Factoring Agreement Document With Iphone In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-00037DR

Format:

Word;

Rich Text

Instant download

Description

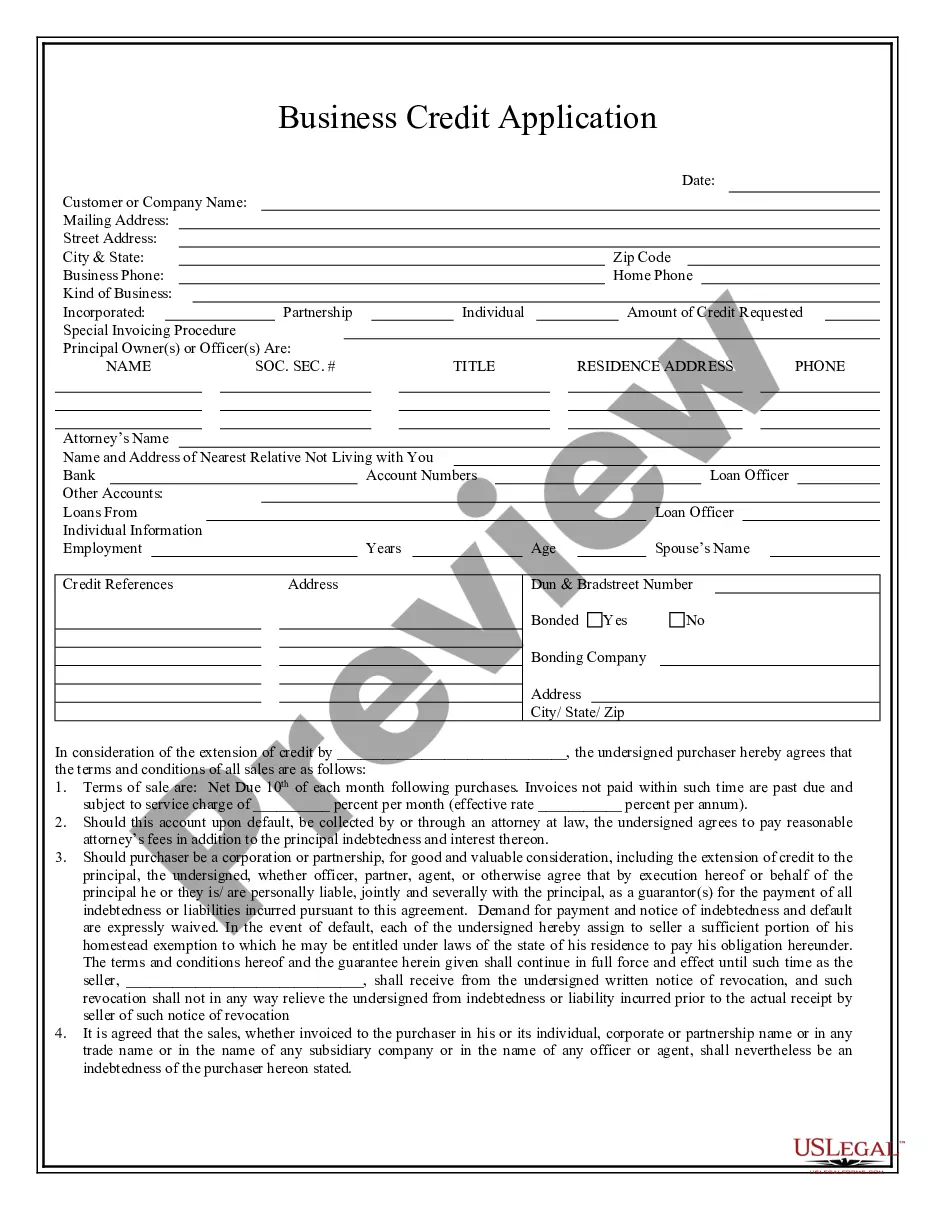

The Factoring Agreement document is a critical legal instrument that facilitates the assignment of accounts receivable from a seller (Client) to a factor (Factor). It outlines the responsibilities and rights of both parties regarding the purchase of receivables in exchange for immediate funds, thus enabling the Client to enhance cash flow. Key features include the assignment of accounts receivable, requirements for credit approval, and stipulations on sales delivery. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this document useful as it provides structured guidelines for managing financial transactions involving accounts receivable. The document includes critical sections on warranties, credit risks, and profit and loss reporting, ensuring transparency and accountability. Users are encouraged to fill in specific details such as dates, percentages, and amounts where indicated, ensuring the document reflects the unique circumstances of the transaction. Editing should maintain legal validity by ensuring any modifications are documented in writing and signed by both parties. Overall, this agreement is an essential tool for those involved in business finance, providing a clear framework for the sale of receivables.

Free preview