Certificate For Employees In Utah

Description

Form popularity

FAQ

File withholding returns online using form TC-941E at tap.utah. You must include your FEIN and withholding account ID number on each return. You must file an annual reconciliation for each year (or partial year) you have a withholding tax account, even if you have no employees or withholding to report for the year.

Use form TC-69 to register with the Utah State Tax Commission for the taxes listed below. To register a DBA, use the Business Name Registration / DBA Application, available at all Department of Commerce registration locations, online at commerce.utah, or by phone at 801-530-4849.

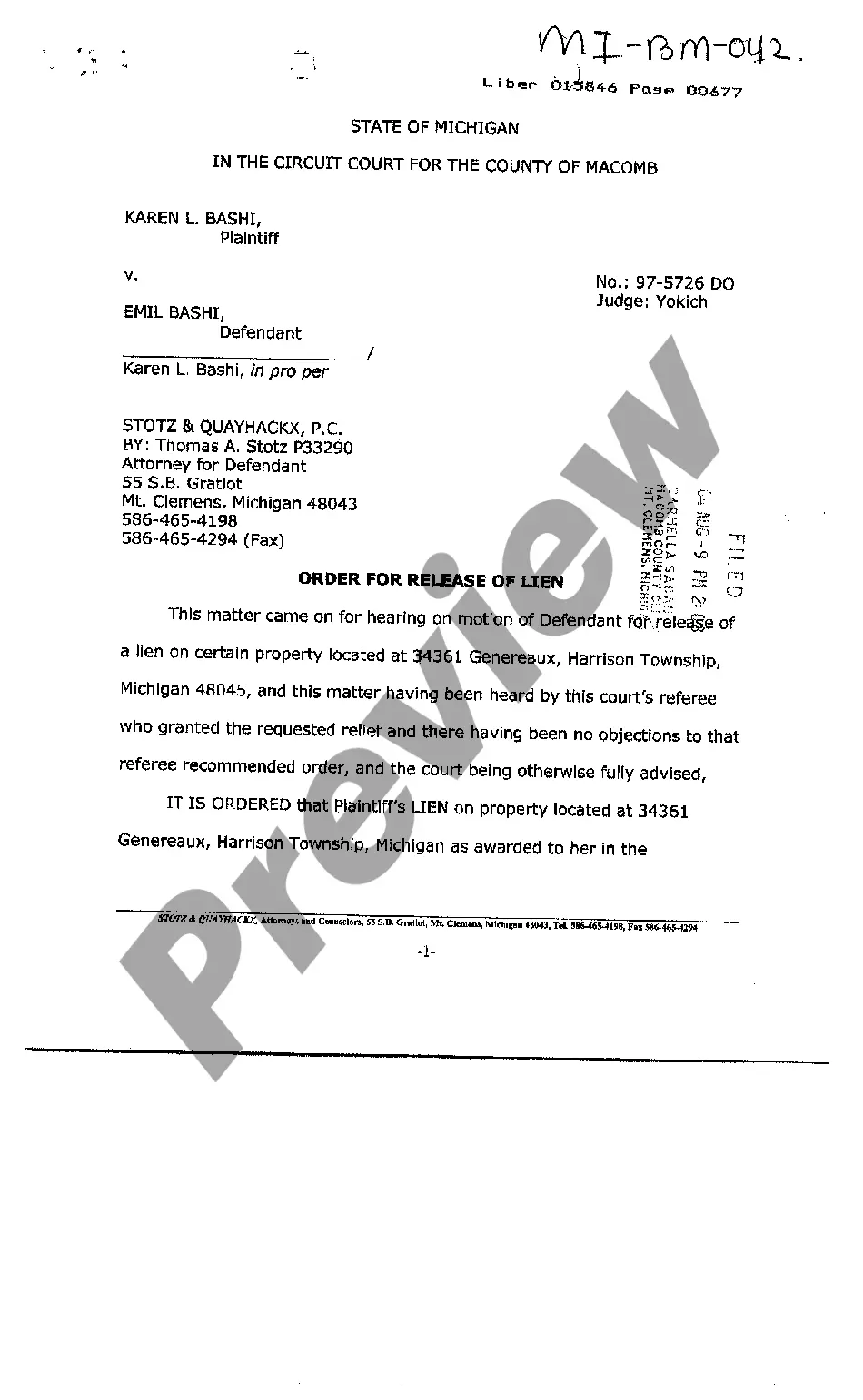

New Hire Paperwork and Compliance for Utah Employment Eligibility Verification (Form I-9) Employee's Withholding Certificate (Form W-4) DWS New Hire Reporting in Utah. Enroll Employee for IRS Form W-2. Enroll Employee for IRS Form 941. Utah Withholding Return Form TC-941. Enroll Employee for IRS Form 940.

Steps to Hiring your First Employee in Utah Step 1 – Register as an Employer. Step 2 – Employee Eligibility Verification. Step 3 – Employee Withholding Allowance Certificate. Step 4 – New Hire Reporting.

UT W-4 Requirements Utah does not require employees to complete a state W-4 form. Withhold amounts based on your employee's federal W-4 form and the Utah withholding schedules or tables in Publication 14, Withholding Tax Guide, .

The Certificate of Organization is the document that officially forms your LLC in Utah. You can file the Utah LLC Certificate of Organization online or by mail. The form asks for basic information like your business name, your LLC address, and your company's Registered Agent information.

So, you want to pursue a rewarding teaching career in Utah? You'll need to complete a bachelor's degree and an Educator Preparation Program (EPP). Then, you'll need to complete a Praxis test required to become licensed in your preferred concentration. You must also pass a background check.

Complete California State DE-4 Form Select Form DE-4 tab. Review your Full Name and Home Address. Select your Filing Status. Enter the Number of allowances you wish to claim in Section 1. Enter any Additional amount you want withheld from each paycheck in Section 2.