Startup Equity Agreement With Clients In Nassau

Description

Form popularity

FAQ

A company provides you with a lump sum in exchange for partial ownership of your home, and/or a share of its future appreciation. You don't make monthly repayments of principal or interest; instead, you settle up when you sell the home or at the end of a multi-year agreement period (typically between 10 and 30 years).

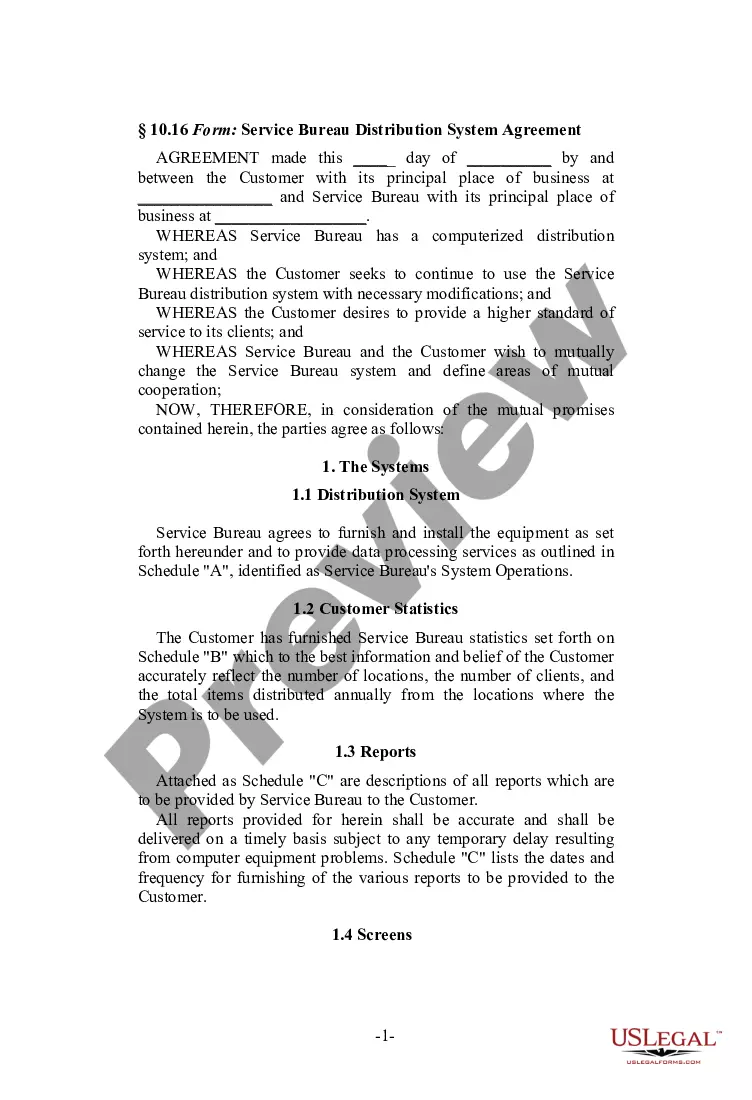

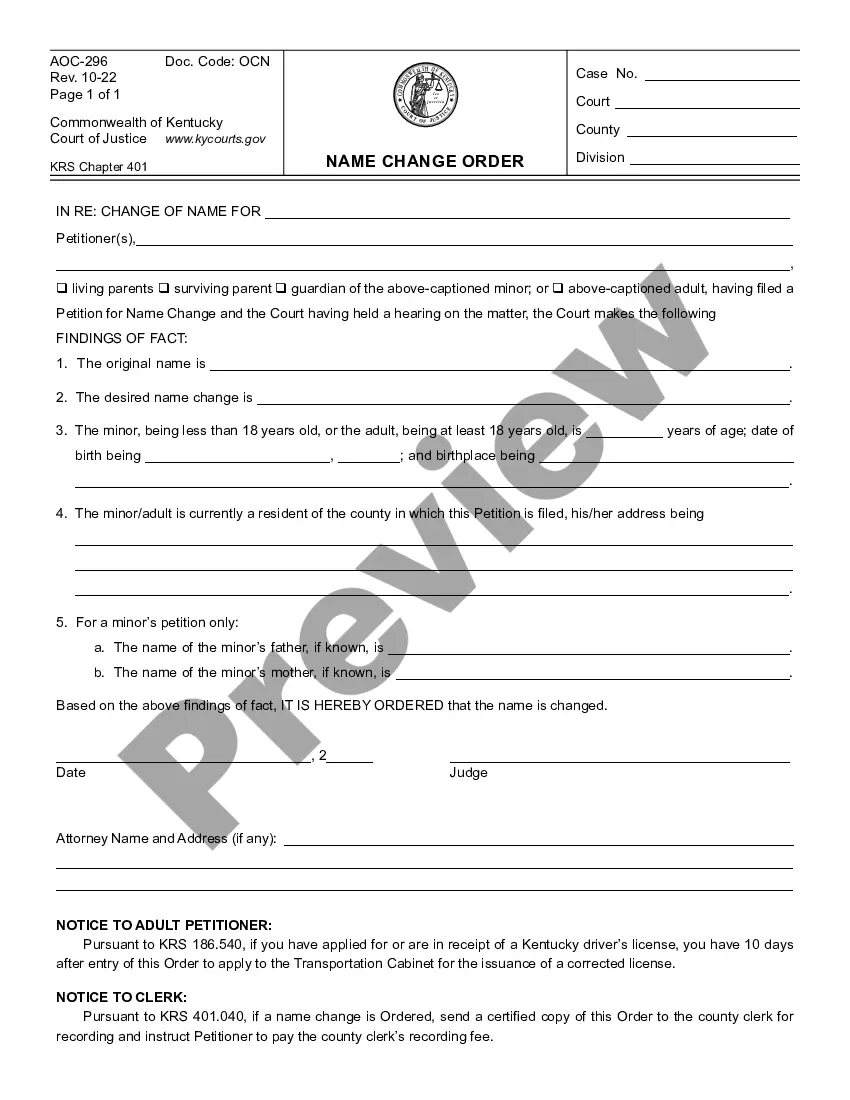

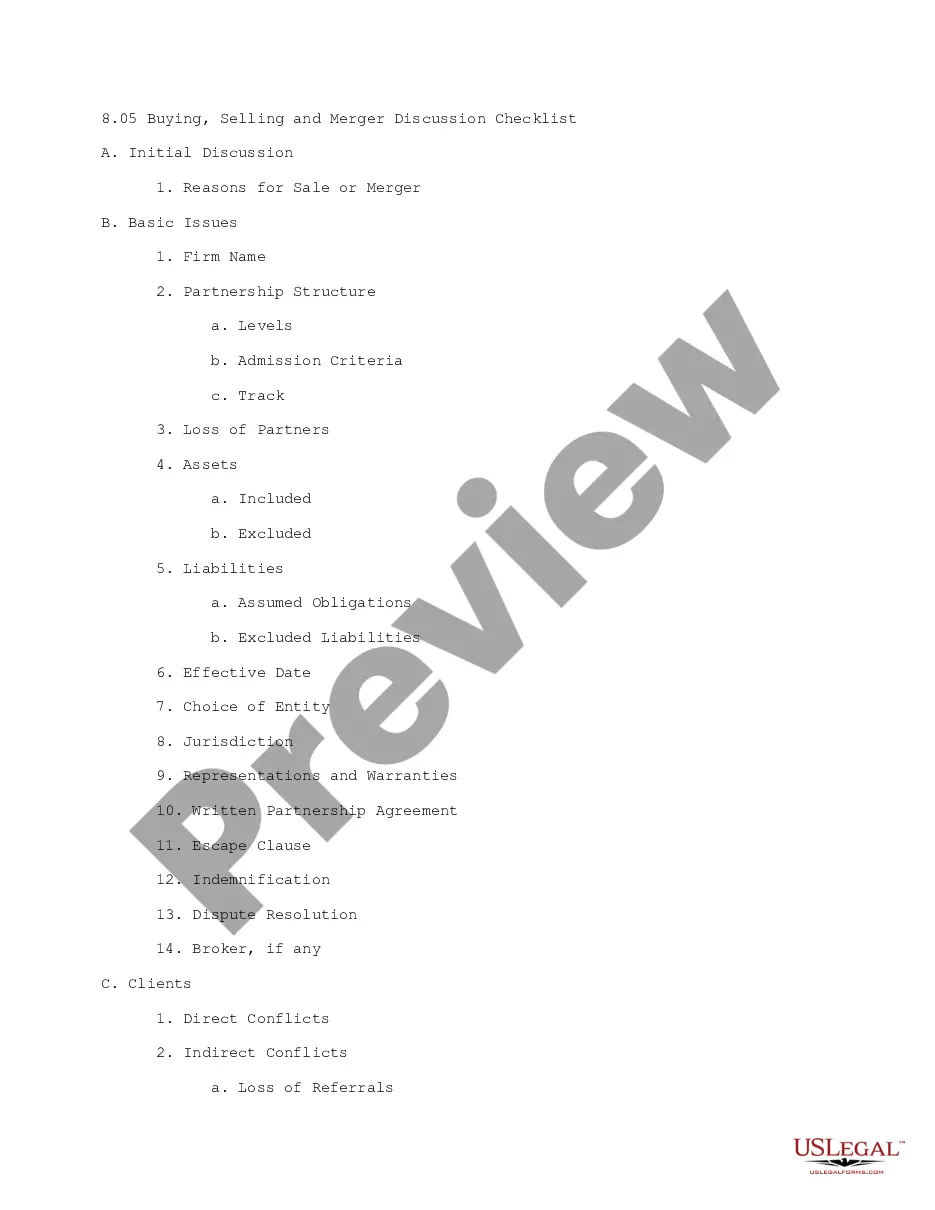

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Equity agreements are a cornerstone for startups, providing a solid foundation for their business endeavors while ensuring fairness and clarity in equity distribution. Understanding the legal aspects and best practices of equity agreements is crucial for the long-term success and stability of startups.

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

Different ways to split equity among cofounders Equal splits. Weighted contributions. Dynamic or adjustable equity. Performance-based vesting. Role-based splits. Hybrid models. Points-based system. Prenegotiated buy/sell agreements.

Startups typically allocate 10-20% of equity during the seed round in exchange for investments ranging from $250,000 to $1 million. The percentage and amount can be dependent on the company's stage, market potential, and the extent of capital needed to achieve initial milestones.

As a rule of thumb, a non-founder CEO joining an early-stage startup (that has been running less than a year) would receive 7-10% equity. Other C-level execs would receive 1-5% equity that vests over time (usually 4 years).

In summary, 1% equity can be a good offer if the startup has strong potential, your role is significant, and the overall compensation package is competitive. However, it could also be seen as low depending on the context. It's essential to assess all these factors before making a decision.

Angel and venture capital investors are great, but they must not take more shares than you're willing to give up. On average, founders offer 10-20% of their equity during a seed round. You should always avoid offering over 25% during this stage. As you progress beyond this stage, you will have less equity to offer.