Equity Shares For Long Term In Travis

Description

Form popularity

FAQ

Long-term capital gains (LTCG) tax on shares applies to profits made from selling equity shares held for more than one year. Under the current tax regime, gains exceeding Rs. 1.25 lakh in a financial year are taxed at a rate of 12.5%. This change aims to provide a uniform tax structure for all financial assets.

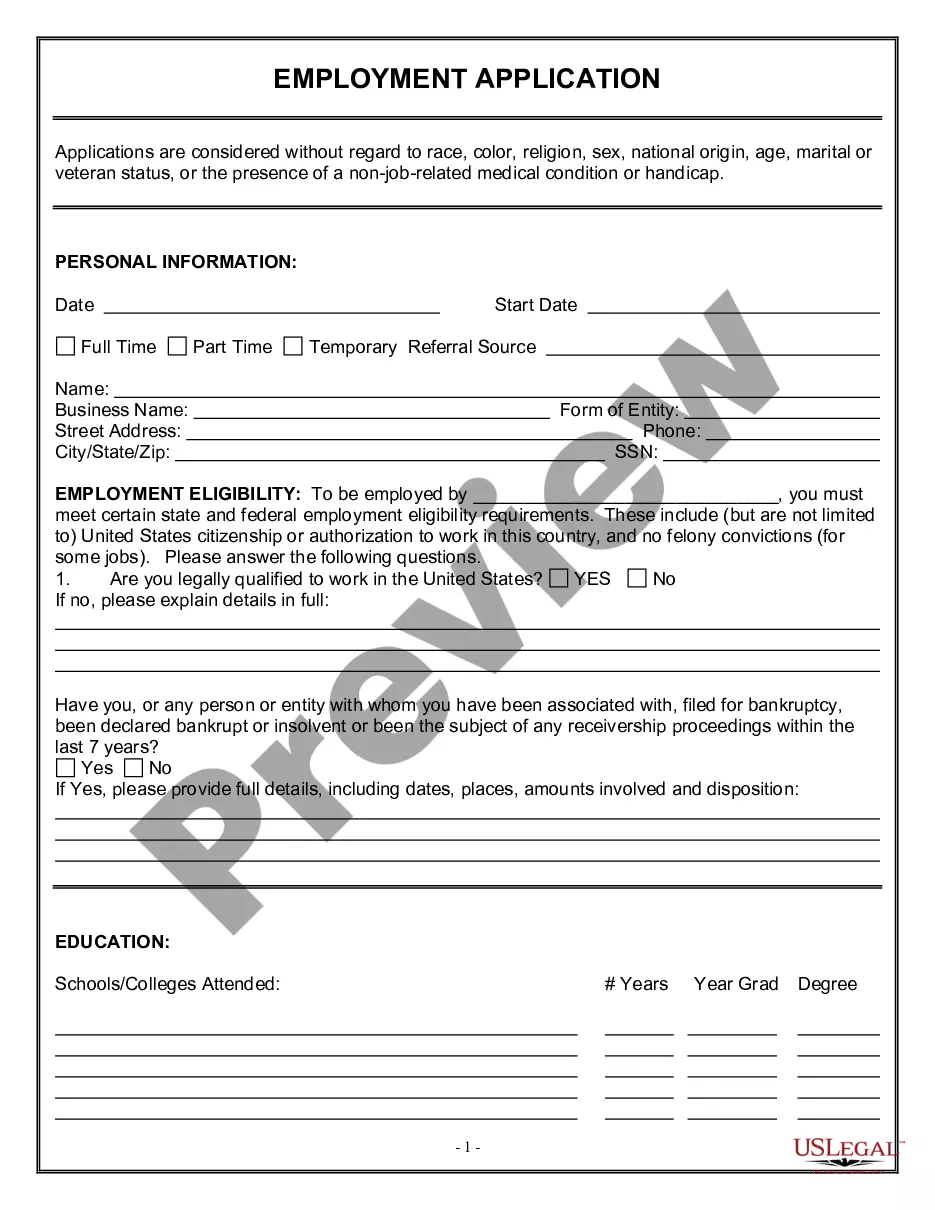

You should report a long-term gain on Schedule D of Form 1040. A short-term gain will typically appear in box 1 of your W-2 as ordinary income, and you should file it as wages on Form 1040.

Generally, if you hold the asset for more than one year before you dispose of it, your capital gain or loss is long-term. If you hold it one year or less, your capital gain or loss is short-term.

Selecting a relevant schedule for reporting capital gains in ITR is very important. The long-term capital gains from equity-oriented mutual funds need to be reported in 'Schedule 112A'. If you have short-term capital gains, that needs to be reported in Schedule CG.

If you have income from capital gains from equity shares, mutual funds, or house property, you need to show it in the income tax return. Taxpayers with capital gains income must select ITR-2 while filing an income tax return for AY2024-25.

Steps For Filing ITR Through The New Income Tax Portal Log into the portal with your PAN card. Verify your bank details already saved with the portal or add the details if you are doing it for the first time. Go to the File Return Tab. The next step is to Find the right ITR form and start filing it.

Here is how investors can invest in long term stocks in India: Open a Demat/Trading/Brokerage account. Conduct thorough research into the stocks that may seem suitable to you for the leng term. Place a 'Buy' order on the long term stocks of your choosing. Monitor your investments regularly.

The S&P 500 has returned more than 10% per year on average. This is true for that benchmark index of U.S. stocks over both the past 10 years and over the past several decades. The average stock market return, as measured by the S&P 500 index, is about 11% over the last 10 years, ing to S&P Dow Jones Indices.

Steps to buy shares in Upstox Log in to the upstox pro website or mobile app. Transfer funds from your bank to trading account. In the watchlist, search for the desired company. Enter order details like quantity, order type, position, validity etc. Review and confirm the order.

Generally, a 10% return is seen as a good return on an investment and can be seen as a sign of a healthy portfolio. However, it is important to remember that past performance is not indicative of future performance, and investments can always be subject to market volatility.