Chattel Mortgage Form With Affidavit Of Good Faith In Chicago

Description

Form popularity

FAQ

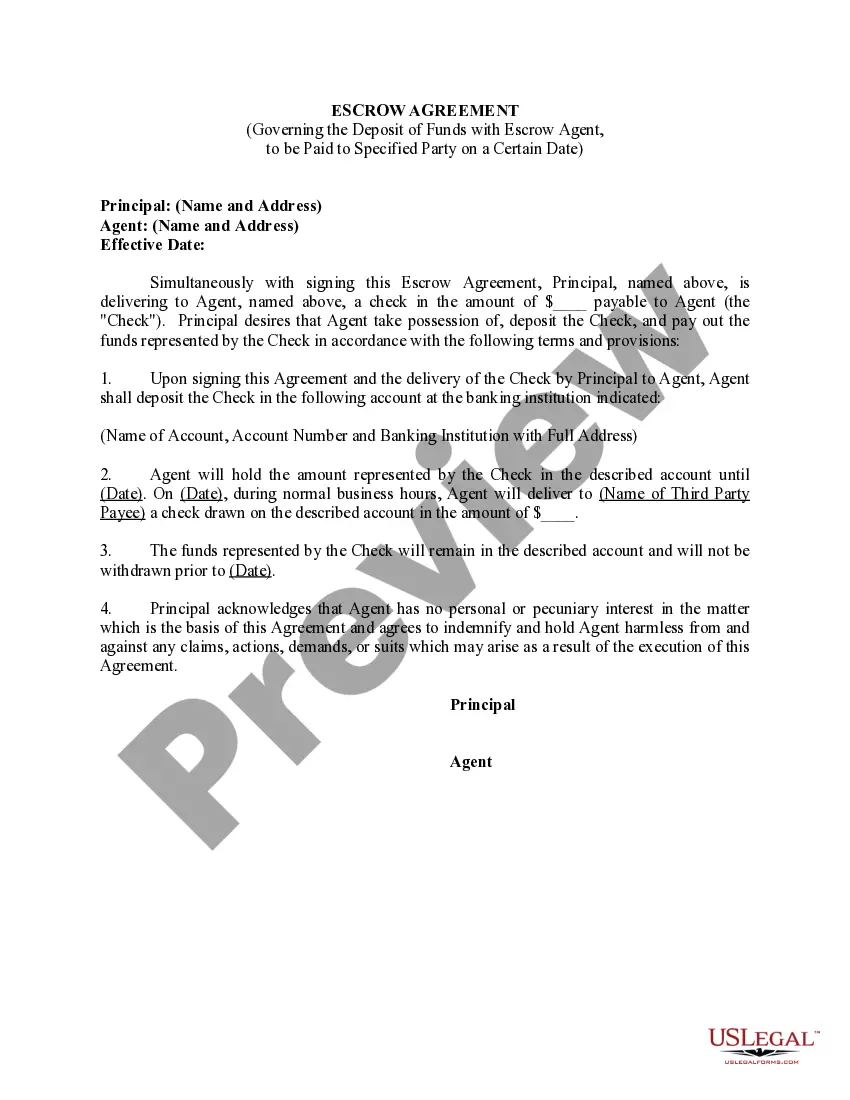

A subject-to mortgage is a real estate investing strategy where a buyer purchases a property while leaving the existing mortgage in place.

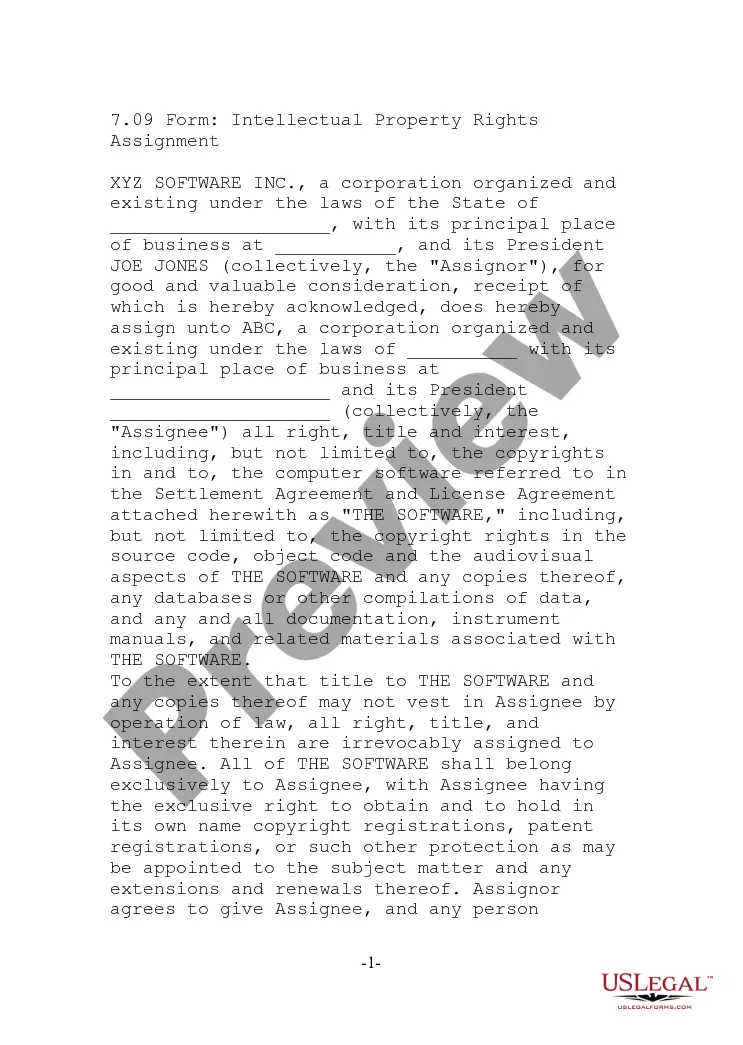

By chattel mortgage, personal property is recorded in the Chattel Mortgage Register as a security for the performance of an obligation. If the movable, instead of being recorded, is delivered to the creditor or a third person, the contract is a pledge and not a chattel mortgage.

Chattel is any tangible personal property that is movable. Examples of chattel are furniture, livestock, bedding, picture frames, and jewelry.

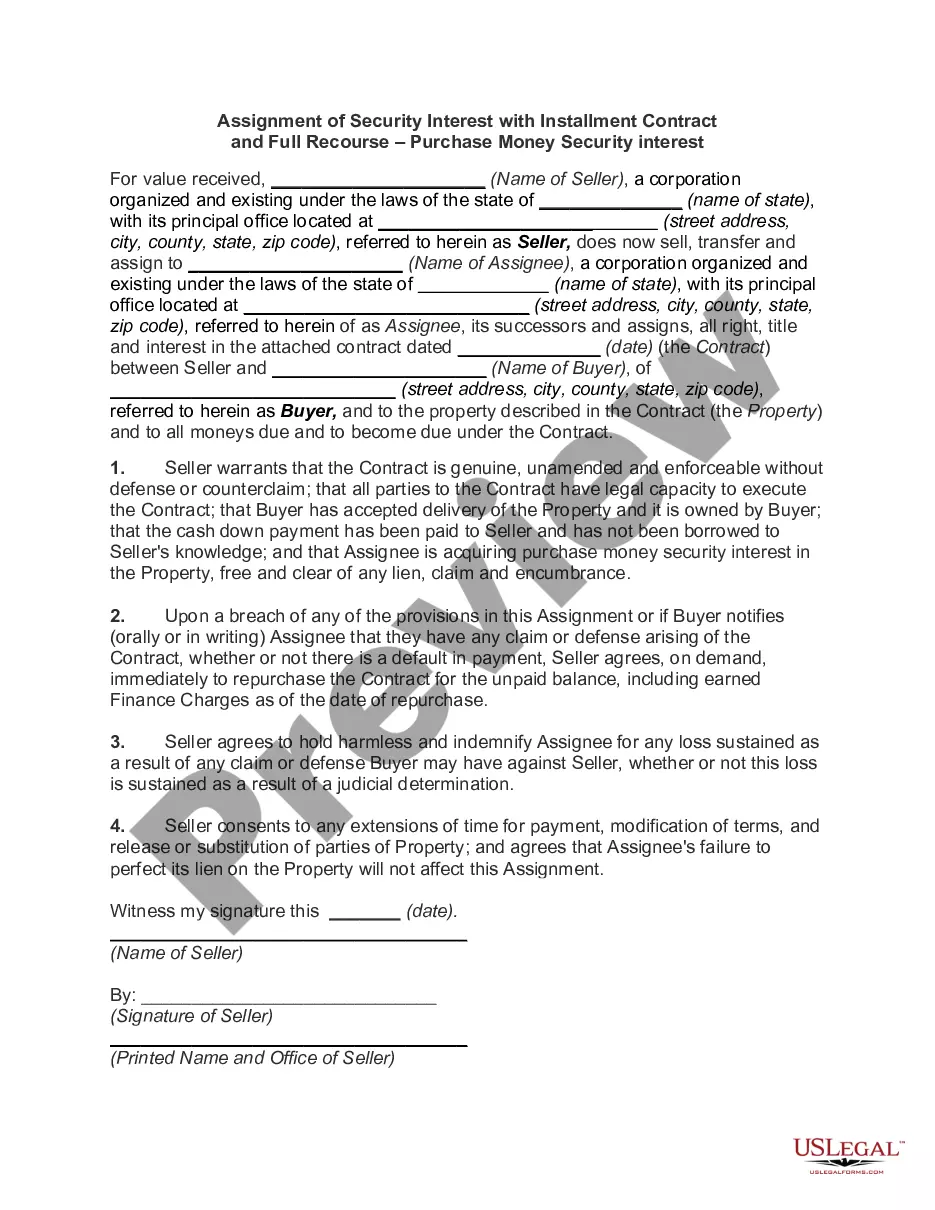

A chattel mortgage must adhere to a prescribed form and execution process: It must be signed by the mortgagor in the presence of two witnesses. An affidavit affirming the mortgage's purpose and validity must be included and signed by the parties involved. The affidavit must be certified by an authorized officer.

The Bottom Line. If you're looking to buy a modular home or movable piece of equipment, taking out a chattel mortgage could be right for you. These loans come with shorter terms and much lower processing fees. However, the interest rate will be higher than what you'd receive on a conventional mortgage.

The Bottom Line. Chattel mortgages are a little-known but potentially good option if you're looking to finance a manufactured home or heavy equipment. These loans are smaller than conventional loans and tend to have higher rates, but they have shorter terms and quicker payoffs.