Factoring Agreement Contract For Car In Ohio

Description

Form popularity

FAQ

You need to consider the fees associated with switching before committing to the change. Once you've decided to leave your current factor, you will need to give notice. All factoring companies require written notice to terminate the contract. The expectation is usually 30 – 60 days prior to the renewal date.

In simple terms, a company will send out an invoice to a customer, who will have pre-agreed payment terms. These are usually 30, 60, 90 and 120 day payment terms. A finance company (the factor) will look at the strength of the customers, the borrower and further possible security offered.

Exiting a factoring agreement requires a proper notice within a notice window. Ensure to set your calendar for reminders to send your termination notices and that they are accepted.

Normally, a period of notice is required to terminate a factoring facility. There may also be other restrictions on when notice can be given. Again, you need to understand how much notice you need to give and how and when. Calculate the costs of leaving your facility as explained in our article.

This will help you understand your rights and options. Contact the factoring company. Talk to the factoring company directly and explain the situation. Ask them why the release hasn't been issued yet and when you can expect it. Be polite and professional, but be firm in your request. Get everything in writing.

This will help you understand your rights and options. Contact the factoring company. Talk to the factoring company directly and explain the situation. Ask them why the release hasn't been issued yet and when you can expect it. Be polite and professional, but be firm in your request. Get everything in writing.

Factoring companies will typically run a background check. While less-than-perfect backgrounds can be approved for factoring, certain violent or financial crimes may be disqualifying.

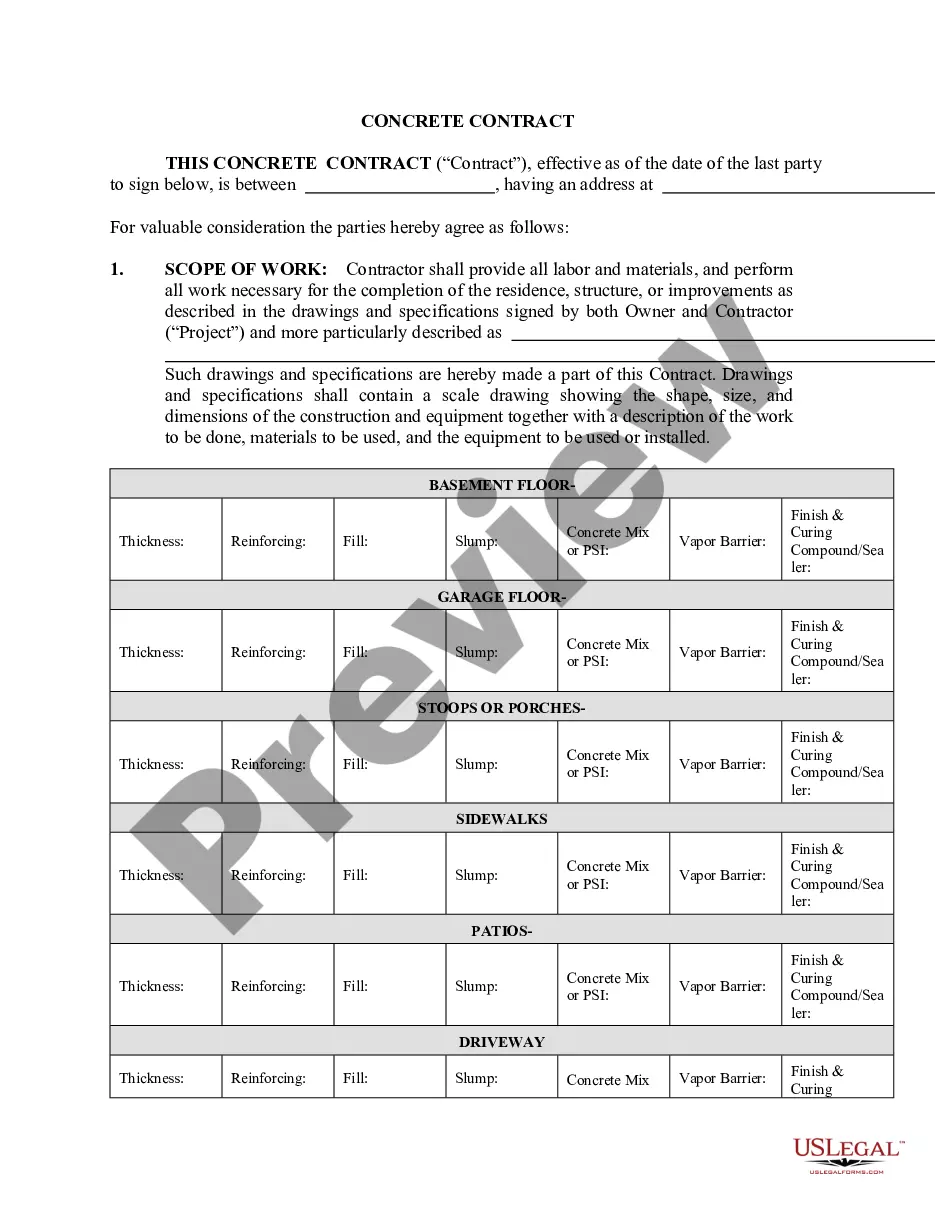

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.