Agreement Receivable Statement With Text In Arizona

Instant download

Description

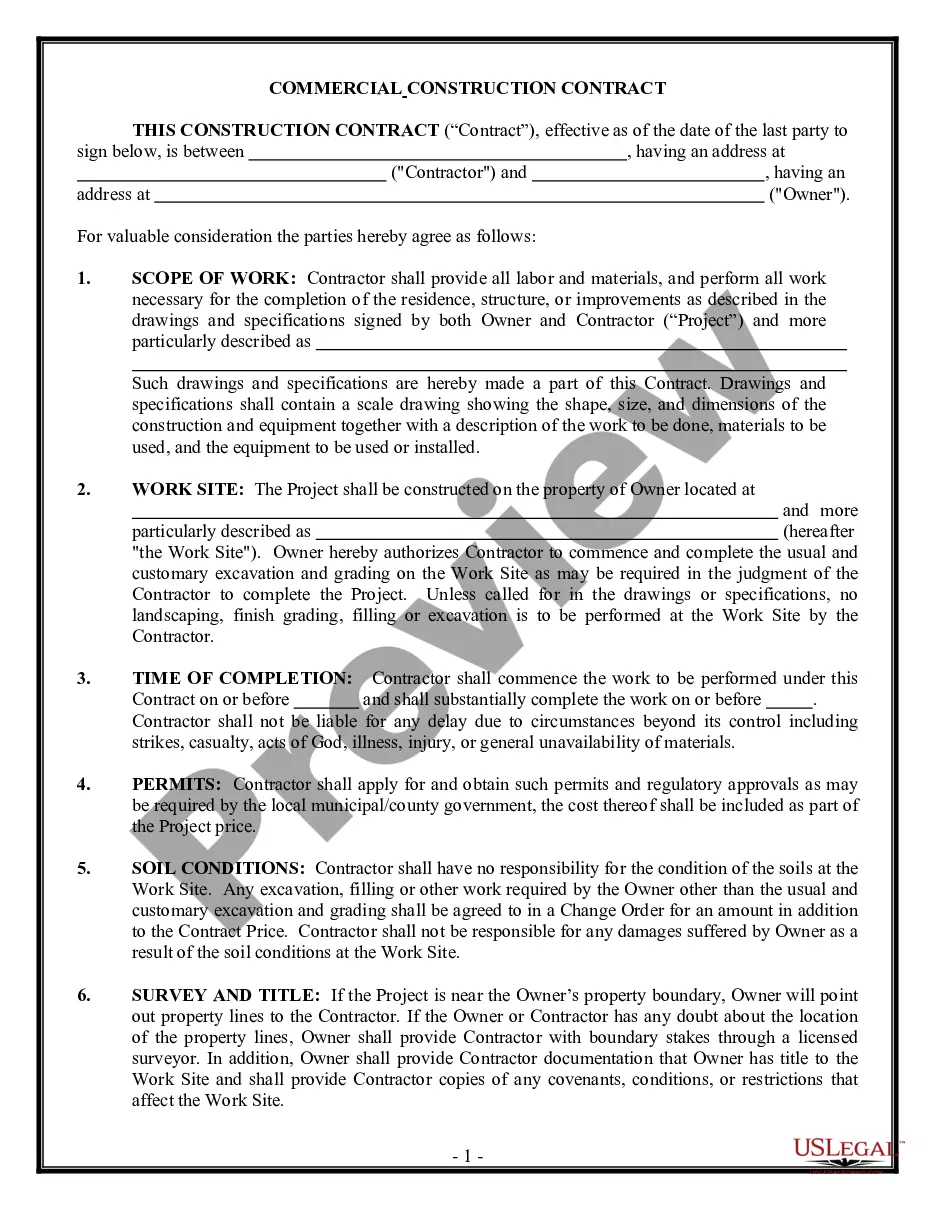

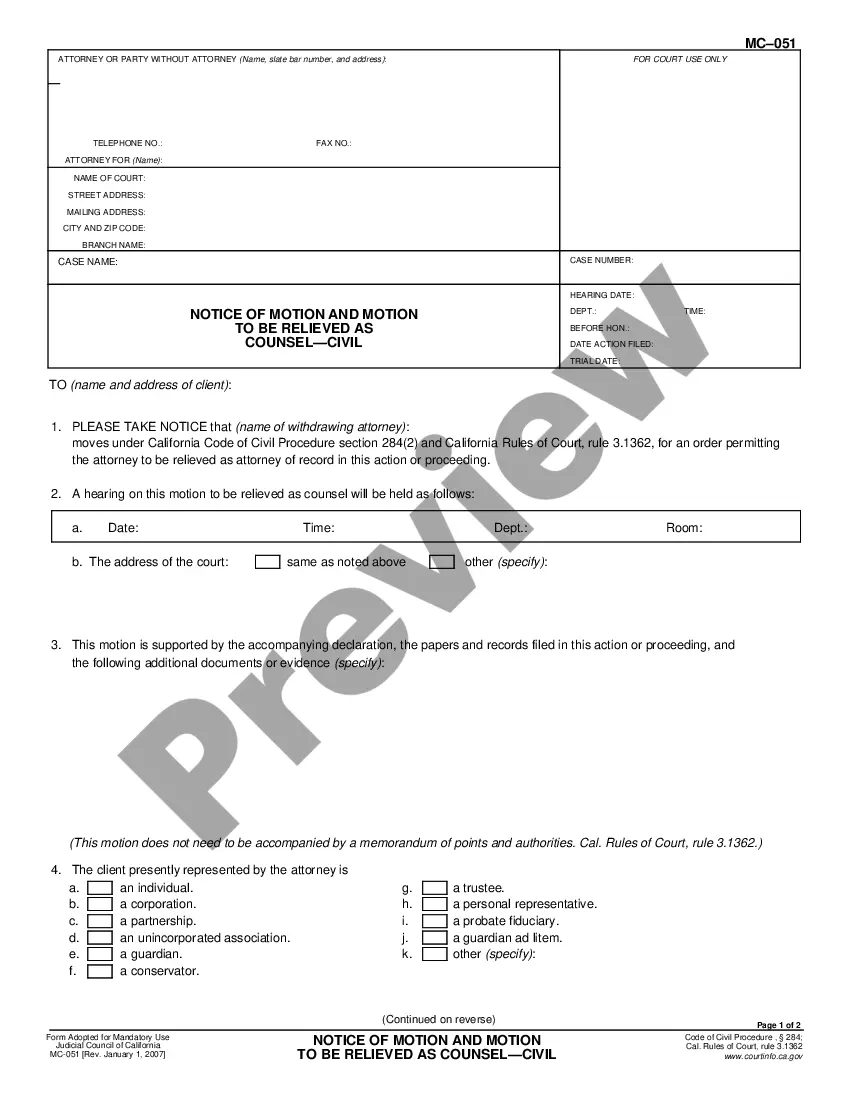

The Agreement Receivable Statement with text in Arizona serves as a critical document in facilitating the assignment of accounts receivable between a Factor and a Client. This form outlines the rights and responsibilities of both parties in the assignment process, ensuring a clear understanding of the transactions involved. Key features include detailed sections on the assignment of accounts receivable, sales and delivery terms of merchandise, and credit approval processes. Users must follow specific instructions for filling out the form, including identifying parties, specifying commission rates, and acknowledging the assumptions of credit risks. Additionally, the form includes provisions for reporting financial statements and maintaining transparency in dealings. This document is highly useful for attorneys, partners, and legal assistants engaged in commercial finance, as it provides a structured way to secure funding against accounts receivable. Paralegals and associates benefit from its clarity, enabling efficient processing and management of client accounts. Overall, this agreement ensures legal compliance and protects the interests of both the Factor and the Client in the state of Arizona.

Free preview

Form popularity

FAQ

Therefore, when a journal entry is made for an accounts receivable transaction, the value of the sale will be recorded as a credit to sales. The amount that is receivable will be recorded as a debit to the assets. These entries balance each other out.

To report accounts receivable, gather information about outstanding amounts owed by customers, create an accounts receivable ledger, categorize the accounts by age, prepare a report that summarizes the outstanding amounts, analyze the report, and take action to collect payments and manage the balance.

What is the 10 rule for accounts receivable? The 10 Rule for accounts receivable suggests that businesses should aim to collect at least 10% of their outstanding receivables each month.