Cost Sharing Contract Example Withholding Tax In Wayne

Description

Form popularity

FAQ

A taxpayer makes the election by checking box 5a on Schedule A of Form 1040. If you elect to deduct state and local general sales taxes, you can use either your actual expenses or the optional sales tax tables.

Don't deduct the withholding tax from the value on the invoice. If you need to show the value of the withholding tax, you can do this by adding a comment or additional text. Don't show the tax as a negative value invoice line item as the income will not be accounted for in full.

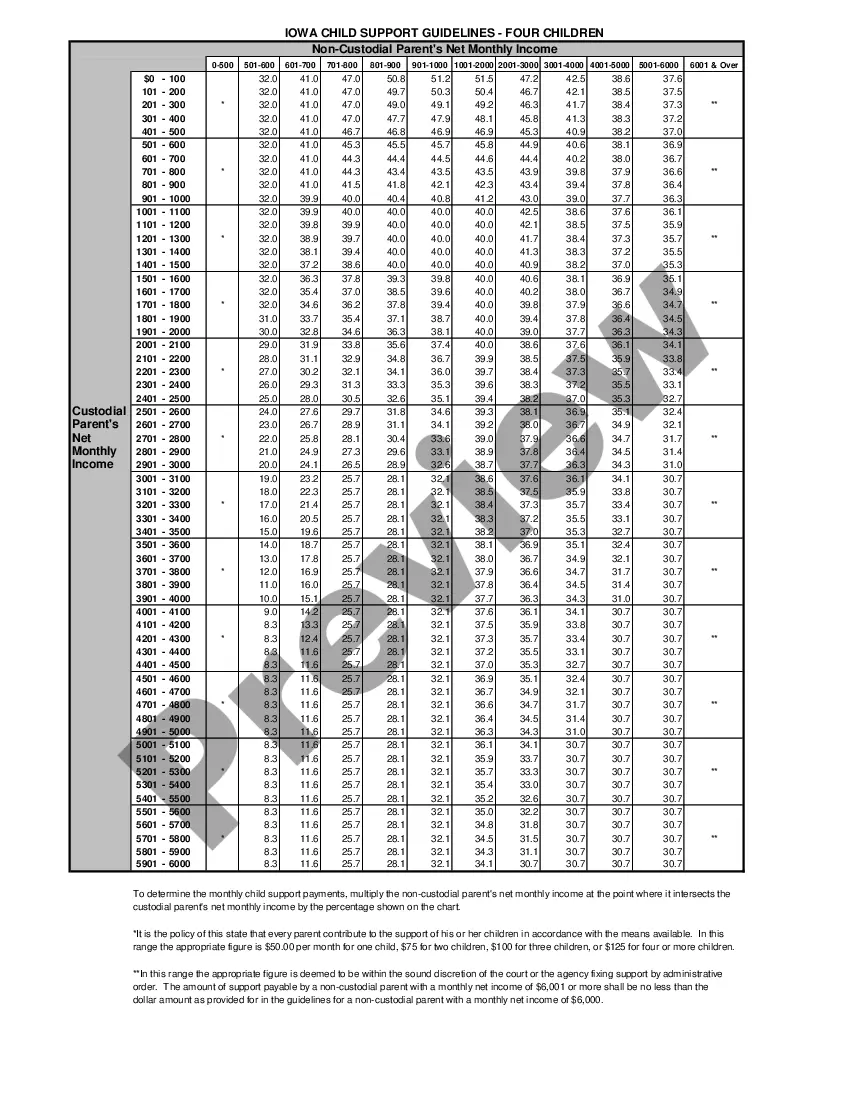

State income tax (SIT) withholding StateWithholding rate California 6.6% - 10.23% Colorado 4.63% Connecticut No supplemental rate Delaware No supplemental rate47 more rows

To apply the state tax rate, find the appropriate rate for your taxable income bracket. Multiply your taxable income by this rate to calculate the amount of state income tax you owe. For example, if your taxable income is $50,000 and your state tax rate is 5%, you would owe $2,500 in state income tax.

The Withholding Tax Rate in Kenya stands at 25 percent. Withholding Tax Rate in Kenya averaged 25.00 percent from 2022 until 2024, reaching an all time high of 25.00 percent in 2023 and a record low of 25.00 percent in 2023. In Kenya, the withholding tax rate is a tax collected from companies.

10% if gross income exceeds 3M • 5% if otherwise (or does not exceed 3M) • On the gross professional, promotional and talent fees or any other form of remuneration for the services rendered.

New York State payroll taxes Calculating taxes in New York is a little trickier than in other states. The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

Tax Sharing Agreements This allows companies leaving the tax group (for example on a sale to a third party) to rely on the 'clear exit' rule which limits that leaving company's exposure to the joint and several tax liabilities of the whole group.