Employee Rental Agreement With Utilities Included In Utah

Description

Form popularity

FAQ

Yes, you can create your own lease agreement without the assistance of a lawyer or other professional.

Employer-provided housing can be tax-deductible for the company if it meets certain criteria but may also be taxable for the employee unless specific conditions are met.

Landlord's Duties (Utah Code Ann. Landlords must maintain in good and safe working order all electrical, plumbing, heating, hot and cold water, any air-conditioning, and other facilities and appliances, supplied or required to be supplied by the landlord.

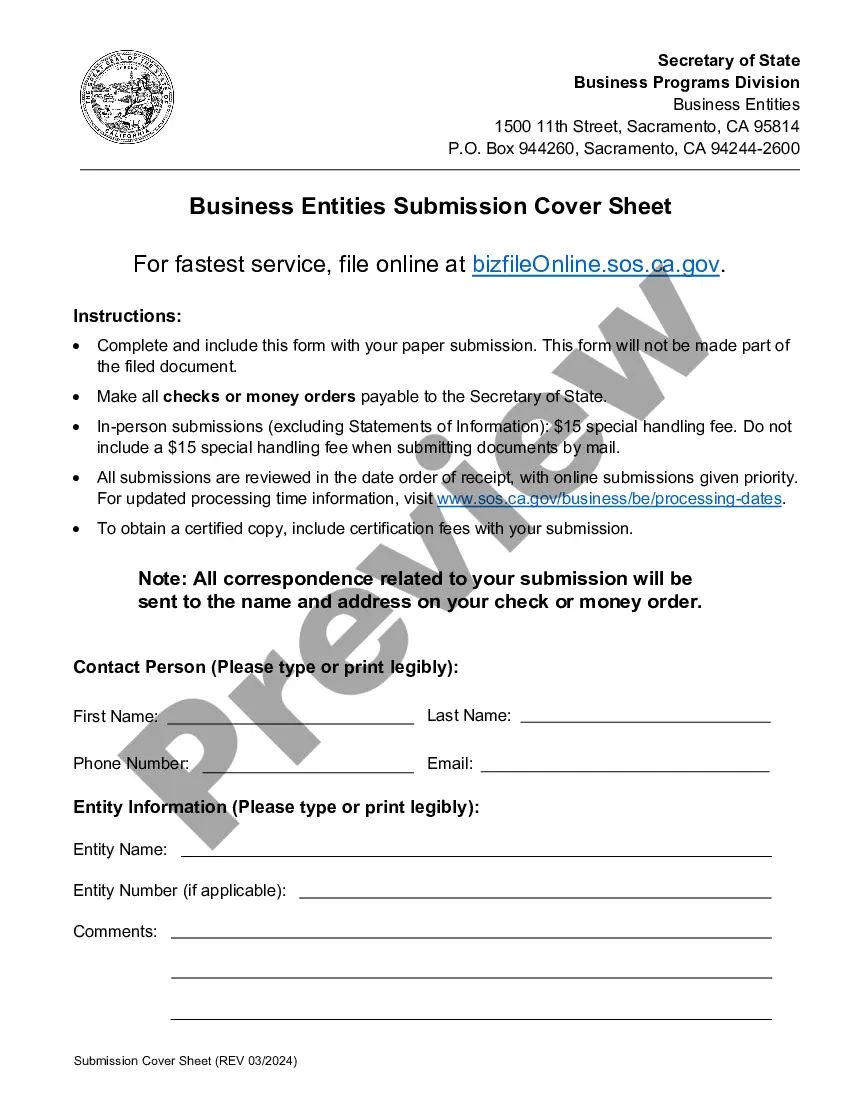

At this time, California is the only state in which employer-provided lodging is subject to taxation. Although state income tax does not apply, lodging is subject to other taxes: State Unemployment Insurance, Employee Training Tax and State Disability Insurance.

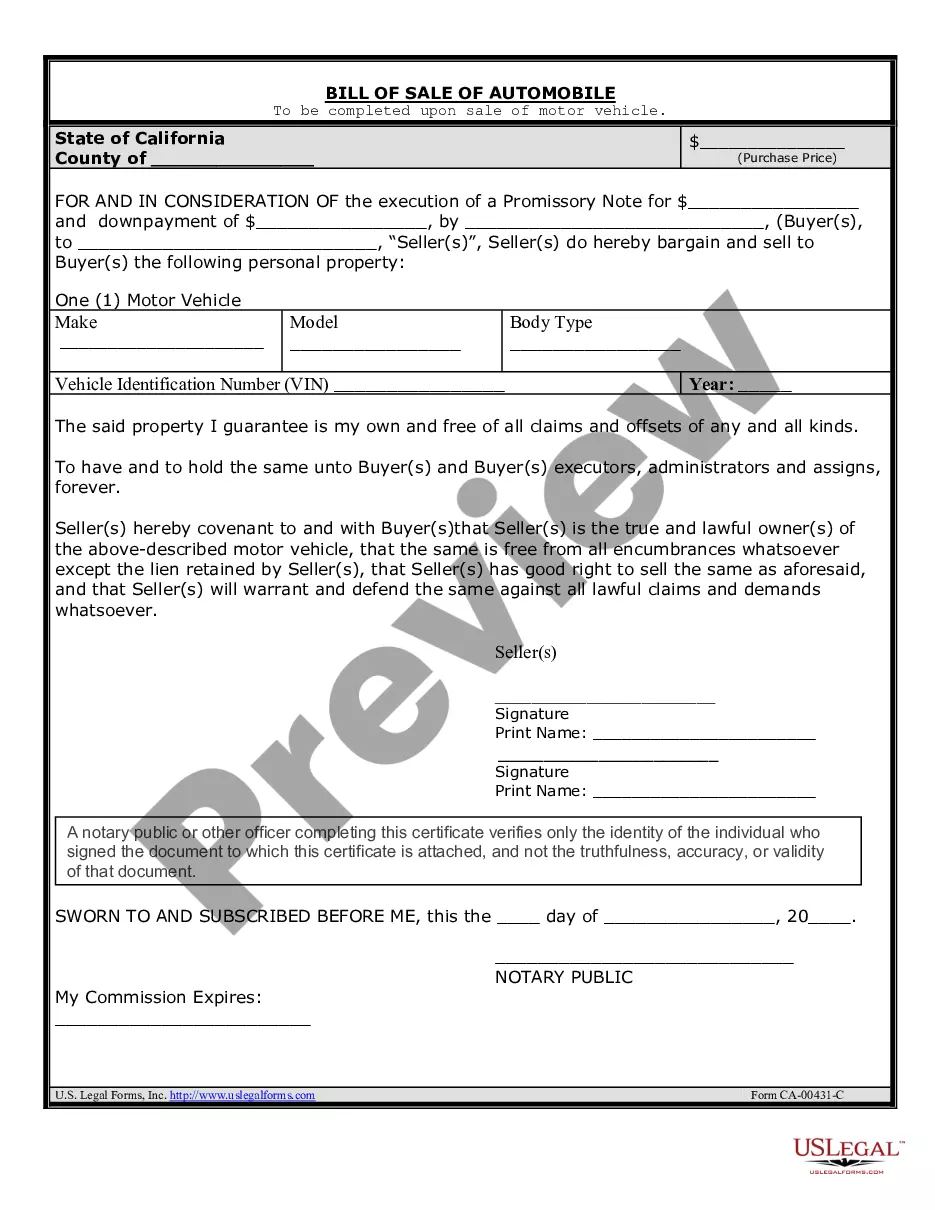

In general, employee housing is privately-owned housing that houses five or more employees and meets the following: Living quarters provided in connection with any work, whether or not rent is involved.

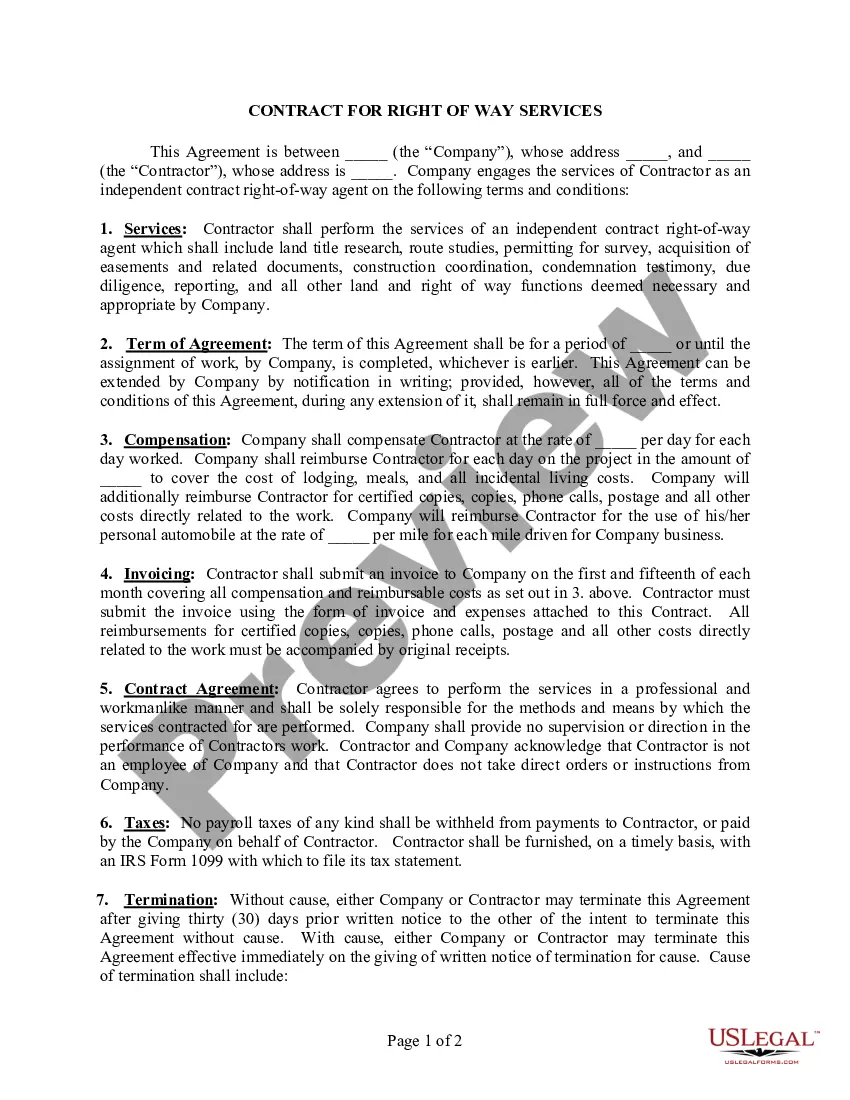

An initial decision to be made when it comes to employee housing is whether you want your employees to occupy your housing as a tenant, or under a license. A license means that the employee is there under the owner's permission, and housing is connected directly to his or her employment.

Is this possible? A: Provided your corporation's by-laws permit the leasing of real estate (typically by-laws do) then renting under a corporate name is possible.

The Employee Housing Act and the adopted regulations govern the standards for the construction, maintenance, use, and occupancy of living quarters, called "employee housing," provided for five or more employees under specified circumstances.

The Premises describes what is being leased. At minimum, this means the land, but can also include buildings and other infrastructure such as greenhouses, wells, and fencing. Leased equipment could be part of the Premises, or could be contained in a separate lease.