Chattel Form Paper Withdrawal In San Diego

Description

Form popularity

FAQ

Other situations permitting withdrawal include, for example: (1) where the client insists on action that the lawyer believes is criminal or fraudulent, (2) certain instances where the lawyer has an inability to work with co-counsel, (3) the lawyer's mental or physical condition renders it difficult for the lawyer to ...

Consensual withdrawal Where your client consents to your withdrawal, have them sign a Substitution of Attorney (in California it's Judicial Council Form MC-050). File and serve the signed Substitution on all parties to the action and you are out of the case.

Send us a letter saying you want to withdraw your legal representative and intend to continue your case without any legal representation. If you do so, USCIS will communicate only with you. The USCIS office where your case is pending. Find the USCIS office address on the most recent notice you received from USCIS.

LBR 2091-1(a) provides a procedure for an attorney to withdraw as counsel, and that withdrawal results in the client no longer being represented by an attorney. The former client is now considered to be a "Self-Represented Party".

Consensual withdrawal Where your client consents to your withdrawal, have them sign a Substitution of Attorney (in California it's Judicial Council Form MC-050). File and serve the signed Substitution on all parties to the action and you are out of the case.

Civil Division | Superior Court of California - County of San Diego.

(1) An attorney may request withdrawal by filing a motion to withdraw. Unless the court orders otherwise, the motion need be served only on the party represented and the attorneys directly affected. (2) The proof of service need not include the address of the party represented.

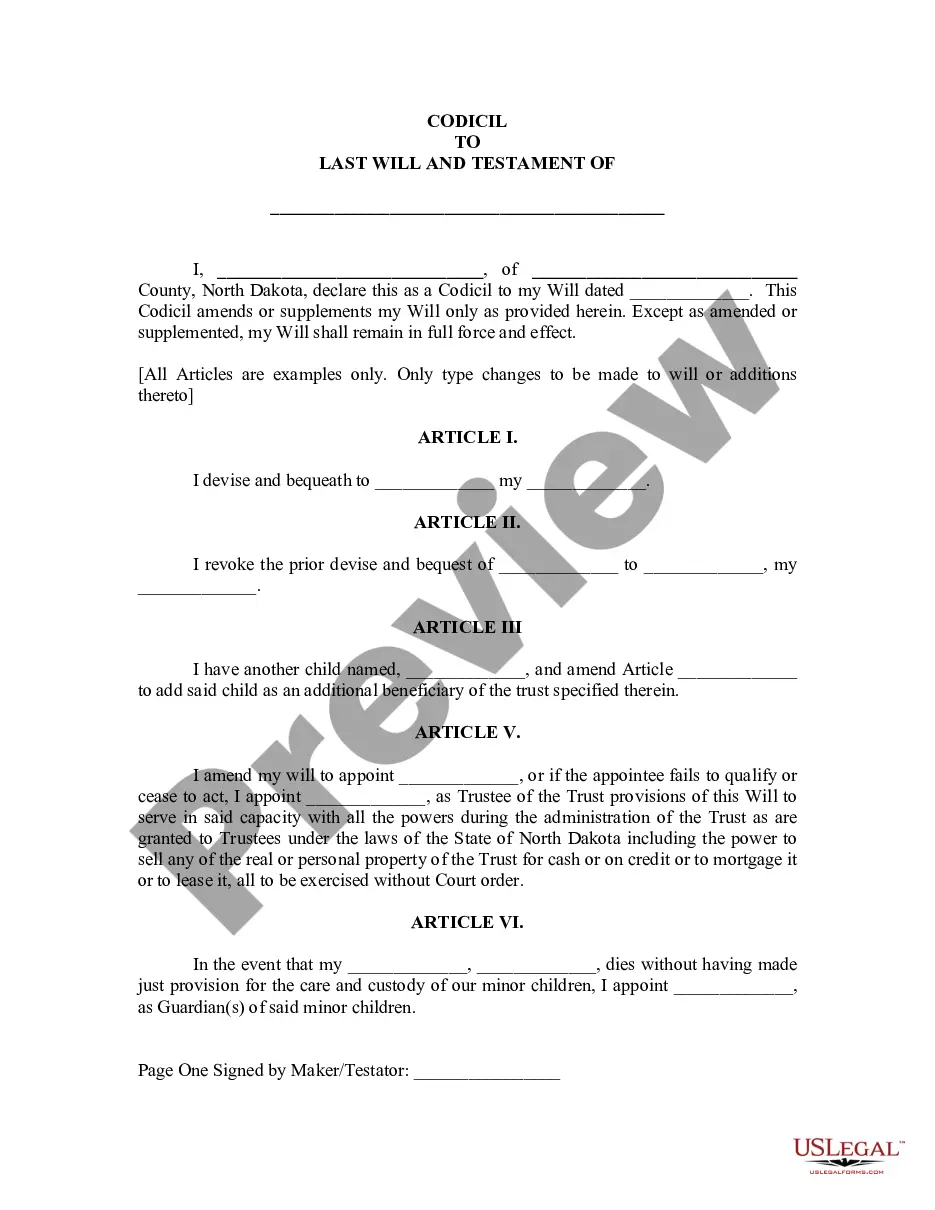

If everything is in order, the court grants 'Letters Testamentary' or 'Letters of Administration,' officially appointing the executor or administrator. This person is now legally able to manage the estate and is often referred to as the personal representative of the estate.

A parent's testamentary trust can be established with instructions that the funds would only be distributed to the beneficiaries following a specific milestone. For example, funds from the trust would not be distributed to a decedent's children until they turn 18 years of age.