Law Book For Banking In Dallas

Description

Form popularity

FAQ

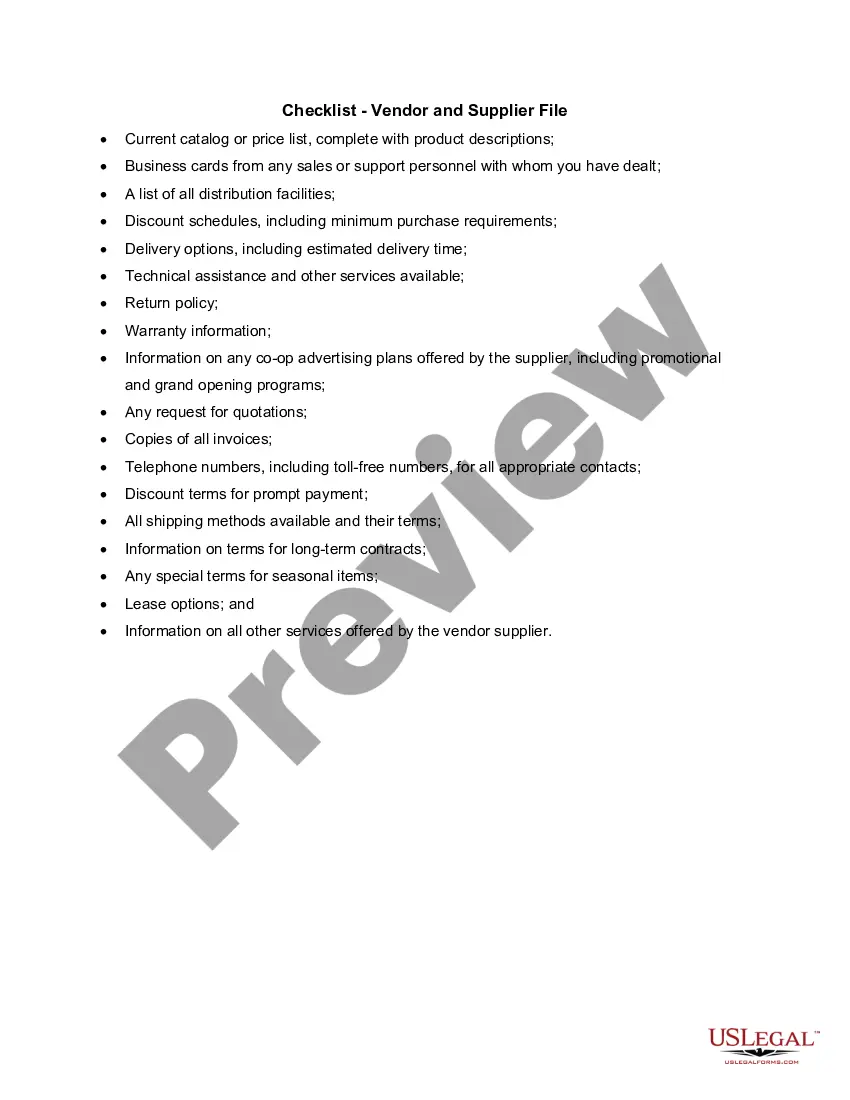

2. Corporate bylaws prove that your business is a legitimate corporation. Not only does having bylaws signals to others that you run a legitimate business—banks, land lords and potential investors will probably ask to see your bylaws before doing business with you.

The financial services industry continues to be a large source of hiring of both law students and practicing attorneys. Such employers include investment banks, private equity funds, hedge funds, wealth management firms, bond rating agencies and government regulatory agencies.

Financial institutions are required to take steps to protect the privacy of consumers' finances under a federal law called the Financial Modernization Act of 1999, also known as the Gramm-Leach-Bliley Act.

Every law firm should have three basic bank accounts: an operating account, a savings account, and a trust or IOLTA account.

We work to ensure that financial services providers: act professionally, treat you fairly and prioritise your best interests. provide you with financial products that meet your needs. meet their responsible lending obligations.

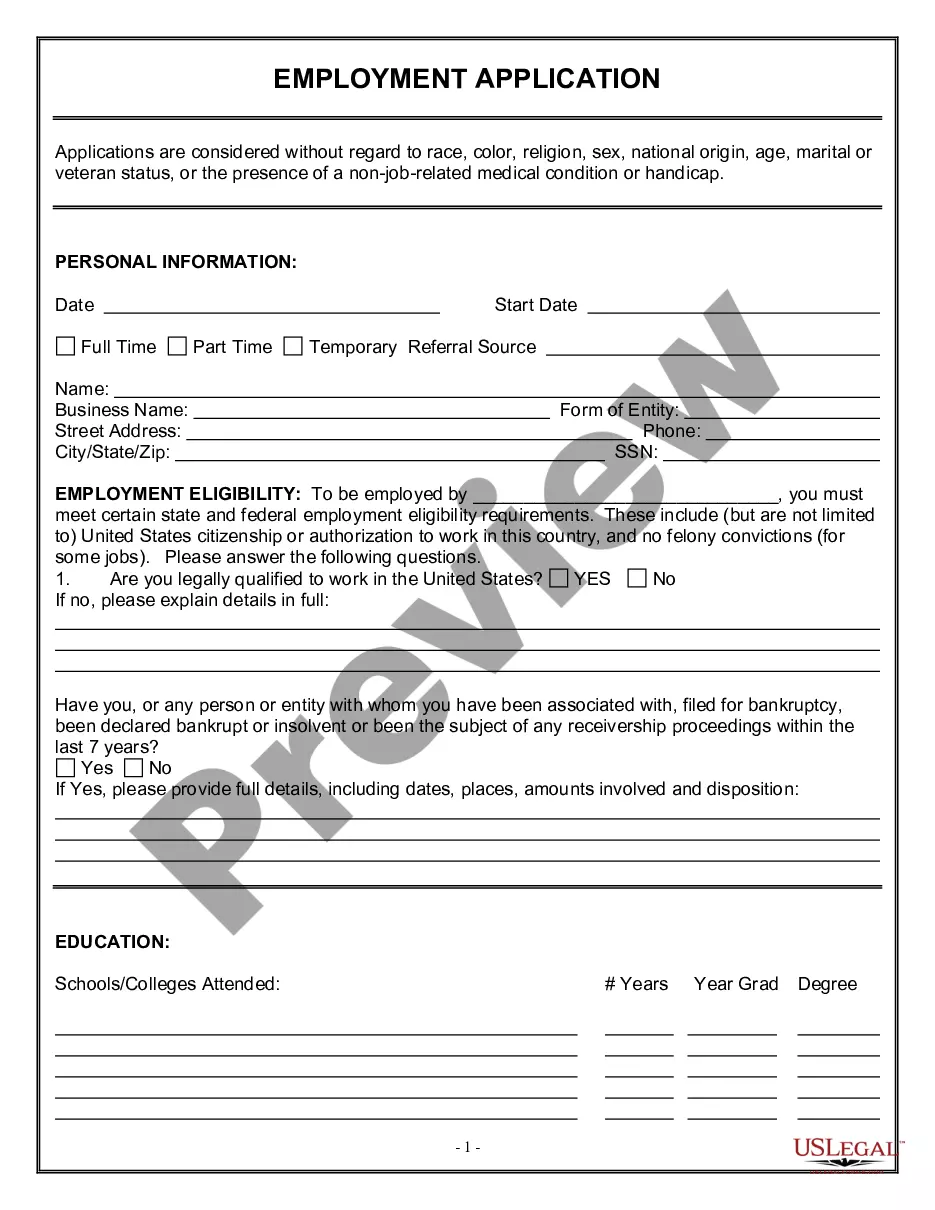

You, as the principal, must accompany the agent to a financial center and provide a list of account numbers to which you want the agent to have access (a form must be completed for each account). You and the agent must provide valid and unexpired IDs, one of which should be a government-issued photo ID.

National banks and federal savings associations are among the most highly regulated institutions in the country, with many laws and regulations that govern their activities.

The Bank's Board of Directors shall prescribe Branch bylaws regulating the manner in which the Branch board of directors may conduct business of the Branch board.

Research and Comply with Regulatory Oversight. Practice Strict Financial Discipline, Always. Assess All of Your Options. Draft a Detailed Business Plan. Secure Finances. Register as a Legal Business Entity. Obtain an Employer Identification Number. Apply for Charters.

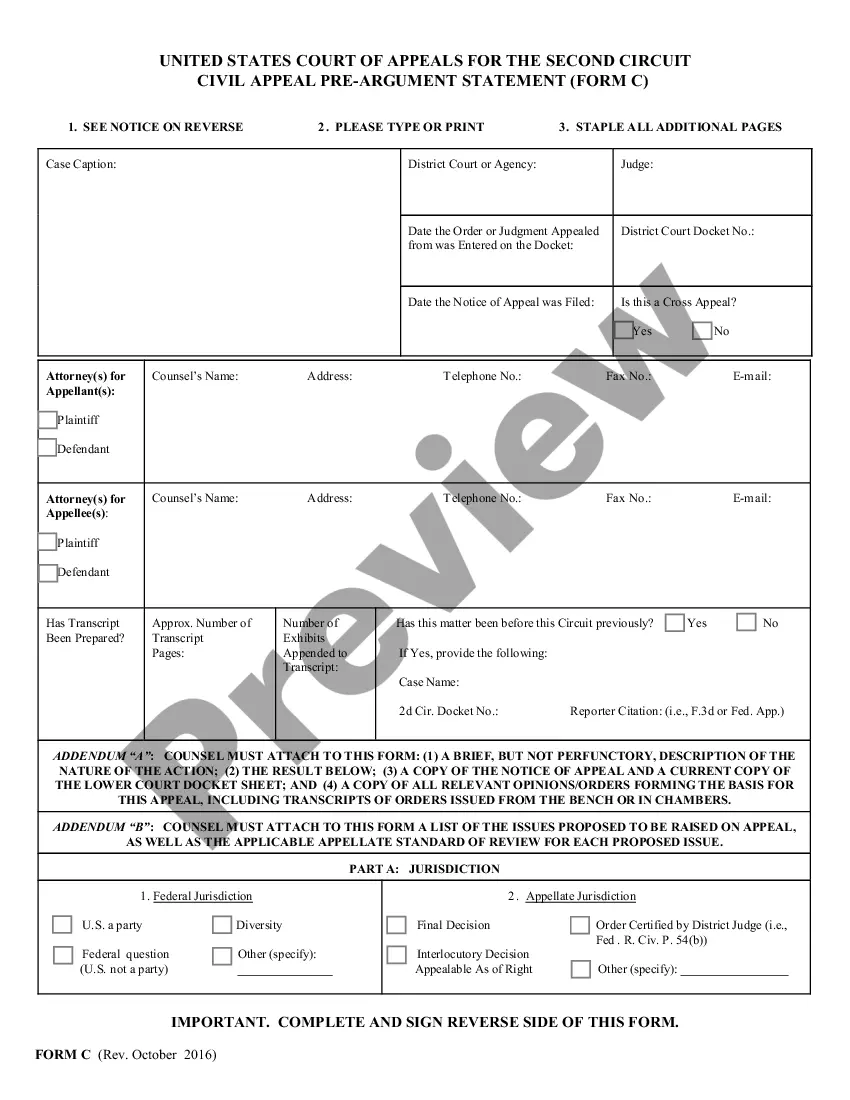

If you are a customer at a bank, and unauthorized bank accounts have been opened in your name that results in fees or unwanted services, you may qualify to file an unauthorized bank account class action claim.