Factoring Agreement Form For Employees In Pima

Description

Form popularity

FAQ

There are at least two parties to a contract, a promisor, and a promisee. A promisee is a party to which a promise is made and a promisor is a party which performs the promise. Three sections of the Indian Contract Act, 1872 define who performs a contract – Section 40, 41, and 42.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...

Who Are the Parties to the Factoring Transaction? Factor: It is the financial institution that takes over the receivables by way of assignment. Seller Firm: It is the firm that becomes a creditor by selling goods or services. Borrower Firm: It is the firm that becomes indebted by purchasing goods or services.

A factoring agreement involves three key parties: The business selling its outstanding invoices or accounts receivable. The factor, which is the company providing factoring services. The company's client, responsible for making payments directly to the factor for the invoiced amount.

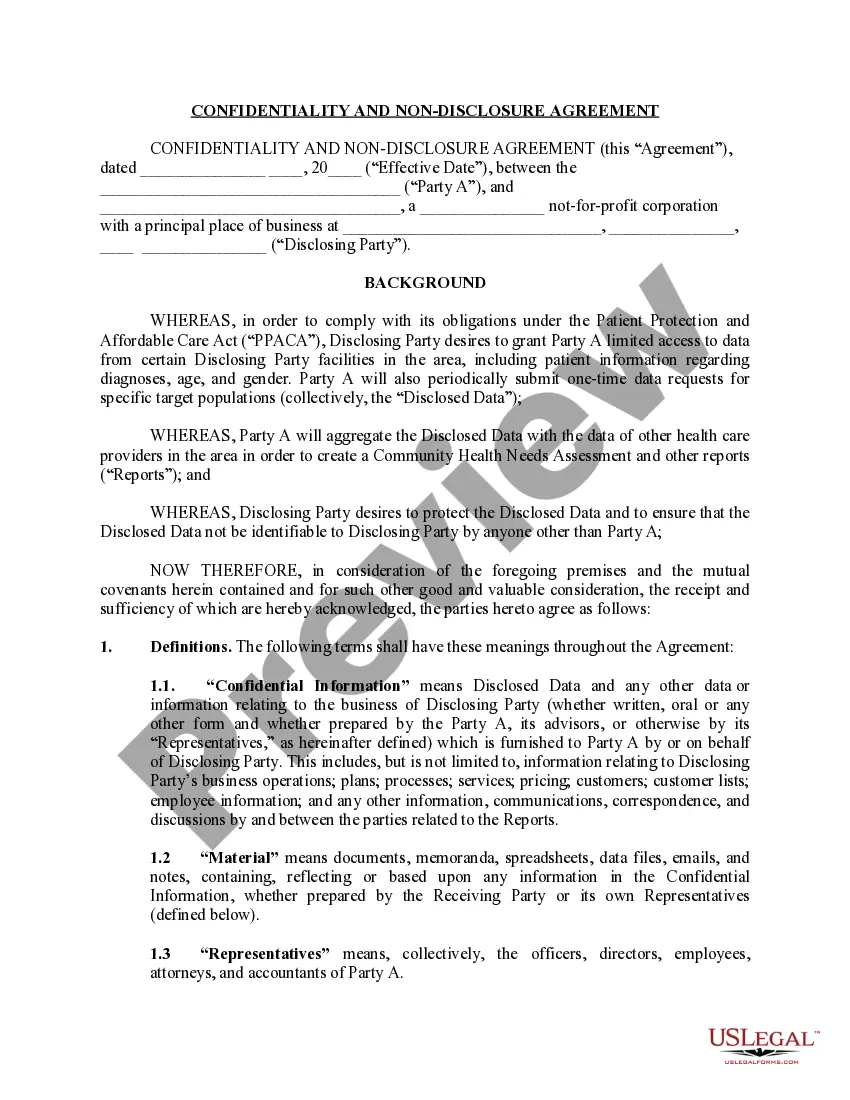

The agreement should have an introductory paragraph outlining who is the client and who is the service provider. It should contain the legal names of both parties, the date, and the physical addresses of each party.

IRS Tax Form W-9 This tax form for independent contractors should be kept on file for four years in case questions arise from either the contractor or the IRS. Who completes the Form W-9? The independent contractor should complete the W-9 and return it to the business with other requested information.

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.