Factoring Agreement Online Format In King

Description

Form popularity

FAQ

Types of Factoring polynomials Greatest Common Factor (GCF) Grouping Method. Sum or difference in two cubes. Difference in two squares method.

Factor expressions, also known as factoring, mean rewriting the expression as the product of factors. For example, 3x + 12y can be factored into a simple expression of 3 (x + 4y). In this way, the calculations become easier. The terms 3 and (x + 4y) are known as factors.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

The best method for teaching students how to find factor pairs is to have them start at 1 and work their way up. Give your students a target number and ask them to put “1 x” below it. Let them fill in the right side with the number itself. We know that any number has one “factor pair” of 1 times itself.

Key takeaways Factoring rates typically range from 1% to 5% of the invoice value per month, but vary based on the invoice amount, your sales volume and your customer's creditworthiness, among other factors. Invoice factoring can be a good option for business-to-business companies that need fast access to capital.

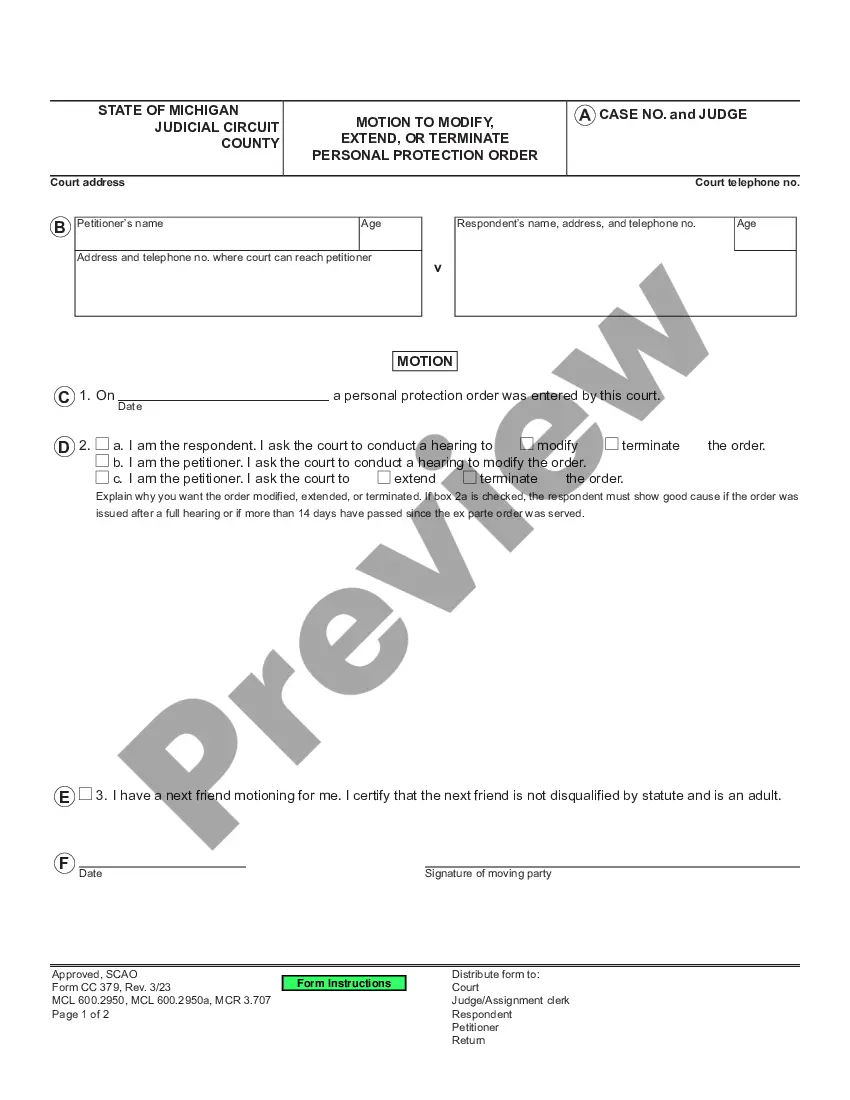

To cancel or terminate a factoring agreement, first review the terms in your contract regarding notice periods and potential penalties for early termination. You'll need to formally notify your factoring company, usually in writing, of your intention to end the agreement.

Who Are the Parties to the Factoring Transaction? Factor: It is the financial institution that takes over the receivables by way of assignment. Seller Firm: It is the firm that becomes a creditor by selling goods or services. Borrower Firm: It is the firm that becomes indebted by purchasing goods or services.

A factoring relationship involves three parties: (i) a buyer, who is a person or a commercial enterprise to whom the services are supplied on credit, (ii) a seller, who is a commercial enterprise which supplies the services on credit and avails the factoring arrangements, and (iii) a factor, which is a financial ...