Employee Leasing Company In Nj In Harris

Description

Form popularity

FAQ

Call the Department of Labor and Workforce Development at 609-633-6400 for assistance. You are responsible for ensuring Square Payroll has the correct tax ID numbers and tax rates for your business.

While leased employees are legally employed by a PEO, they work under the day-to-day management and supervision of the leasing business — much like any other employee. This generally gives the leasing business control over how they spend their time, which tools they use to perform their work, their deadlines, and more.

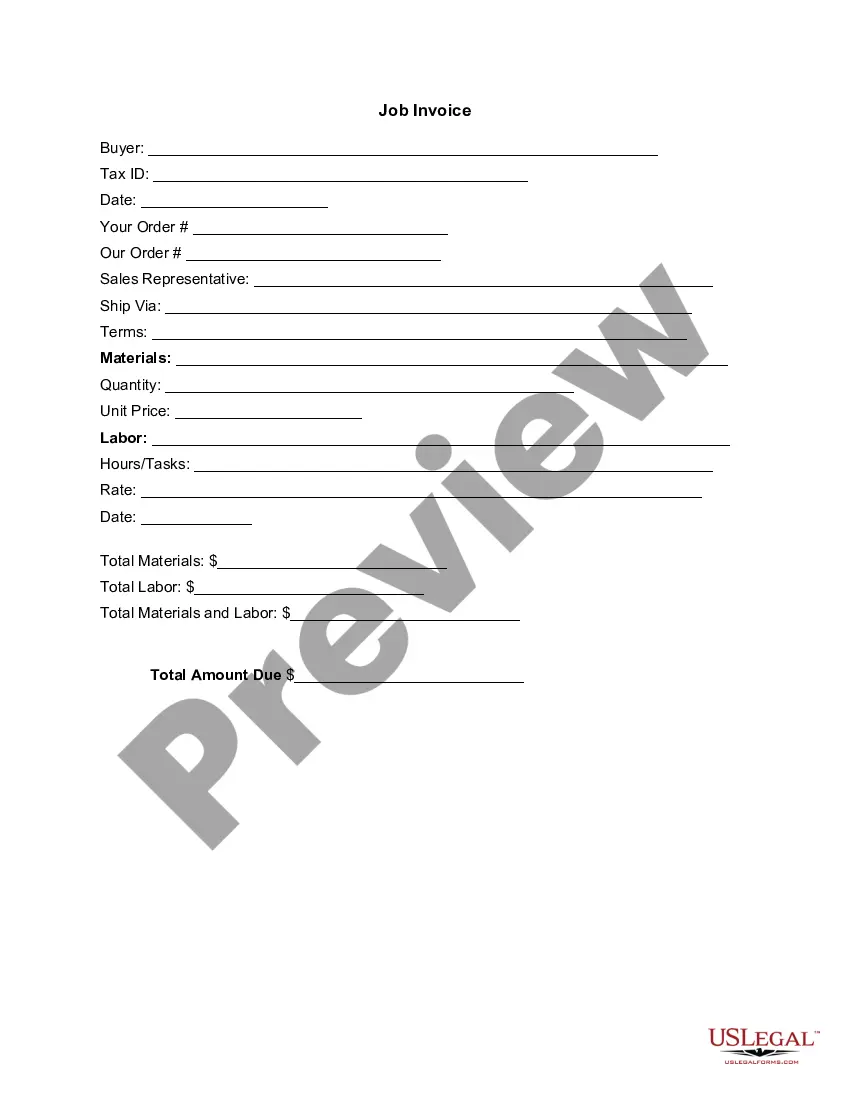

Your New Jersey tax identification (ID) number has 12 digits. If you have a Federal Employer Identification Number (FEIN) assigned by the Internal Revenue Service (IRS), your New Jersey tax ID number is your FEIN followed by a three-digit suffix. If you do not have a suffix, enter three zeroes.

A payroll number is a distinct string of digits and letters that each employee of an organisation might have assigned to them by their employer. Important personal information can be linked to a person's number in order to ensure safe and effective tracking, which is especially helpful for big companies.

Employee leasing is an arrangement between a business and a staffing firm, who supplies workers on a project-specific or temporary basis. These employees work for the client business, but the leasing agency pays their salaries and handles all of the HR administration associated with their employment.

Your New Jersey Employer Registration Number matches your nine-digit Federal Employer Identification Number (FEIN). If you are unsure of your EIN, you can locate it on any previously filed tax forms. Your EIN will be listed at the top of Form 941.

A PEO, or professional employer organization, has a different relationship with client companies. Instead of being a firm that leases employees to their clients, a PEO becomes an employer of record for the client's employees. This is known as a co-employment agreement.

A payroll number is typically the same as an employee number; it uniquely identifies an employee within the company's payroll system and appears on their payslip. This is essential for accurate record-keeping and payroll processing.

Once your established business employs one or more individuals and pays wages of $1,000 or more in a calendar year, you are considered an employer.

Find your New Jersey employer registration number Your New Jersey Employer Registration Number matches your nine-digit Federal Employer Identification Number (FEIN). If you are unsure of your EIN, you can locate it on any previously filed tax forms. Your EIN will be listed at the top of Form 941.