Employee Form Fillable For Pf Withdrawal In Salt Lake

Description

Form popularity

FAQ

To claim your PF online, ensure your Universal Account Number (UAN) is activated and linked with your Aadhaar, PAN, and bank details. Log in to the EPFO member portal, navigate to 'Online Services,' select 'Claim (Form-31, 19 & 10C),' verify your bank account, and submit your claim.

Here are the steps you need to follow: Log in to the portal. Visit the EPFO e-SEWA portal, log in using your UAN and password, and enter the captcha code. Visit the online claims section. Enter bank account details. Confirm terms & conditions. Select reason for withdrawal. Enter details and upload documents. Get Aadhaar OTP.

An individual is not permitted to withdraw PF funds, partially or fully, until the time he/she is employed. One can withdraw up to 75% of the funds if he/she is unemployed for at least 1 month and the balance amount if they are unemployed for 2 months or more.

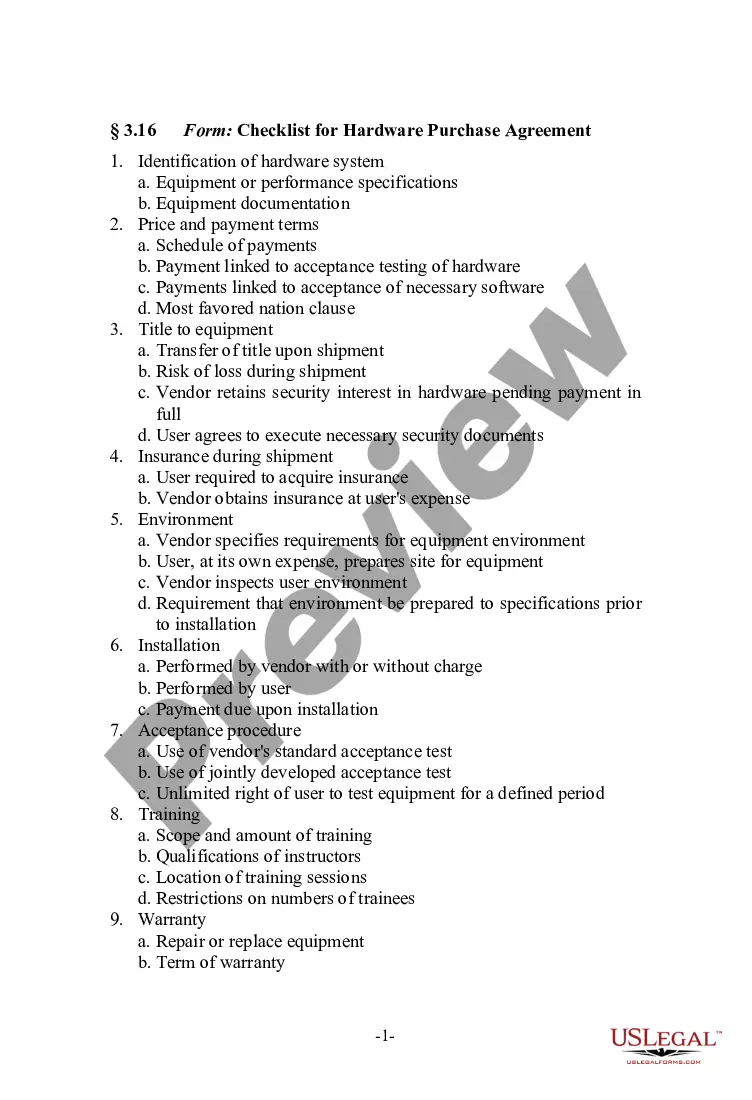

Form 19 is filled for PF final settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal. However, only the Composite Claim Form has to be filled for withdrawing funds offline.

If employee withdraws amount more than or equal to Rs. 30000/-, with service less than 5 years, then a) TDS will be deducted @ 10% if Form-15G/15H is not submitted provided PAN is submitted. b) TDS will be deducted @ maximum marginal rate (i:e. 34.608%) if employee fails to submit PAN.

Enter your name, PAN number and address in the spaces provided. Select the box to indicate whether you are an individual or a Hindu Undivided Family (HUF). Enter the details of the depositor, such as name, PAN, and address. Mention the details of the fixed deposit, such as date of deposit, bank name, and amount.

Steps to fill Form 19 for PF withdrawal Step 1: Sign to the EPF member portal. Step 2: Go to the 'Online Service' section and select 'Claim Form- 31, 19, 10C & 10D. Step 3: Now fill all the required details. Step 4: Verify your bank account details and type the last four digits of your bank account number.

Yes, Form 15G is mandatory if you don't want TDS to be deducted from the PF withdrawal amount. Section 192A of the Finance Act 2015 states that PF withdrawal will attract TDS if the withdrawal amount is more than Rs.50,000 and your employment tenure is of less than 5 years.

The main difference between Form 15G and Form 15H is that Form 15G is meant for non-senior citizens (i.e., in case of individuals, they should be below 60 years of age) and non-individuals such as Trusts, Associations, Clubs, Hindu Undivided Family (HUF) and Societies; whereas Form 15H is meant for senior citizens only ...

What Information is Included in EPF Form 31? Mobile number. Reason for advance request. Amount needed as an advance. EPF member's name. Husband's name (for married women) PF account number. Monthly salary plus dearness allowance. Full postal address.