Agreement Form Assignment For Life Insurance In San Diego

Description

Form popularity

FAQ

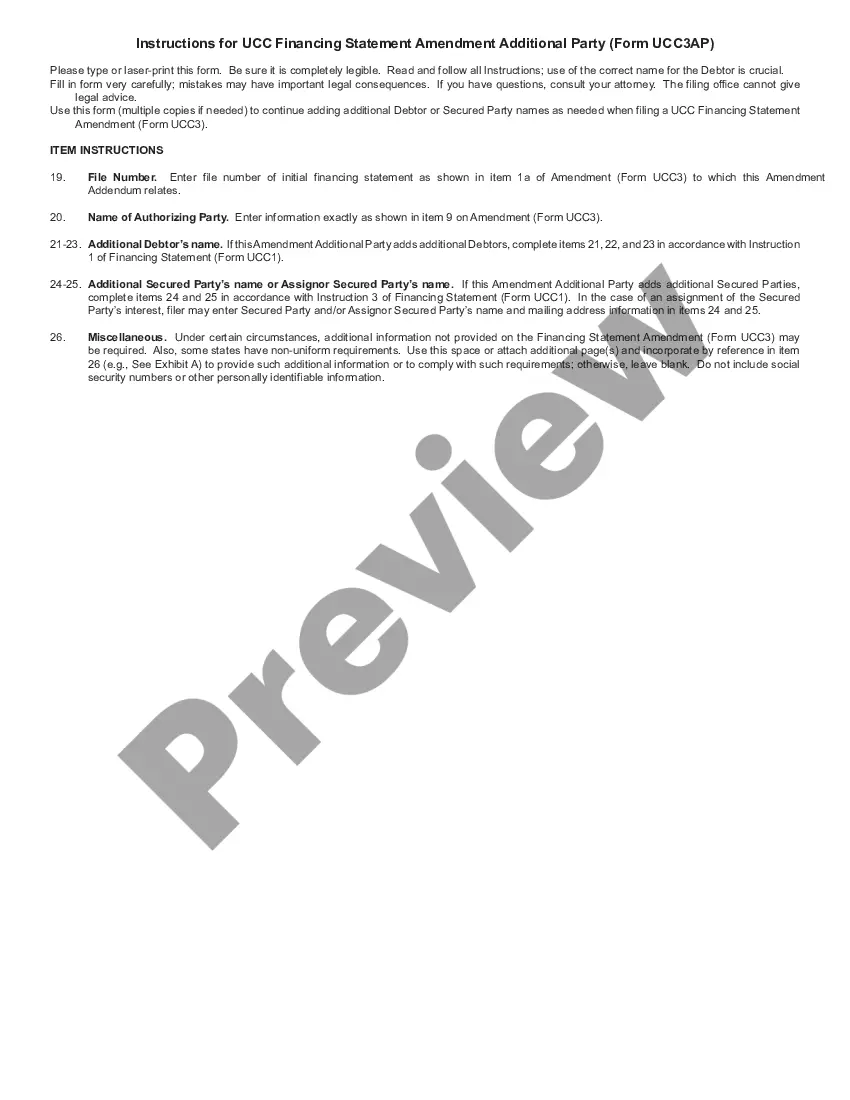

WARNING! This form permanently transfers ownership of your FEGLI insurance to another individual, trustee, or corporation (however, premiums continue to be withheld from your salary/annuity). An assignment is irrevocable, and cannot be changed later.

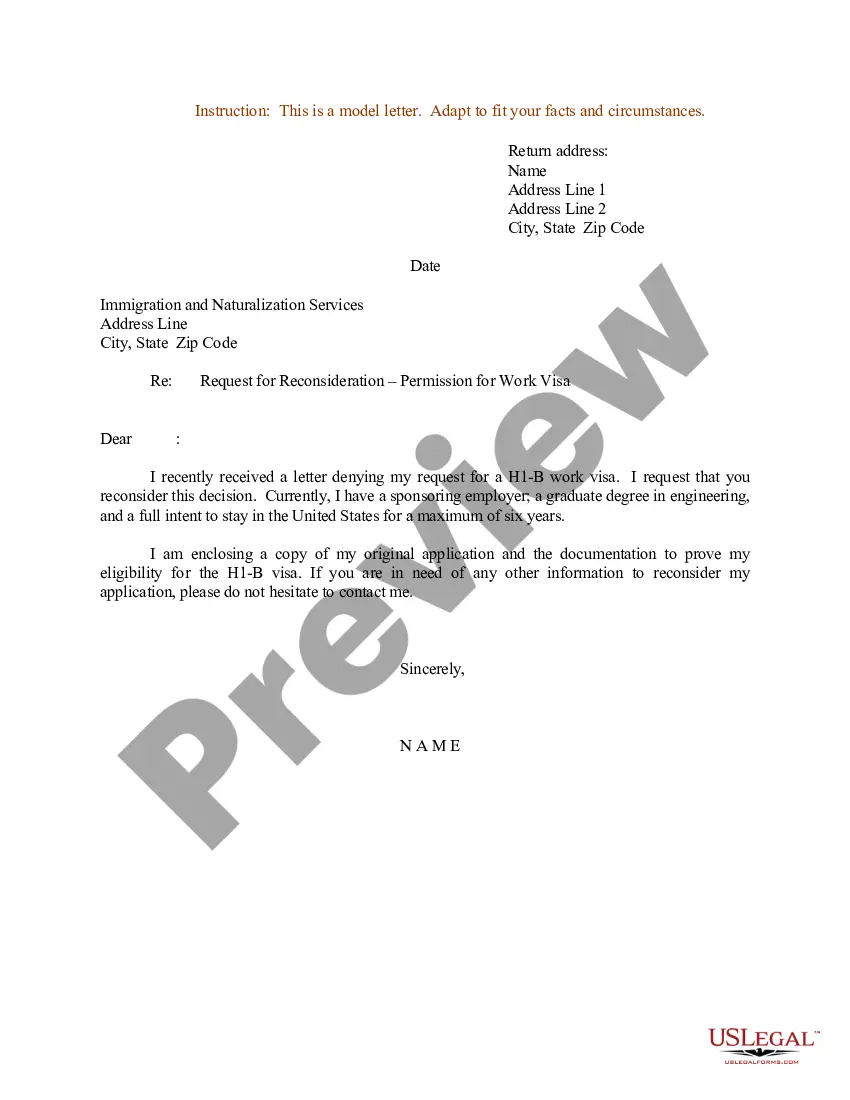

In General. The assignment of an owner's policy means to assign the benefits of an already issued policy from the named insured to another party.

The insured needs to either endorse the policy document or make a deed of assignment and register the same with the insurer. A form prescribed by the insurers must be filled and signed. In case of conditional assignment, your reason needs to be mentioned as well.

The assignee of your life insurance policy becomes the nominee and receives the claim benefits, if it arises. The appointed nominee receives the claim benefits if you pass away during the policy period.

Assignee in an Insurance Policy In the context of a life insurance policy, interest in a policy can be transferred from the policyholder to a lender or relative by assignment of the policy. In this case, the policyholder is the assignor and the person in whose favor the policy has been assigned is called the assignee.

In a life insurance assignment, a policy owner transfers his ownership rights of the policy to another party. The original owner is the assignor and the second party is the assignee.

You can freely assign your life insurance policy unless some limitation is specified in your contract (your insurance company can furnish the required assignment forms). Through an assignment, you can transfer your rights to all or a portion of the policy proceeds to an assignee.

Since the policyowner actually owns the policy, not the insurer, the owner has every right to give the policy away just like any other owned piece of property; the insurer's permission is not required. The transfer of ownership is referred to as assignment and the new owner is the assignee.

--(1) A transfer or assignment of a policy of insurance, wholly or in part, whether with or without consideration, may be made only by an endorsement upon the policy itself or by a separate instrument, signed in either case by the transferor or by the assignor or his duly authorised agent and attested by at least one ...