Stock With Equity In Wayne

Description

Form popularity

FAQ

A 20% equity stake means you own 20% of a company. This means you have a right to 20% of the company's profits and assets. If the company were to be sold, you would be entitled to 20% of the proceeds.

Equity includes stocks as well as other tangible assets excluding debt. While it's possible to trade stocks, not all equities can be traded. In other words, equity is generally not freely tradable in the market since it directly affects the holding of a business entity but stocks can be traded in the market.

Stock ownership gives shareholders access to potential capital gains and dividends. It may also give shareholders voting rights during the elections for the board of directors or other corporate activities. Other terms like shareholders' equity, book value, and net asset value are often used to describe equity.

What is Equity? The term “equity” refers to fairness and justice and is distinguished from equality: Whereas equality means providing the same to all, equity means recognizing that we do not all start from the same place and must acknowledge and make adjustments to imbalances.

Equity is simply the value of an investor's stake in a company. It is represented by the value of shares an investor owns. Stock ownership gives shareholders access to potential capital gains and dividends.

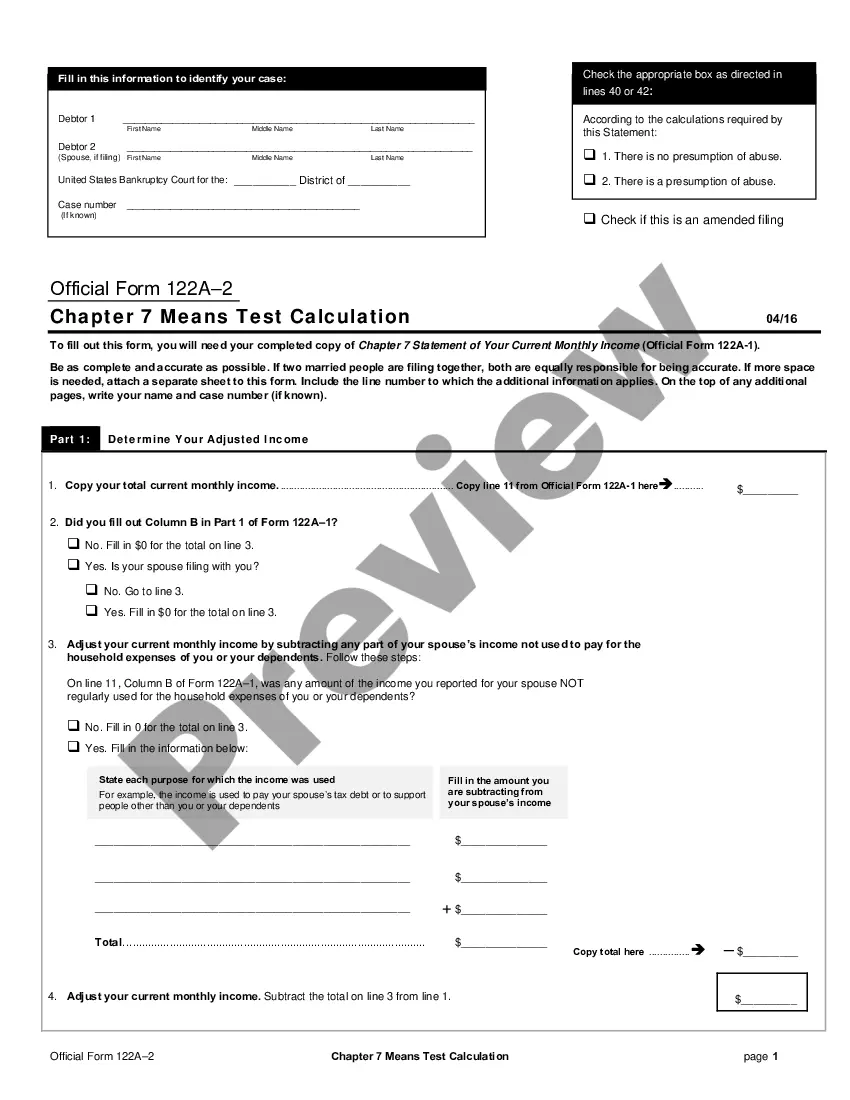

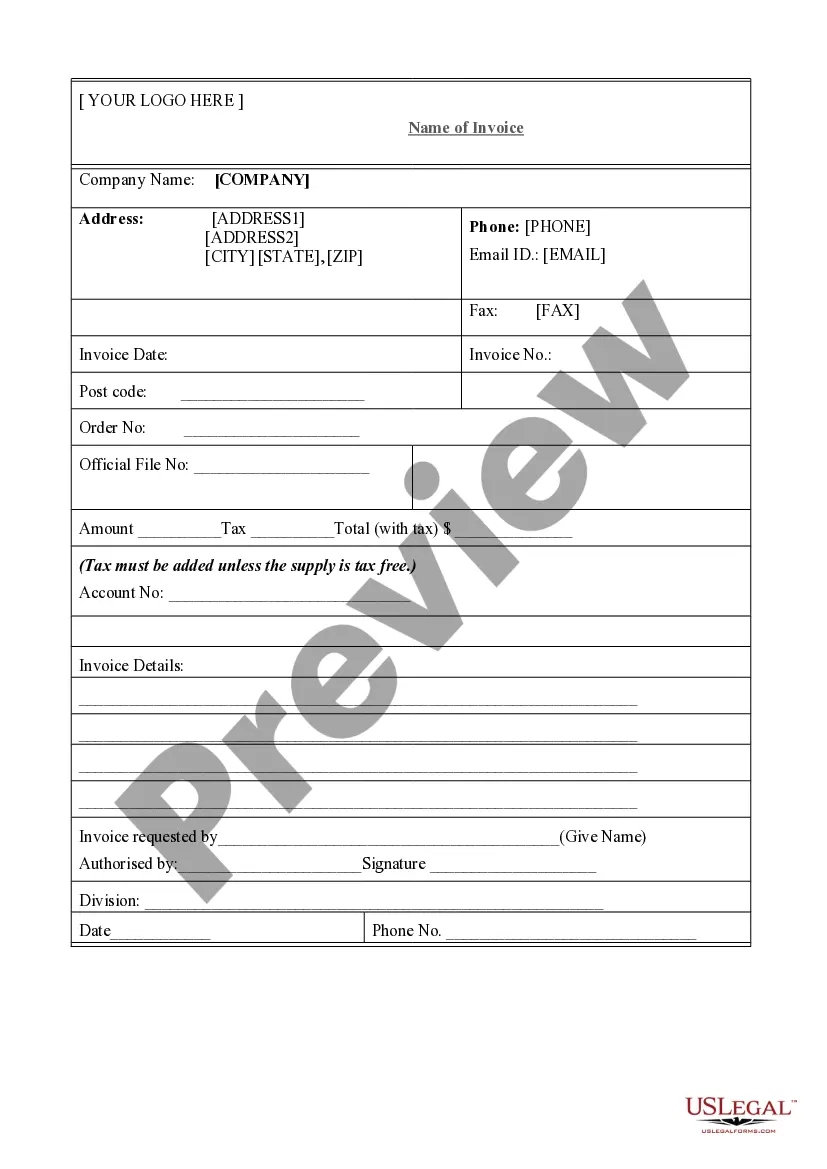

You may have to report compensation on line 1a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors and capital gain or loss on Schedule D (Form 1040), Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when you sell the stock.

You should report a long-term gain on Schedule D of Form 1040. A short-term gain will typically appear in box 1 of your W-2 as ordinary income, and you should file it as wages on Form 1040.

Steps For Filing ITR Through The New Income Tax Portal Log into the portal with your PAN card. Verify your bank details already saved with the portal or add the details if you are doing it for the first time. Go to the File Return Tab. The next step is to Find the right ITR form and start filing it.

If you have income from capital gains from equity shares, mutual funds, or house property, you need to show it in the income tax return. Taxpayers with capital gains income must select ITR-2 while filing an income tax return for AY2024-25.

Selecting a relevant schedule for reporting capital gains in ITR is very important. The long-term capital gains from equity-oriented mutual funds need to be reported in 'Schedule 112A'. If you have short-term capital gains, that needs to be reported in Schedule CG.