Equity Agreement Contract With Security Agency In Tarrant

Description

Form popularity

FAQ

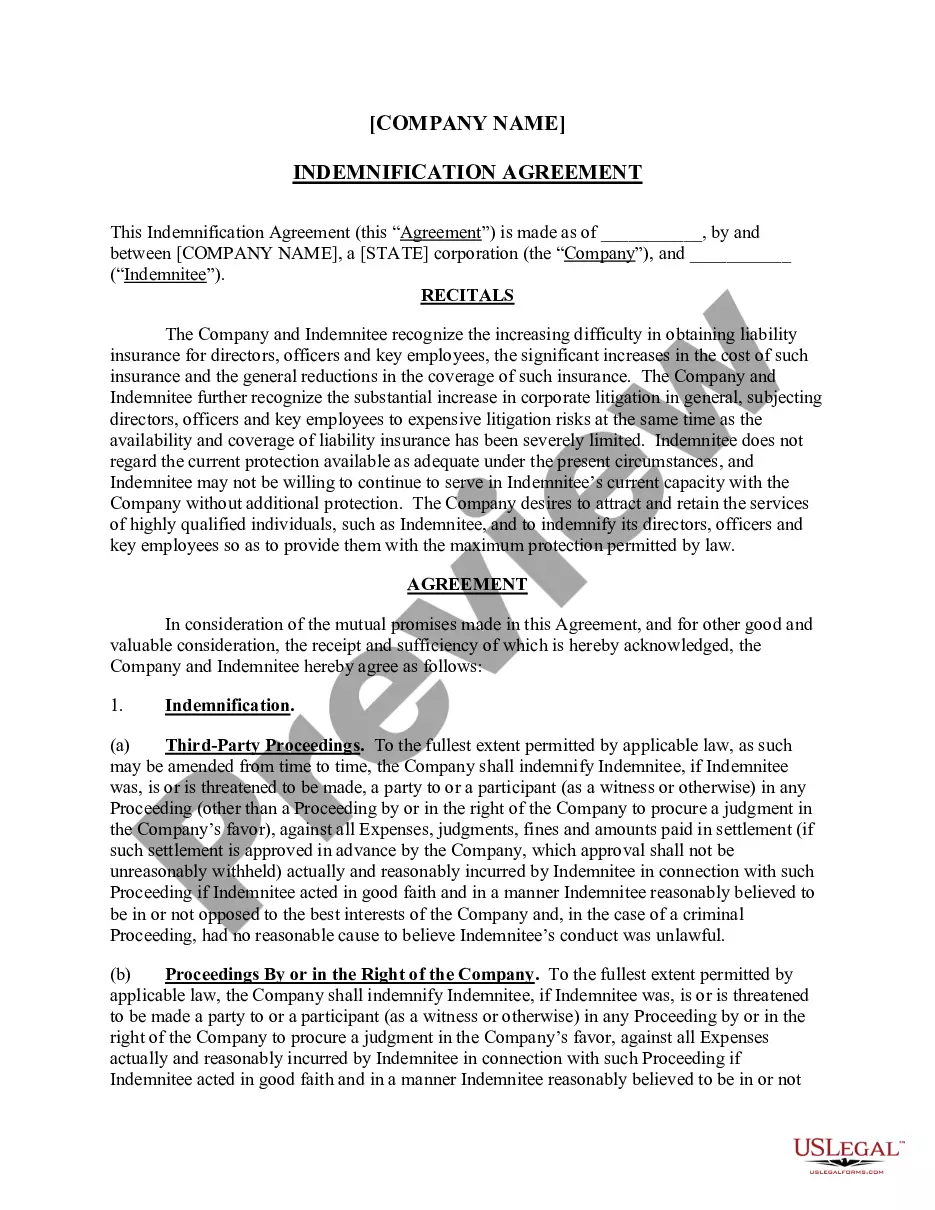

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

The Debtor Authenticates a Security Agreement For purposes of attachment, the debtor must "authenticate" a security agreement. In other words, the debtor must sign the written agreement that gives the secured party an interest in the collateral.

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Perfection can be achieved through different methods depending on the type of collateral the security interest is attached to, with the most common methods being: filing, possession, and control.

Enforcing the security agreement You can also file a Unified Commercial Code-1 (UCC-1) statement with your state, which acts as a lien on the property. Check with your state's Secretary of State, or government agency that regulates businesses, to get a UCC-1 form, as each state has its own unique document.

Under the UCC, a pledge agreement is a security agreement. The nature of the pledged assets means that a pledge agreement may contain different representations and warranties and covenants than a security agreement over business assets (for example, voting rights).

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.