Factoring Purchase Agreement For Business In Allegheny

Description

Form popularity

FAQ

Invoice factoring costs typically range from 1% to 5% of the invoice value per month. Fees depend on factors such as industry, invoice volume, and customer creditworthiness.

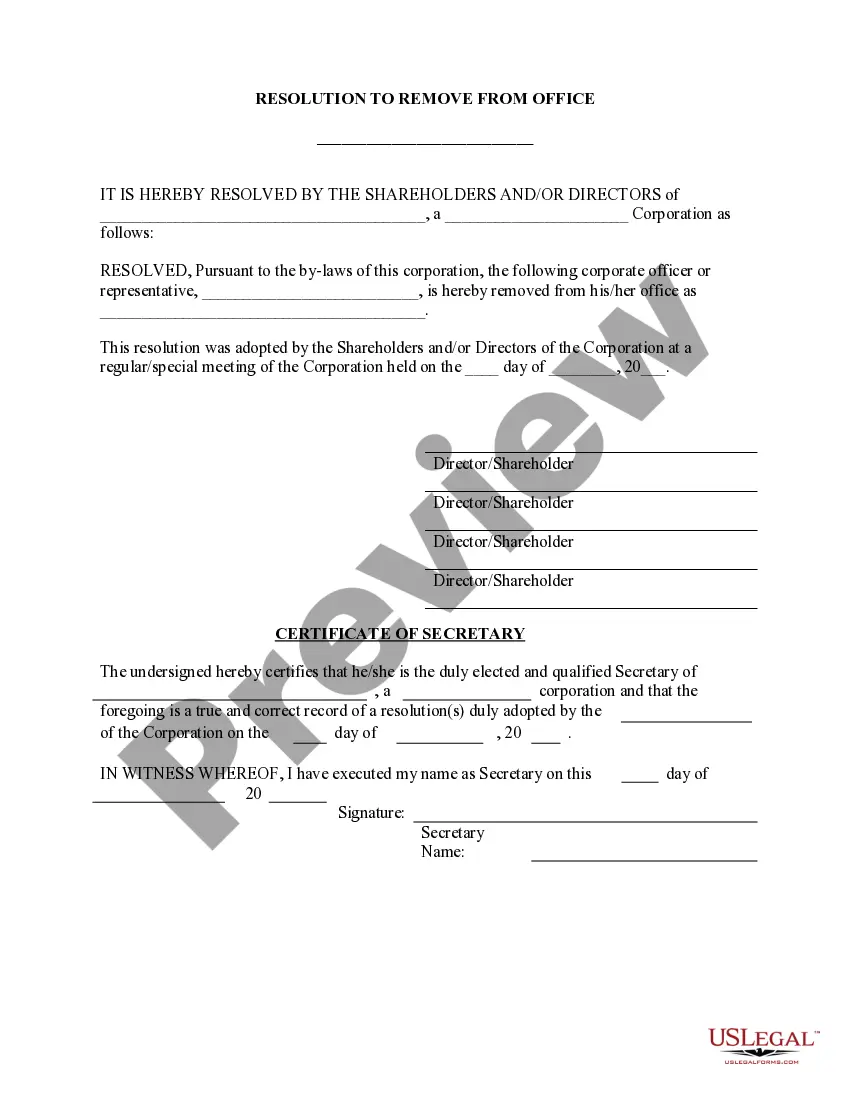

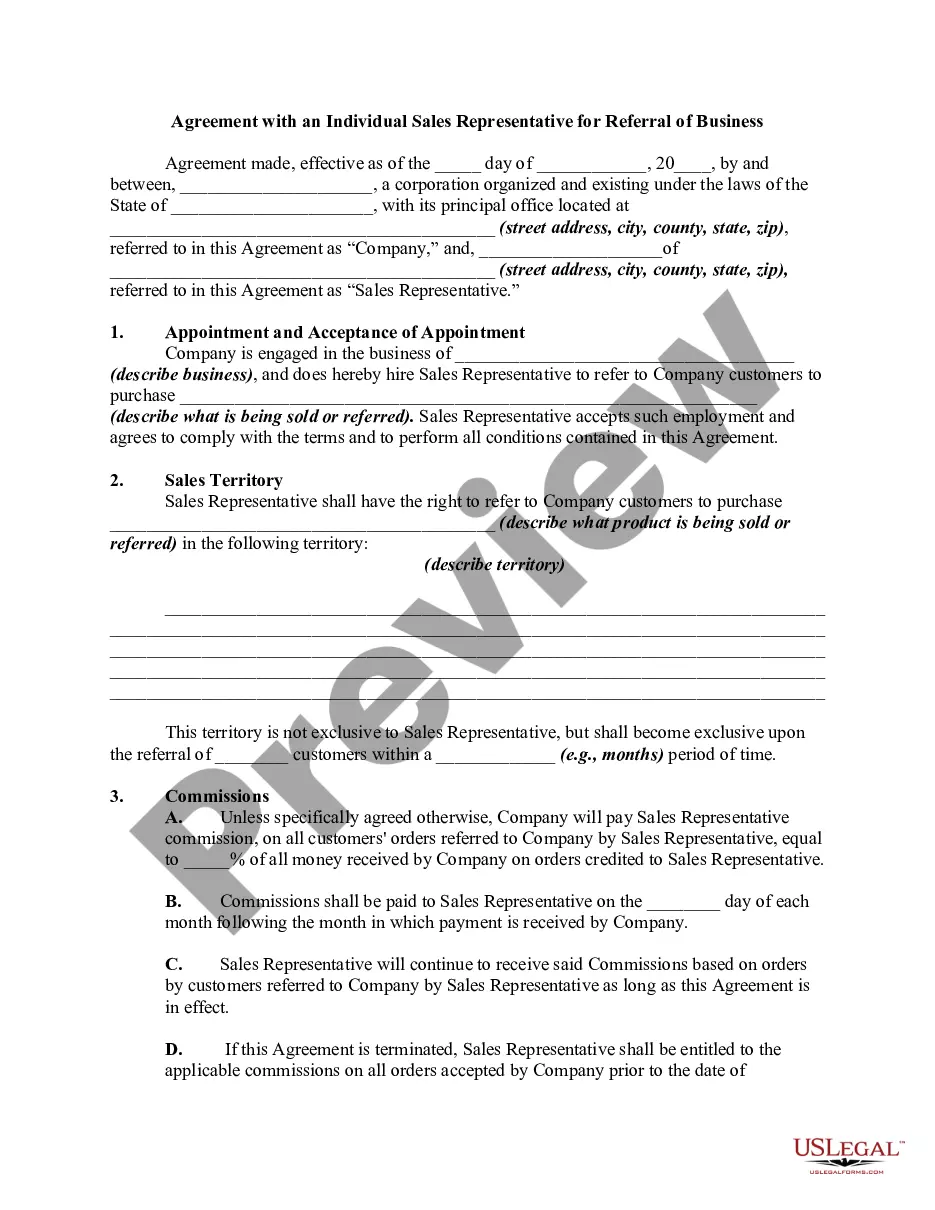

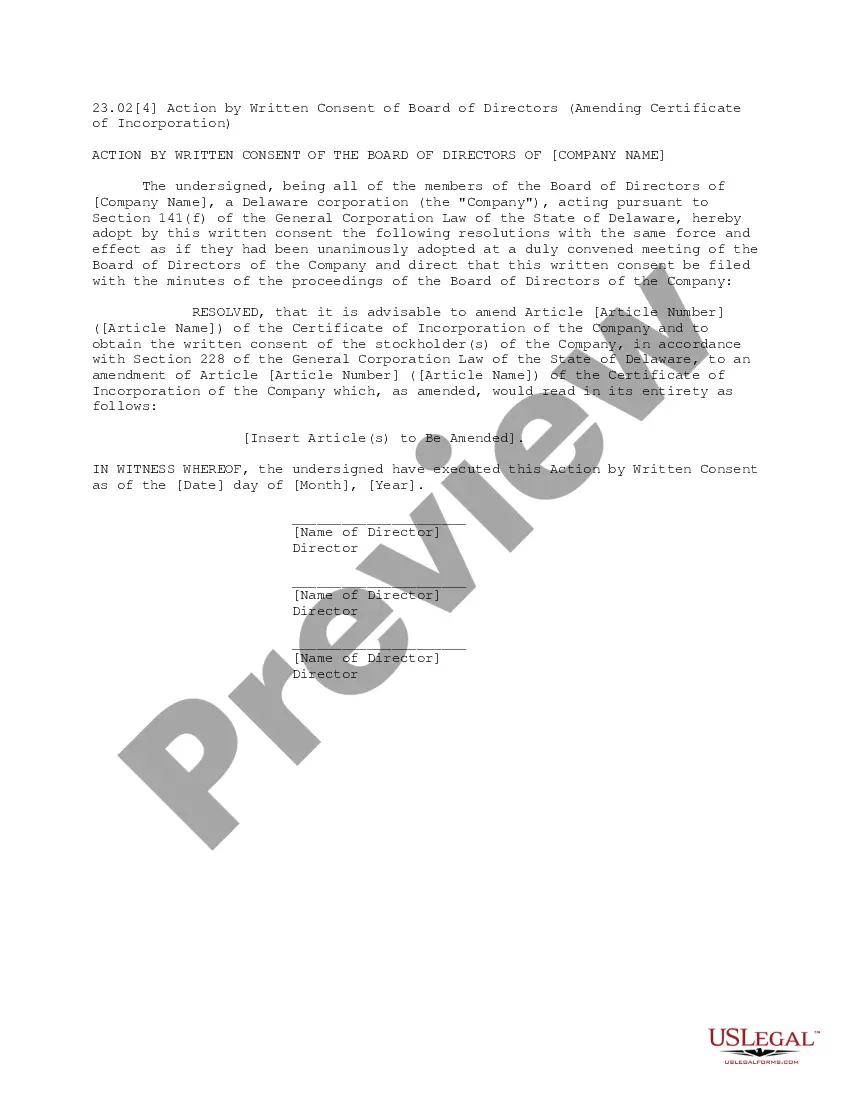

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

Factoring companies will typically run a background check. While less-than-perfect backgrounds can be approved for factoring, certain violent or financial crimes may be disqualifying.

The Most Common Invoice Factoring Requirements A factoring application. An accounts receivable aging report. A copy of your Articles of Incorporation. Invoices to factor. Credit-worthy clients. A business bank account. A tax ID number. A form of personal identification.

How to write a business contract Determine why you need a contract. Define all applicable parties. Include all essential elements of a contract. Select the appropriate governing law and jurisdiction. Write everything in plain language. Use repeatable language and formats when possible. Use tables, lists, and other tools.