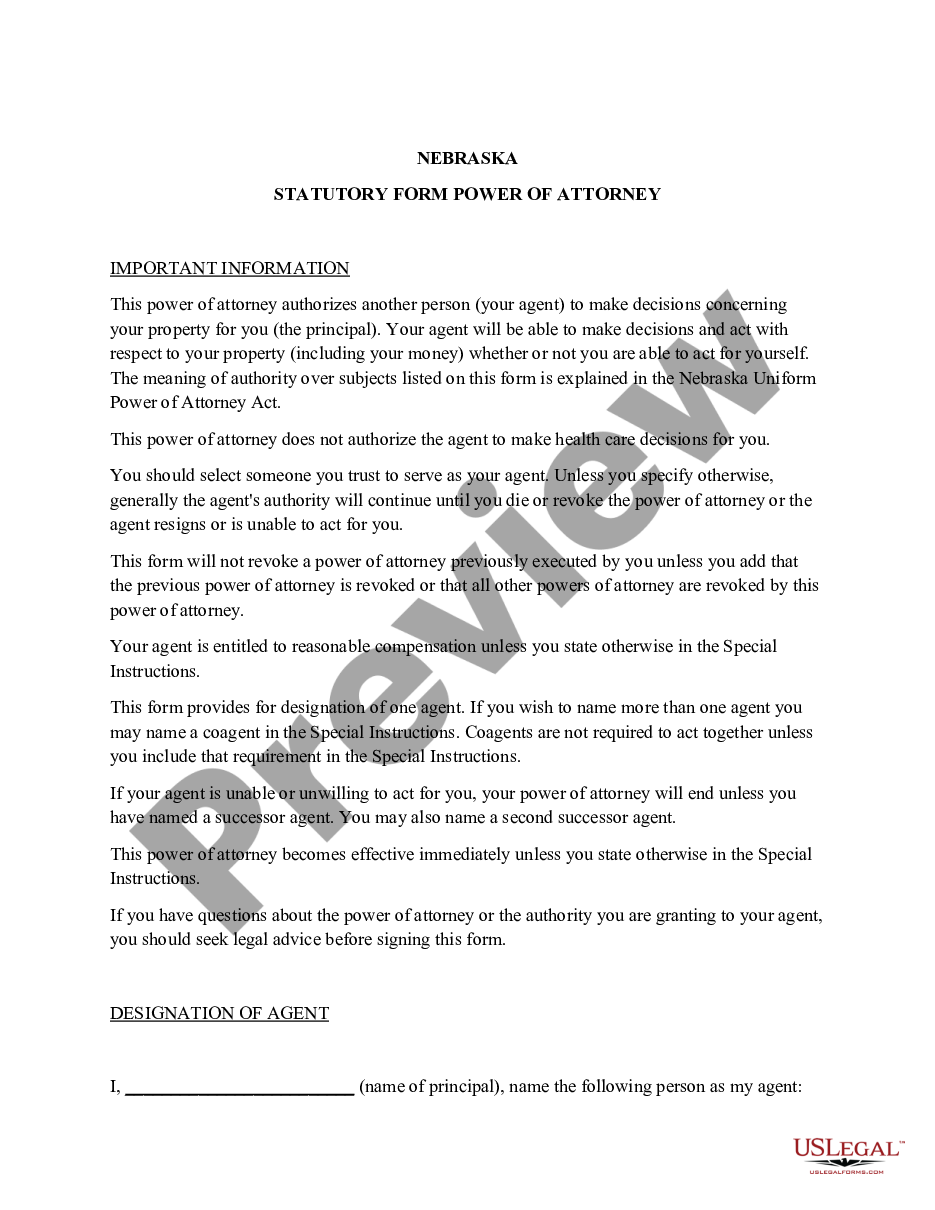

By law, IRS representatives will only speak with the taxpayer or to the taxpayer's legally designated representative. One of these forms, which is current, completed and signed: Form 8821, Tax Information Authorization. Form 2848, Power of Attorney and Declaration of Representative.

One of the changes available to taxpayers is the option to withdraw from a resolved tax lien with the completion of the IRS Form 12277. Note: the IRS may consider other aspects of your credit history in addition to filing Form 12277, so the taxpayer may need to take other actions to help the withdrawal process.

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien.

IRS & State Tax Attorney Resolving Tax Debt… You're absolutely able to sell property that is subject to an IRS lien.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.

Submit a whistleblower claim Individuals must use IRS Form 211, Application for Award for Original Information PDF, and ensure that it contains the following: A description of the alleged tax noncompliance, including a written narrative explaining the issue(s).