Distribution Agreement For In Virginia

Description

Form popularity

FAQ

The term for Distribution Agreements varies, with terms being anywhere from 5 to 15 years. I try to limit the term as much as possible—especially when there is no advance, or a meager one.

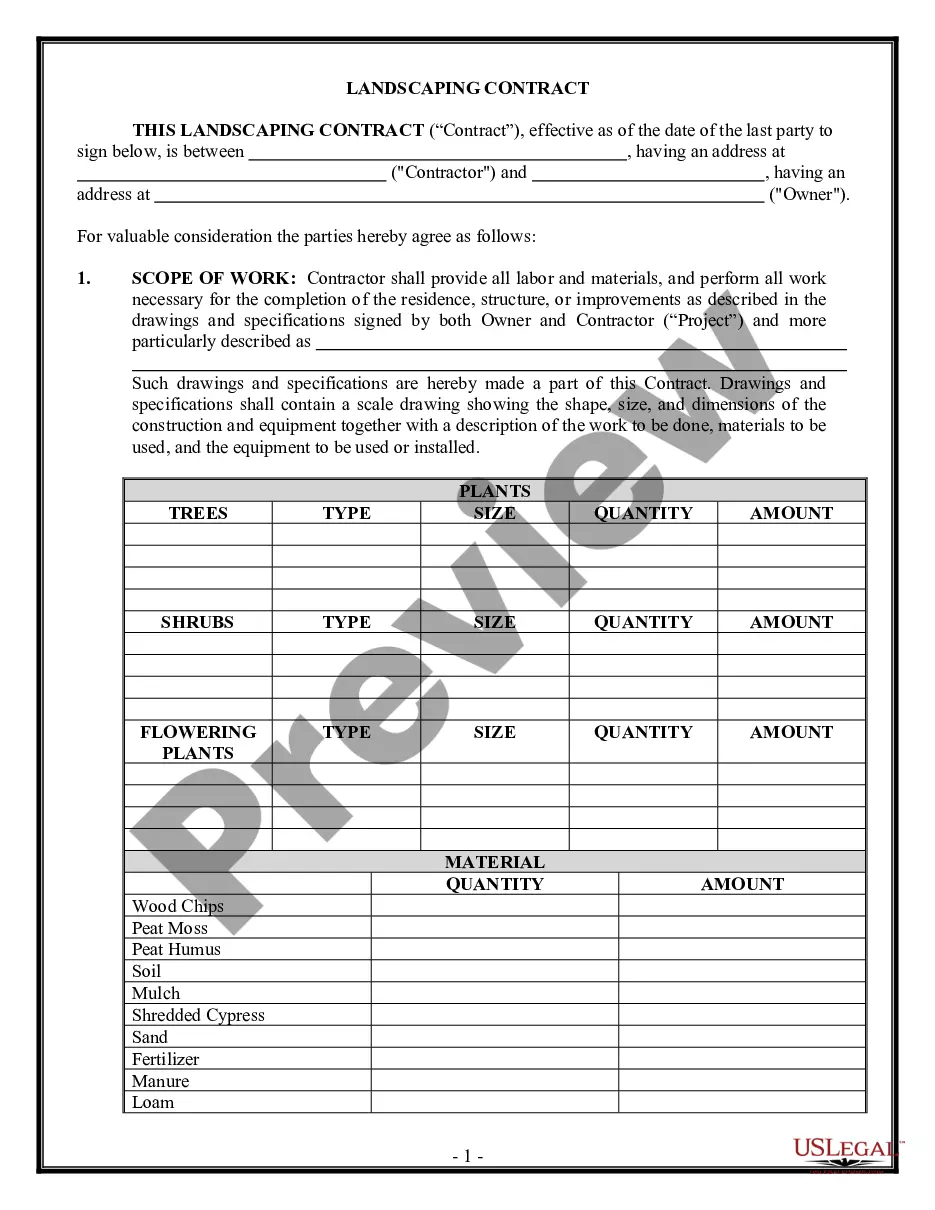

Here are the steps to find and negotiate a distribution agreement: Step 1: Meet with the distributor. Step 2: Discuss the terms of distribution. Step 3: Review the details, such as marketing materials, catalogs, or product literature. Step 4: Hire a lawyer or an expert to draft the agreement.

Negotiating a Distributorship Agreement: Five Critical Steps to Success Execute a master agreement. Define the relevant goods subject to the agreement. Address all relevant intellectual property issues. Make sure renewal options and termination clauses allow the parties to adjust to changing market conditions.

Distribution deal. A distribution deal (also known as distribution contract or distribution agreement) is a legal agreement between one party and another, to handle distribution of a product. There are various forms of distribution deals. There are exclusive and non-exclusive distribution agreements.

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

Can I write my own Operating Agreement? Yes, but we recommend using an Operating Agreement template. An Operating Agreement is a legal document. You don't have to hire an attorney to write one, though.

Every LLC that is registered in the states of California, Delaware, Maine, Missouri, and New York is legally required to have an operating agreement.

The operating agreement is not required in Virginia but is strongly recommended. It can be a crucial document for outlining how your company operates. This can ensure that members are on the same page in times of conflict.

While not always legally required, operating agreements play a critical role in the smooth operation, legal protection, and financial clarity of LLCs. Their absence can lead to governance by default state laws, management, and financial disorganization, and increased legal vulnerabilities.