Form Assignment Accounts Receivable With Credit Card In Dallas

Description

Form popularity

FAQ

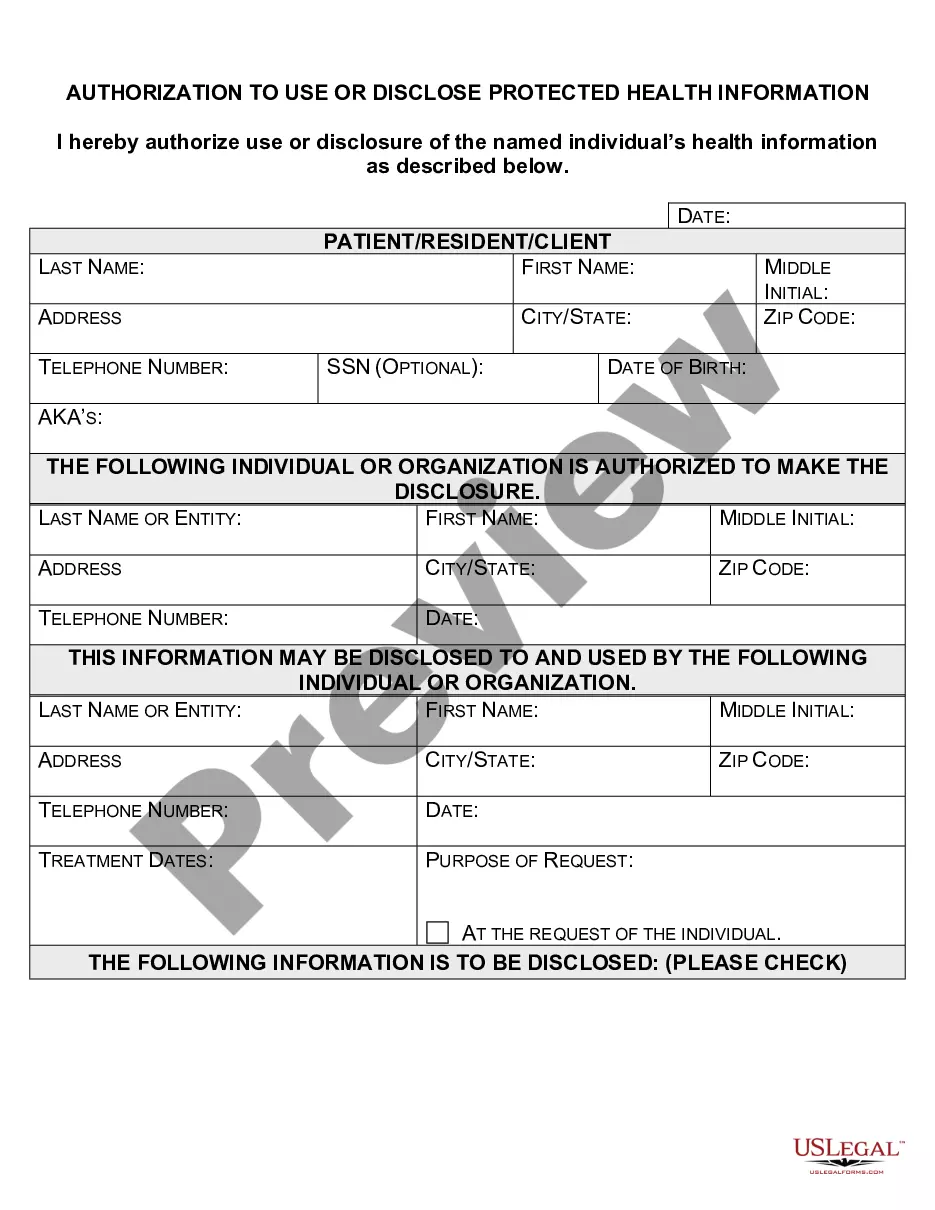

Credit Cards as Liabilities The balance owed on a credit card can be treated either as a negative asset, known as a “contra” asset, or as a liability. In this article we'll explore the optional method of using liability accounts, however, there are several advantages to using the Contra Asset Approach.

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.

How Are Accounts Receivable Journal Entries Recorded? AR journal entries are recorded in the accounting system using a double-entry bookkeeping system. In this system, each transaction is recorded with two journal entries, one debiting one account and one crediting another account.

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.

Average accounts receivable is calculated as the sum of starting and ending receivables over a set period of time (generally monthly, quarterly or annually), divided by two.

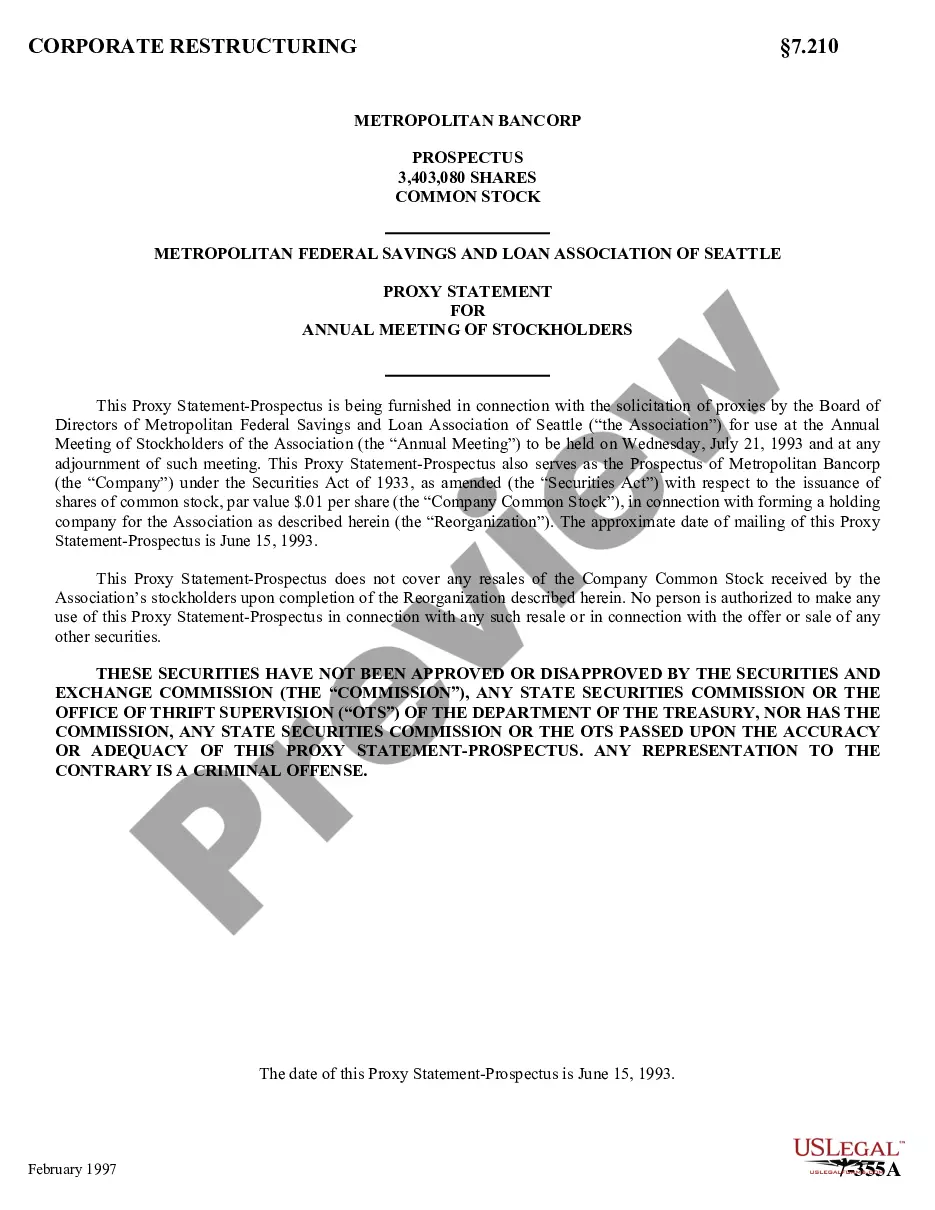

Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor – that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.

The credit card receivable contains amount owed from the customers based on credit-card purchases.

Credit card receivables credit card receivables our credit card payments pending to a business forMoreCredit card receivables credit card receivables our credit card payments pending to a business for previously sold products or services. Any business that takes credit card payments has credit card

Merchant Card Receivables: Amounts owed by banking companies for sales of goods, services, and/or special functions from credit companies. This account will be used for all credit card sales regardless of the credit card company involved.