Finance On Property In Phoenix

Description

Form popularity

FAQ

The City of Phoenix, Arizona has been labeled as one of the most livable cities in the United States. It is no wonder why, with a variety of restaurants, stores, and attractions to choose from, as well as an average temperature of 73 degrees, Phoenix residents have everything they need to enjoy a good quality of life.

Find a Meetup. join a professional org based on your industry, culture, interests. Join a local sports league like kickball, volleyball. All ways I found friends. And had fun experiencing phx.

As the fifth-largest city in the nation, Phoenix has something for everyone. Beautiful weather and a bustling metropolis provide Sun Devils with places to eat and hang out, nearly endless outdoor activities, and career and internship opportunities you just can't find in smaller cities.

Phoenix at a Glance It's the most populous state capital in the nation, the fifth most populous city in the U.S., and the most populous city in the state of Arizona. The median age is 34.4 (lower than the national median of 38.3), and the median household income is $72,092, ing to the U.S. Census Bureau.

Prospective real estate investors should consider owning a Phoenix investment property. With its tourism, growing population, perfect weather, and growing economy, Phoenix properties have the potential of being quite profitable.

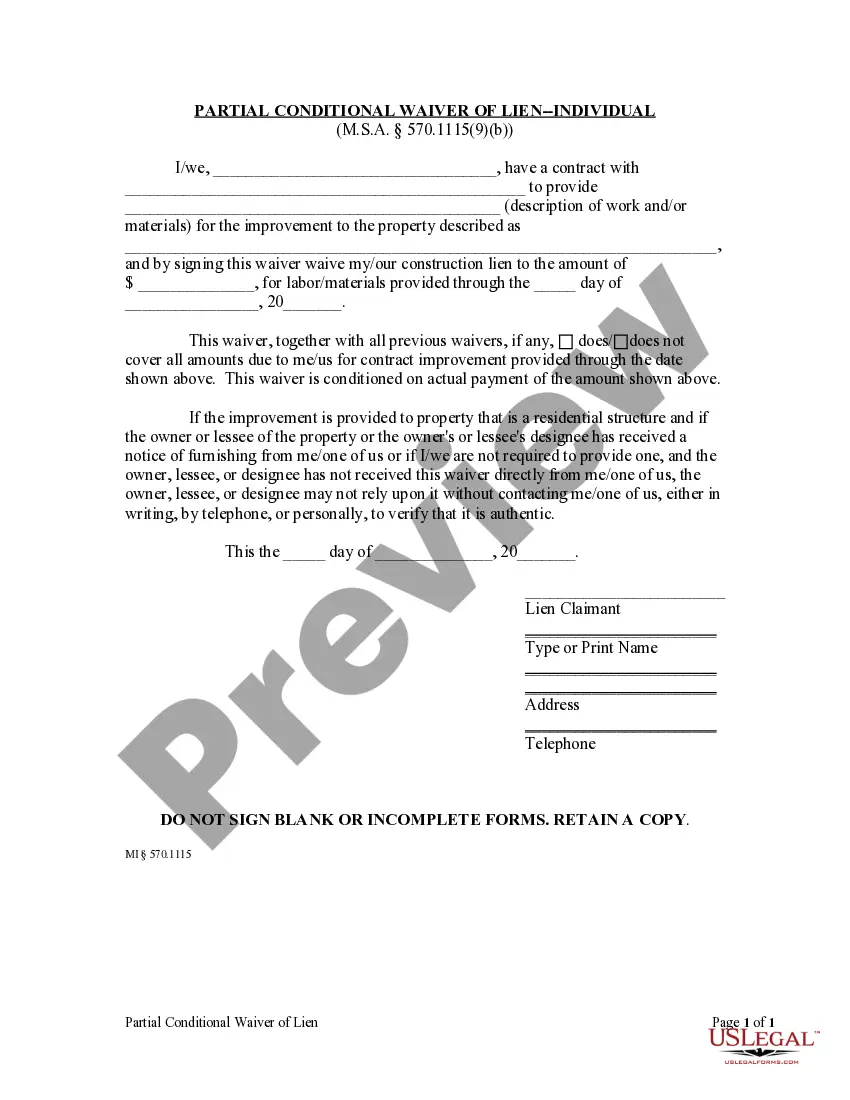

To attach the lien, the creditor files and records a judgment with the county recorder in any Arizona county where the debtor owns property now or where they may own property in the future.

If a notice has not been recorded, however, you will have 120 days after the completion of the project to record the claim. Once your lien claim form has been properly filled out and notarized, you will have to file it at the Arizona county recorder's office where the property being liened is located.

Determine your budget and calculate how much you can afford to spend on a house. Research and explore different mortgage lenders as well as financing options, such as conventional, FHA, VA, and USDA loans. Get pre-approved for a mortgage to strengthen your offer and streamline the buying process.