Certificate Of Discharge Form Within One Year In Riverside

Description

Form popularity

FAQ

A list of all disputed issues with a short explanation of each;A statement of facts from each party; andA signed stipulation as to undisputed issues of fact and law and exhibits, which neither party is objecting. This rule is essentially forcing parties to try to settle issues in their case before going to trial.

This rule is essentially forcing parties to try to settle issues in their case before going to trial. If Local Rule 5153 is not complied with, the Court will not allow your case to go forward until these procedures are met.

Please allow 6-8 weeks to receive your original recorded document back in the mail. Documents are not processed on weekends or on official Riverside County holidays. The County of Riverside is not responsible for the delivery of mail by the United States Post Office or any other delivery service. Prepare your document.

A quick definition of local rule: Local rule: A special rule made by a court that applies only to that court. It can be about things like how many copies of papers need to be filed or what people can do in the courtroom. It's like a special rule just for that court.

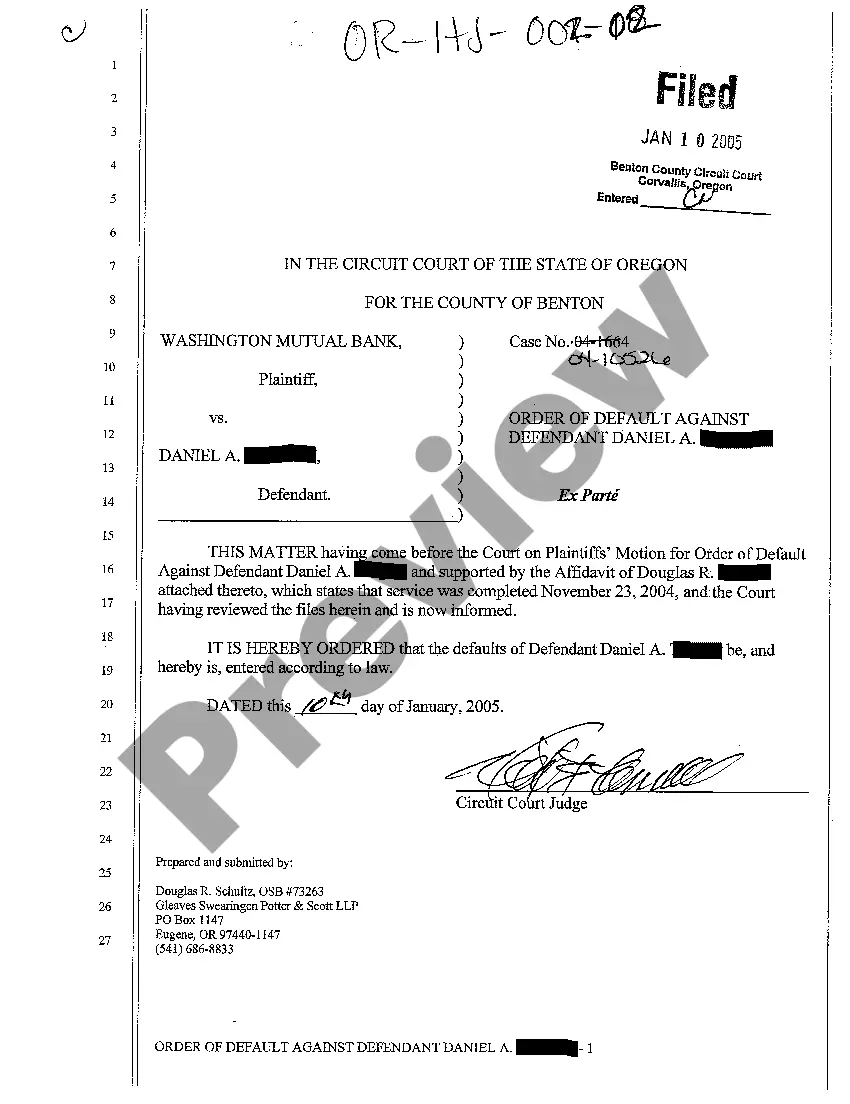

A party seeking an ex parte order must notify all parties no later than a.m. the court day before the ex parte appearance, absent a showing of exceptional circumstances that justify a shorter time for notice. CRC 3.1203 (a).

In California, grant deeds are filed at the county assessor's office with a Preliminary Change of Ownership Request, applicable fees and a Tax Affidavit. All must be notarized for legal transfer and recording.

Riverside Superior Court Local Rule 3116 provides: Unless otherwise specified in the Order to Show Cause, any response in opposition to an Order to Show Case (a) shall be in the form of a written declaration and (b) shall be filed no less than four court days before the hearing on the Order to Show Cause.

Riverside Superior Court Local Rule 3116 provides: Unless otherwise specified in the Order to Show Cause, any response in opposition to an Order to Show Case (a) shall be in the form of a written declaration and (b) shall be filed no less than four court days before the hearing on the Order to Show Cause.

How do I get a grant deed in California? In California, grant deeds are filed at the county assessor's office with a Preliminary Change of Ownership Request, applicable fees and a Tax Affidavit. All must be notarized for legal transfer and recording.

Peter Aldana was elected the Assessor-County Clerk-Recorder for Riverside County in June of 2014. Peter has been with the Riverside County ACR office for over 30 years in a variety of appraisal, supervisory, and management positions.