Cancellation Form Fillable Without Acrobat In Bexar

Description

Form popularity

FAQ

Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home. The Over-65 exemption is for property owners who claim their residence as their homestead - this exemption is a maximum of $85,000 of taxable valuation.

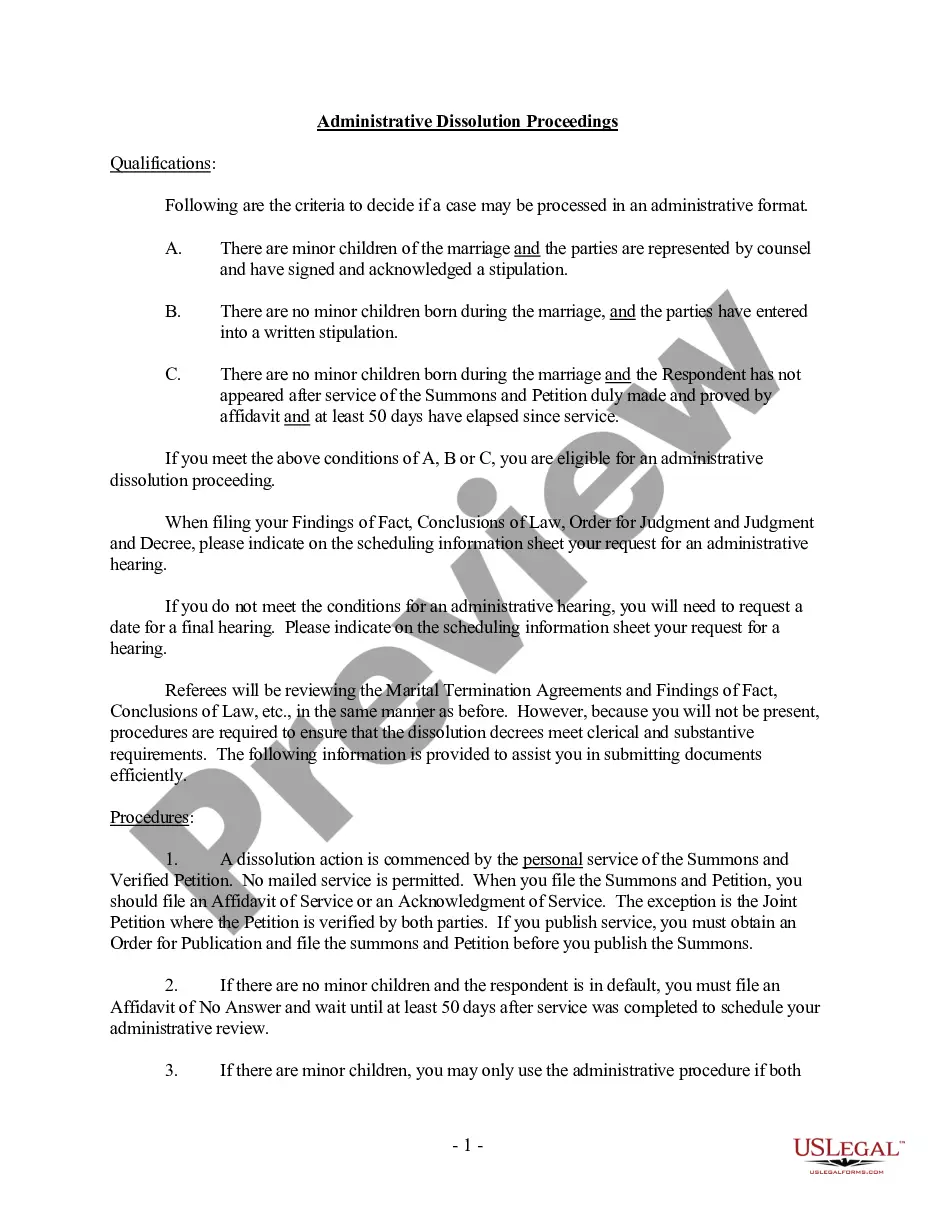

Take the Petition and the copies to the District Clerk's Civil Filing Department. The Civil Filing Department is in the Paul Elizondo Tower at 101 W Nueva, Suite 216. The phone number is 210-335-2621. Turn in your Petition and copies.

Take the Petition and the copies to the District Clerk's Civil Filing Department. The Civil Filing Department is in the Paul Elizondo Tower at 101 W Nueva, Suite 216. The phone number is 210-335-2621.

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

Civil District Courts | Bexar County, TX - Official Website.

In ance to the Tax Code, a Disabled Veteran who has a 100% service-connected rating from the United States Department of Veteran Affairs, or is unemployable, is exempt from taxation on the veteran´s residential homestead.

Do you have your Residential Homestead Exemption? To find out, visit our website by clicking the green box here ? application and then mail to BCAD, P.O. Box 830248, San Antonio, TX 78283. For more information, please call 210-335-2251.

As part of an $18 billion property tax relief package, Texas homeowners will see their homestead exemption on their property tax bill increase from $40,000 to $100,000 of their home's assessed value. If you have an existing homestead, the changes will automatically apply.

Do you have your Residential Homestead Exemption? To find out, visit our website by clicking the green box here ? application and then mail to BCAD, P.O. Box 830248, San Antonio, TX 78283. For more information, please call 210-335-2251.

You may defer or postpone paying taxes on your homestead if you are 65 years of age or older or disabled for as long as you occupy the residence. A homeowner must file a deferral affidavit with the Bexar Appraisal District.