Cost Sharing Contract Example Withholding Tax In Texas

Description

Form popularity

FAQ

For Texas purposes, COGS includes the costs of acquiring or producing goods. In addition, the taxpayer must be selling real or tangible personal property in the ordinary course of business and not intangible property. Services are specifically excluded from COGS.

Texas also provides sales tax exemptions on contractor labor when the real property repair or improvement is for a certain purpose. For example, Texas exempts labor charges to repair nonresidential property damaged by a declared natural disaster.

For most businesses, the franchise tax rate on taxable margin is 0.75%. However, for businesses primarily engaged in retail or wholesale trade the tax rate is 0.375%, reflecting the lower profit margins of these businesses.

Texas does not require state income tax withholding on earnings.

Can Form 05-102, Public Information Report, be electronically filed separately for a Texas Franchise Tax return in CCH Axcess™ Tax or CCH® ProSystem fx® Tax? For REPORT YEARS 2023 and prior, the Form 05-102 can only be e-filed as part of the Texas Franchise Tax return.

Amending a Return Follow the instructions on the form used to file the original return. Write "Amended Return" on the top of the form. You can also electronically file an amended return, even if it reduces the tax due of the original return filed. Additional documentation may be requested to validate your request.

You can file your entity's franchise tax and information reports using: our Webfile system; approved third-party software; or. downloadable paper forms that you may complete, print and mail to the Comptroller's office.

Each taxable entity formed as a corporation, limited liability company (LLC), limited partnership, professional association and financial institution that is organized in Texas or has nexus in Texas must file Form 05-102, Texas Franchise Tax Public Information Report (PIR) annually to satisfy their filing requirements.

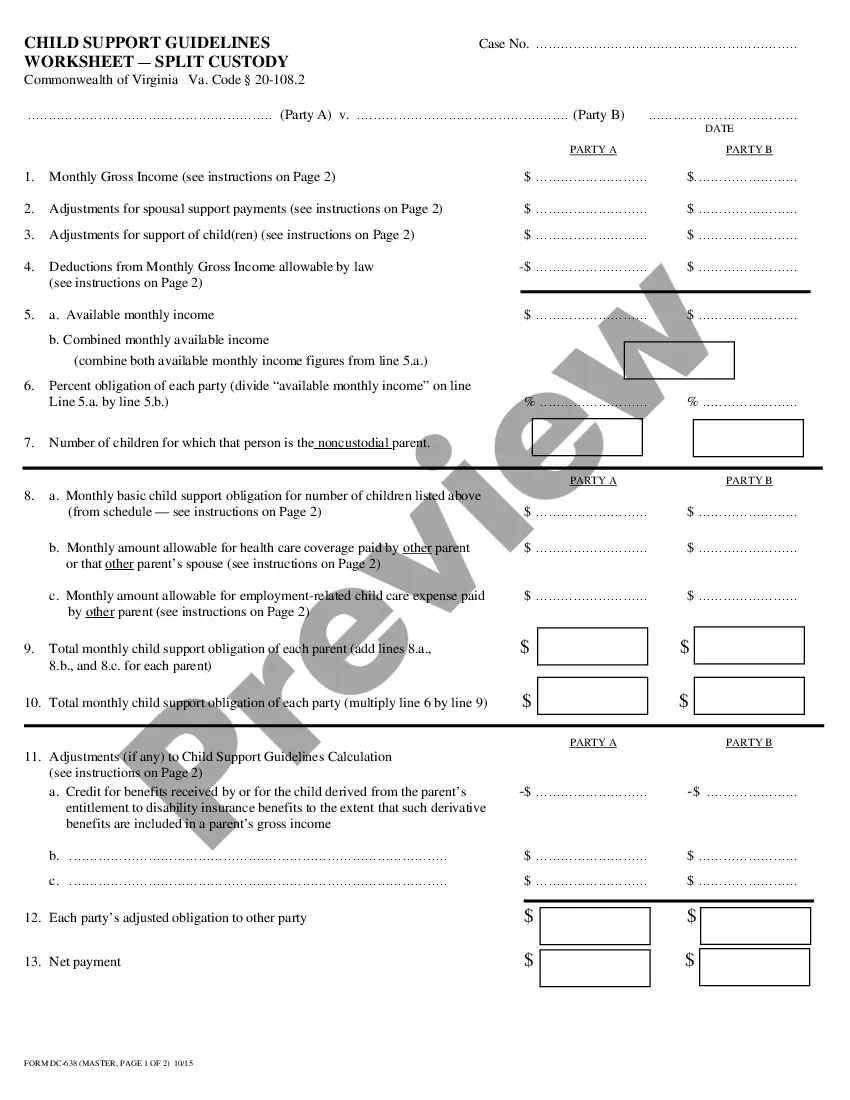

Deductions include a total of 1 8.97% (or $5,218.02) for the federal income tax, 2 0.00% (or $0.00) for the state income tax, 3 6.20% (or $3,605.05) for the social security tax and 4 1.45% (or $843.12) for Medicare. The Federal Income Tax is collected by the government and is consistent across all U.S. regions.