Factoring Agreement Meaning Forfaiting In Dallas

Description

Form popularity

FAQ

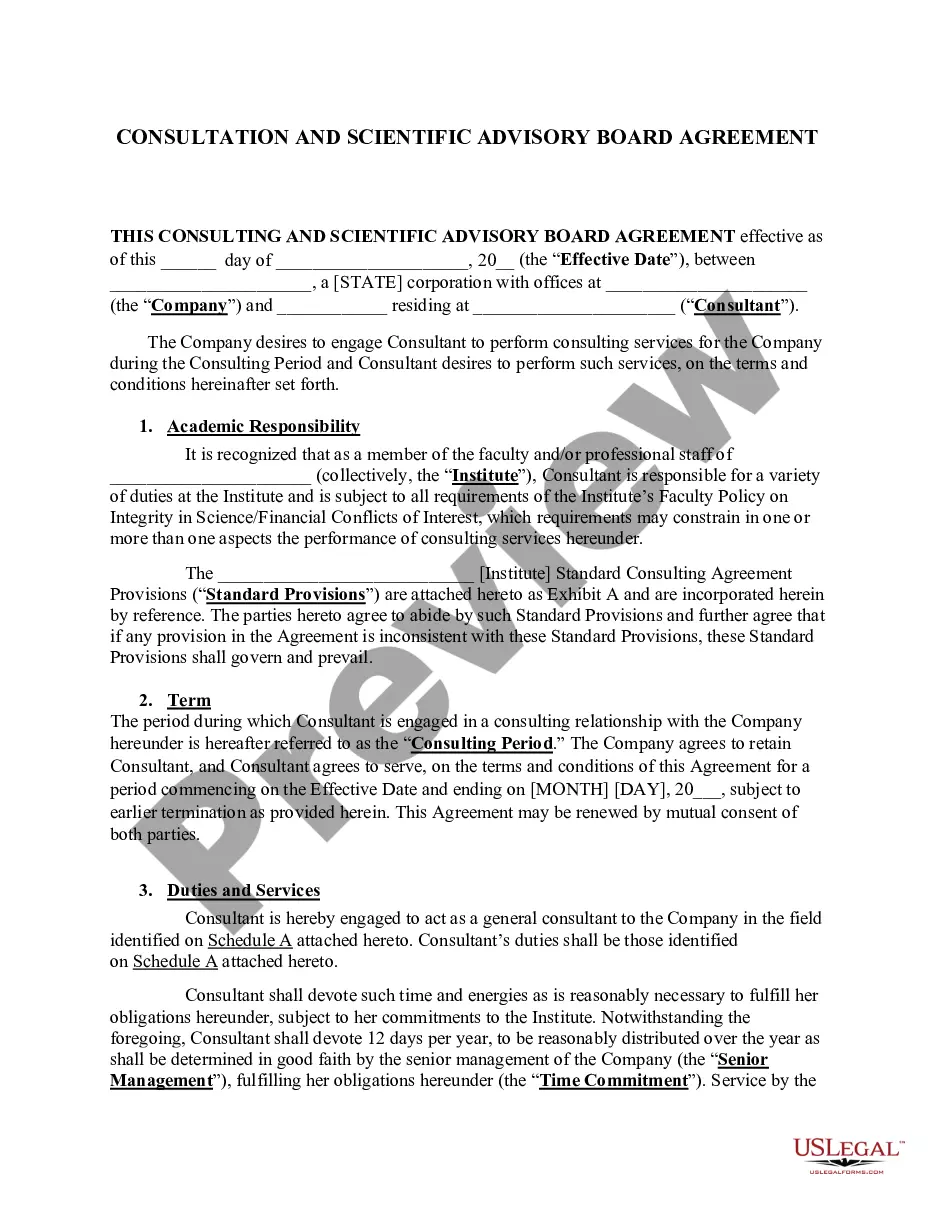

Get a Release Letter: Once all obligations are fulfilled, ask for a release letter from the factoring company. This document should state that you have fulfilled all contractual obligations and that the factoring company has no further claim on your invoices or receivables.

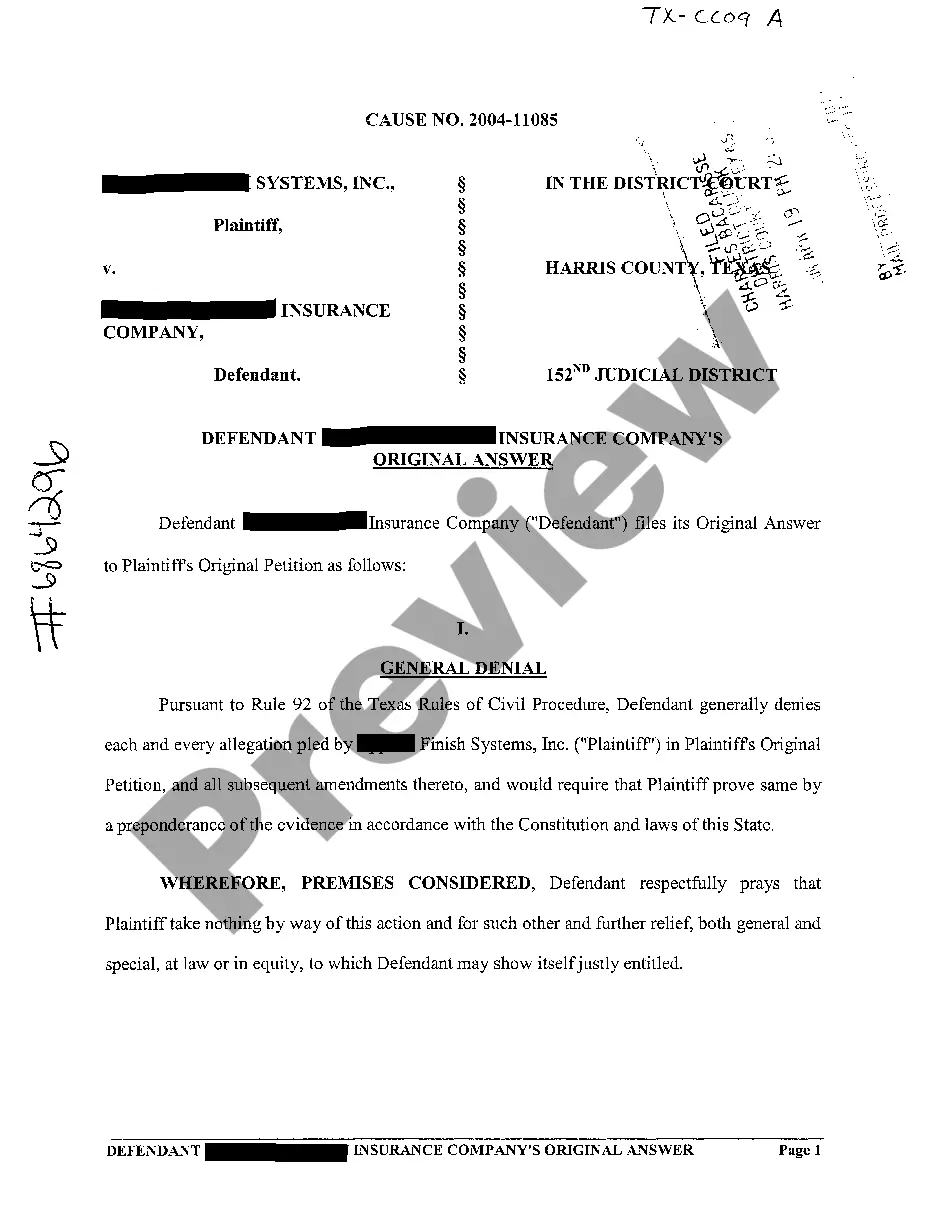

Writing--or hiring an attorney to write--a contract cancellation letter is the safest way to go. Even if the contract allows for a verbal termination notice, a notice in writing provides solid evidence of your decision, and it's always a good idea to have a written record.

The forfaiter is the individual or entity that purchases the receivables. The importer then pays the amount of the receivables to the forfaiter. A forfaiter is typically a bank or a financial firm that specializes in export financing.

They would also forfeit the right to leave their home to their heirs. They do not forfeit basic rights just because they are away from work. He must also forfeit his computer and is barred from the web.

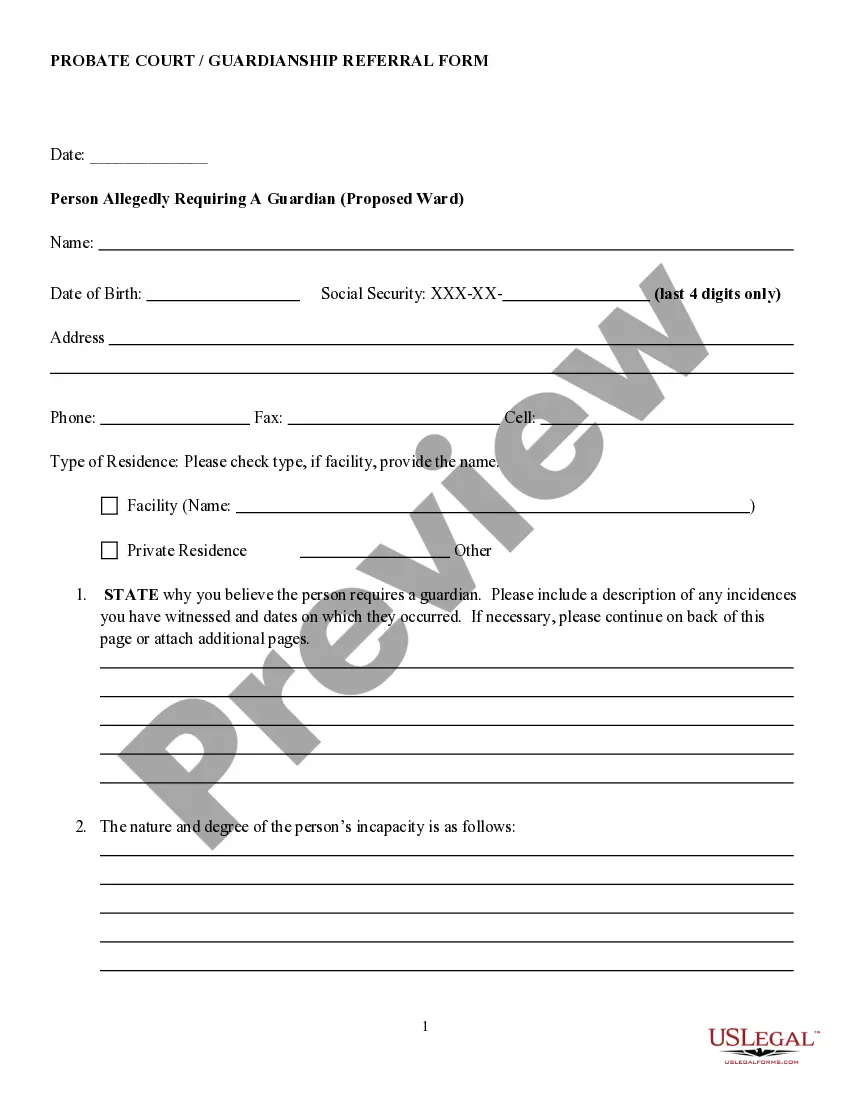

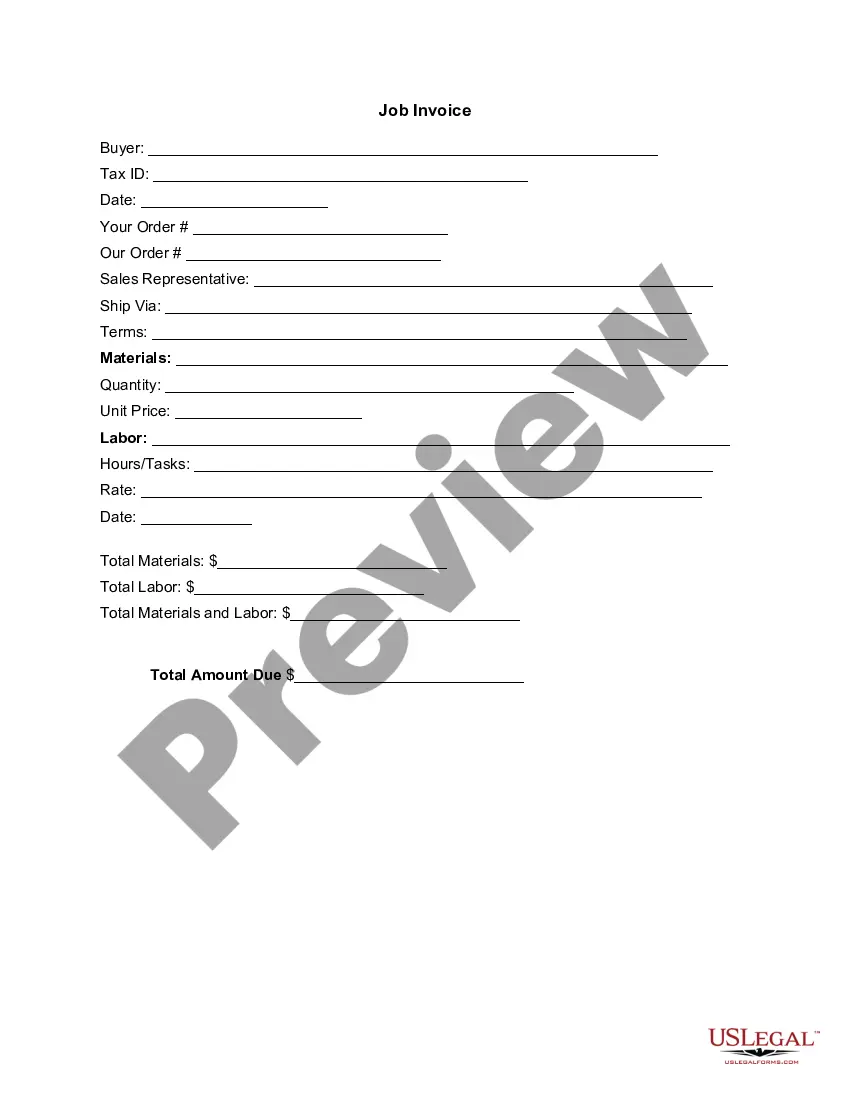

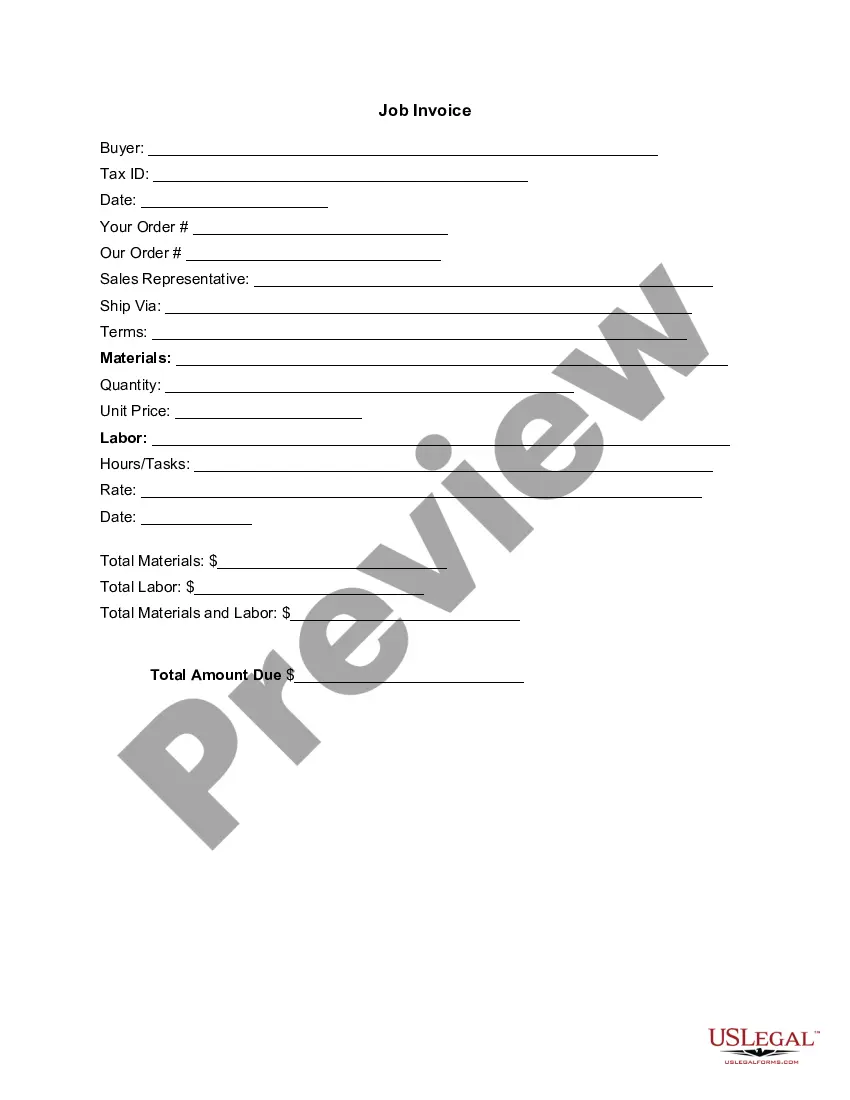

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

Factoring primarily involves the sale of receivables related to ordinary goods and services. Conversely, forfaiting is specifically concerned with the sale of receivables on capital goods.

Purpose: Factoring is typically used to obtain short-term financing, while forfaiting is used to manage long-term trade receivables. Types of assets: Factoring involves the sale of accounts receivable, while forfaiting involves the sale of trade receivables, such as promissory notes and bills of exchange.

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

Factoring is like taking a number apart. It means to express a number as the product of its factors. Factors are either composite numbers or prime numbers (except that 0 and 1 are neither prime nor composite).

Most factoring companies can approve businesses within a few days, sometimes in as little as 24 to 48 hours. The exact timeline depends on factors like the company's application process, how quickly you can provide required documentation (e.g., invoices, financial records), and the creditworthiness of your customers.