Employee Form Fillable Without Acrobat In Virginia

Description

Form popularity

FAQ

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax. Most other states require employees to complete the W-4 for state taxes, unless the state imposes a flat income tax rate.

Employees should complete Form W-4 (Employee's Withholding Allowance Certificate) online using Hokie Spa. The Virginia state income tax withholding form VA-4 can also be completed online using Hokie Spa. Employees working from other states may complete a withholding form for one of the states listed below.

Form 760IP, Automatic Extension Payment, is a payment coupon and worksheet that provides taxpayers who are unable to file their individual income tax return by May 1 a means of calculating and remitting a payment to avoid penalty and interest.

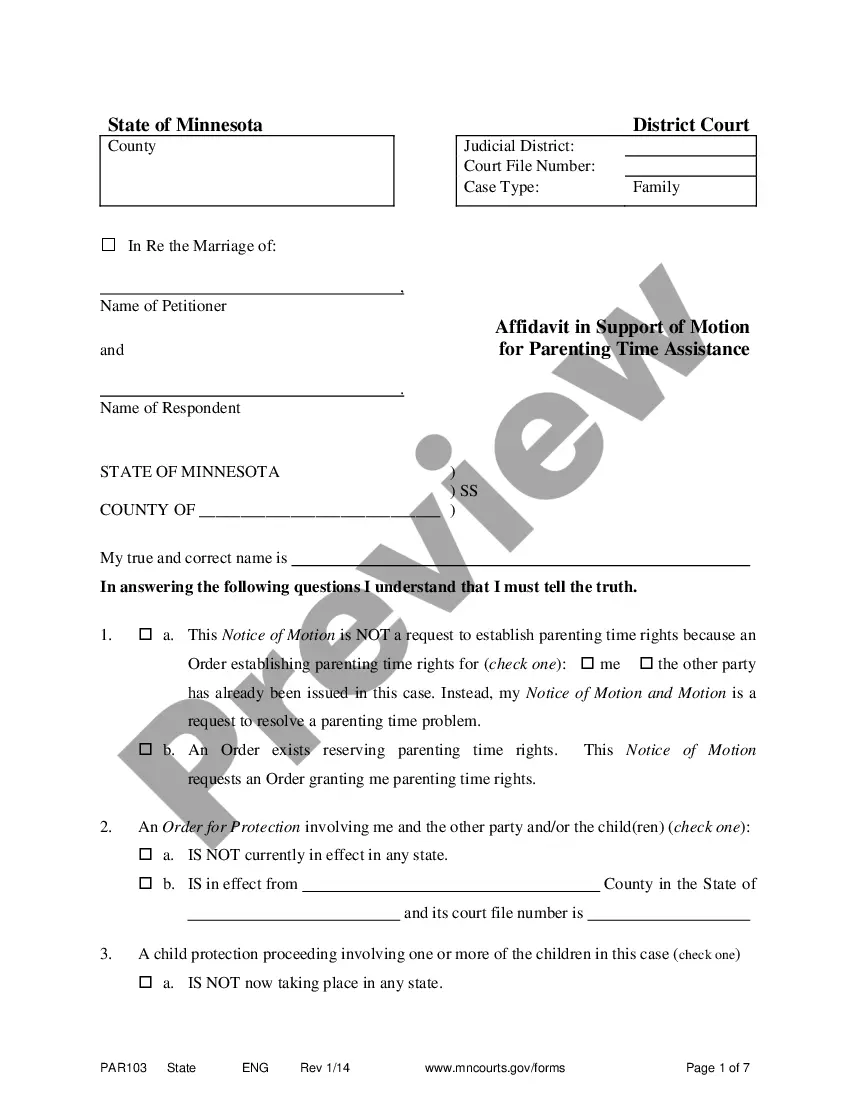

Please download, complete, and bring the following documents with you on your first day: Form I-9, Employment Eligibility Verification (PDF) Form W-4, Employee's Withholding Allowance Certificate (PDF). Form VA-4, Employee's Virginia Income Tax Withholding Exemption Certificate.

Federal and State law requires employers to report newly hired and re-hired employees in Virginia to the Virginia New Hire Reporting Center. Please use this site for information about reporting new hires including reporting online and other reporting options!

You may request or download Virginia State Income Tax forms online from the Virginia Department of Taxation or by calling 804-440-2541.

The new job paperwork checklist: Forms I-9, W-4, and more. A little work before you start work. As a 30+ year member of the AICPA, Nancy has experienced all facets of finance, including tax, auditing, payroll, plan benefits, and small business accounting.

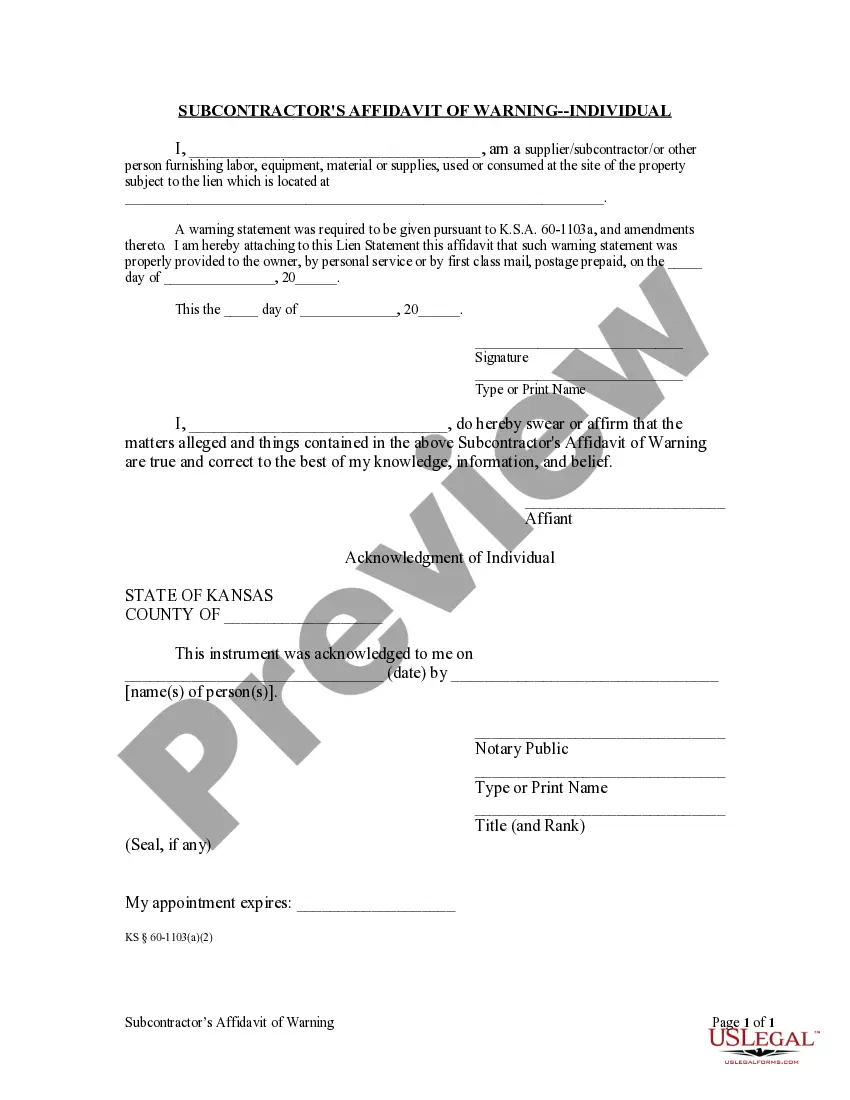

Along with the proof of identification documents, employees must fill out an I-9 form to verify their employment eligibility. After the employee turns in the I-9 form, you must keep it on file, stored separately from other employee documents.

file allows you to file your Virginia tax return electronically at the same time you file your federal forms. This can be done through your tax preparer or at home using your personal computer and approved tax preparation software.

File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Generally, nonresidents with income from Virginia sources must file a Virginia return if their income is at or above the filing threshold.