Form Assignment Accounts Receivable For Your Business In Pima

Description

Form popularity

FAQ

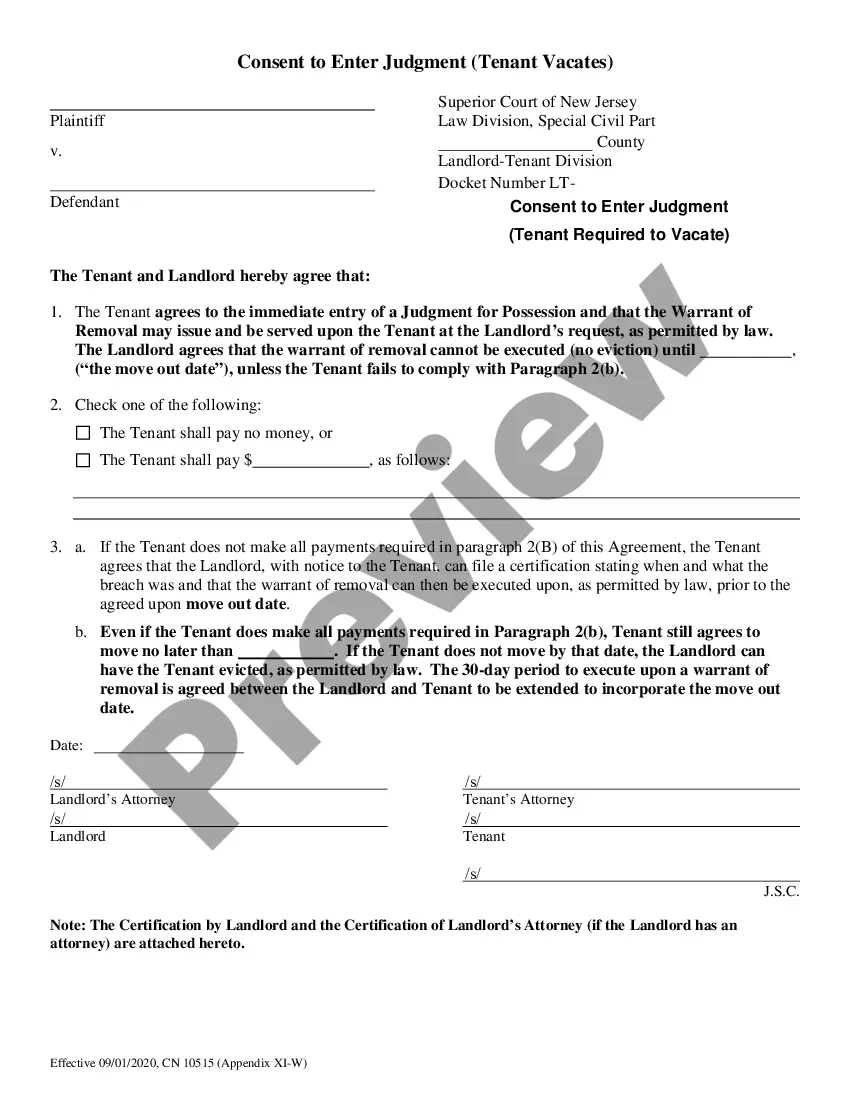

While carrying out an assignment of receivables makes a simple, one-time exchange, using factoring allows you to opt for a range of additional services. One of the additional services available in factoring, is the possibility of insuring receivables in case of debtor insolvency.

Average accounts receivables is calculated as the sum of the starting and ending receivables over a set period of time (usually a month, quarter, or year). That number is then divided by 2 to determine an accurate financial ratio.

Example Of A Journal Entry For Accounts Receivable Assume that a company sells goods worth $5,000 to a customer on credit. The journal entry would be recorded: Debit: Accounts Receivable $5,000. Credit: Sales Revenue $5,000.

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.

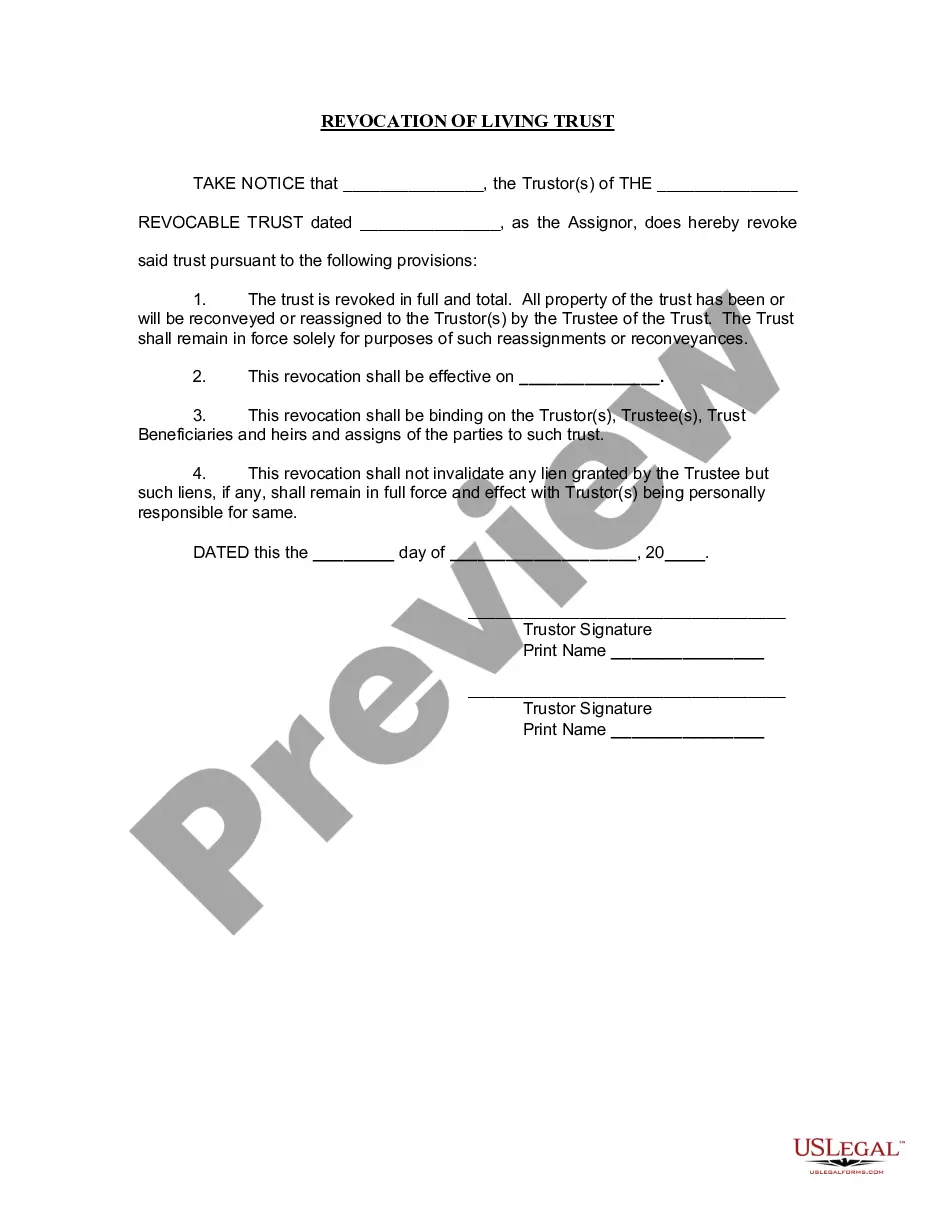

Assignment in the context of a receivable means the transfer of rights related to it to another person or entity. For this purpose, an appropriate contract is usually concluded (although this is not a necessary condition).