Factoring Agreement General Form Calculator In Houston

Description

Form popularity

FAQ

Average Factoring Rates and Advances in 2025 Average Factoring Rates in 2025 IndustryFactoring RateAdvance Rate General Small Business 1.95% – 4.5% 85% – 95% Retail & Wholesale 1.95% – 4.5% 80% – 95% Construction 3.0% – 6.0% 70% – 80%5 more rows •

Factoring formulas are used to write an algebraic expression as the product of two or more expressions. Some important factoring formulas are given as, (a + b)2 = a2 + 2ab + b. (a - b)2 = a2 - 2ab + b.

The quadratic formula helps us solve any quadratic equation. First, we bring the equation to the form ax²+bx+c=0, where a, b, and c are coefficients. Then, we plug these coefficients in the formula: (-b±√(b²-4ac))/(2a) . See examples of using the formula to solve a variety of equations.

To factor on a TI-84, you can use the Equation Solver function. To access it, press the MATH button on your calculator, then hit the up arrow to scroll directly to the bottom of the list. Press ENTER and input the equation.

Button. And on the menu here for the y1. Go ahead and type in your number let's say it's somethingMoreButton. And on the menu here for the y1. Go ahead and type in your number let's say it's something big like 378 you have to find the factors of 378. To add up to a certain number do 378 divided by X.

How can I solve a quadratic equation using Numeric Solver on the TI-84 Plus CE and TI-84 Plus C Silver Edition? Press MATH ALPHA B. Once you will the two boxes, E1 and E2, press x x2 next to E1. Arrow down to E2 and press 5 x - 6 then press GRAPH to select OK.

Although that's pretty easy to memorize. Like this is an example so a squared plus and then you typeMoreAlthough that's pretty easy to memorize. Like this is an example so a squared plus and then you type a alpha. And then over here alpha means it'll go to this green letter above it.

Then we want B. Minus four alpha then we press a alpha C divided by 2 alpha. A and then we pressMoreThen we want B. Minus four alpha then we press a alpha C divided by 2 alpha. A and then we press equals. And you press this then s to D and that is one of our solutions.

So hit Alpha P. Now for some reason on this calculator. I have to do that twice. But you shouldn'tMoreSo hit Alpha P. Now for some reason on this calculator. I have to do that twice. But you shouldn't have to all right I'll bring it down to your p's. And you're going to go to now prompt.

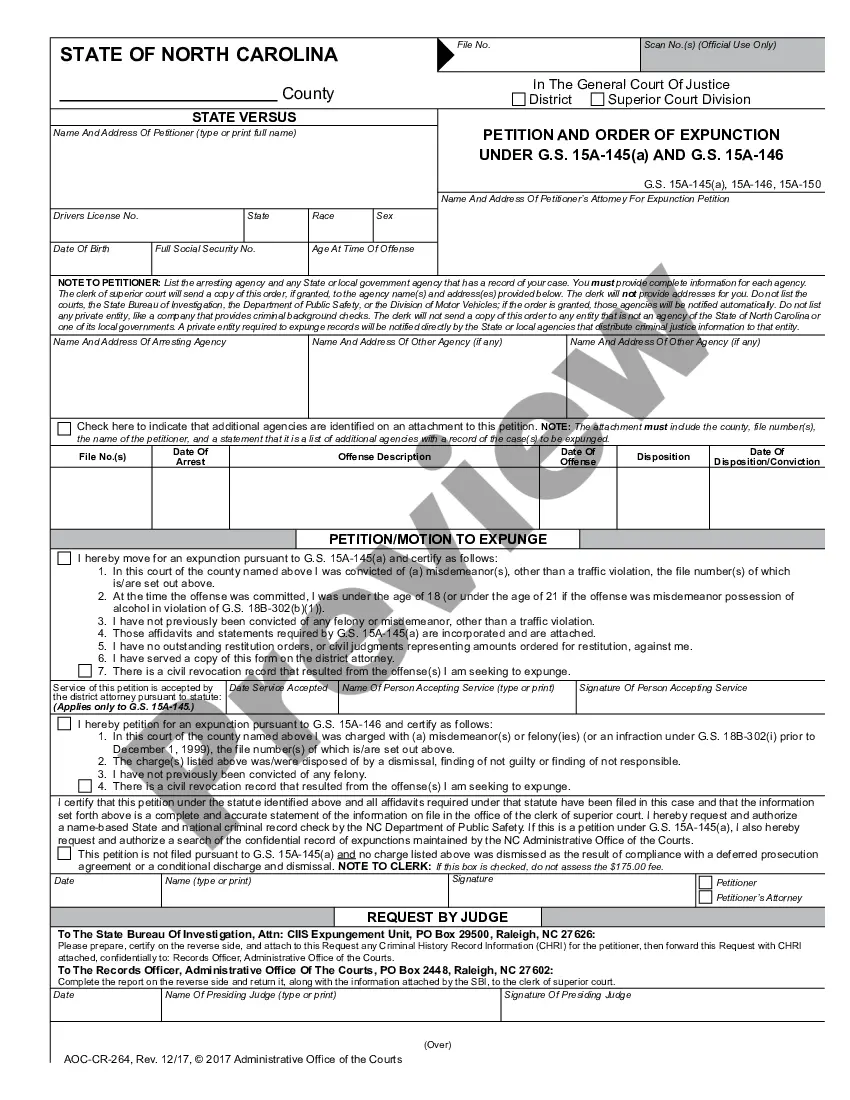

A factoring agreement involves three key parties: The business selling its outstanding invoices or accounts receivable. The factor, which is the company providing factoring services. The company's client, responsible for making payments directly to the factor for the invoiced amount.