Shared Equity Agreements For Startups In Nassau

Description

Form popularity

FAQ

In summary, 1% equity can be a good offer if the startup has strong potential, your role is significant, and the overall compensation package is competitive. However, it could also be seen as low depending on the context. It's essential to assess all these factors before making a decision.

Different ways to split equity among cofounders Equal splits. Weighted contributions. Dynamic or adjustable equity. Performance-based vesting. Role-based splits. Hybrid models. Points-based system. Prenegotiated buy/sell agreements.

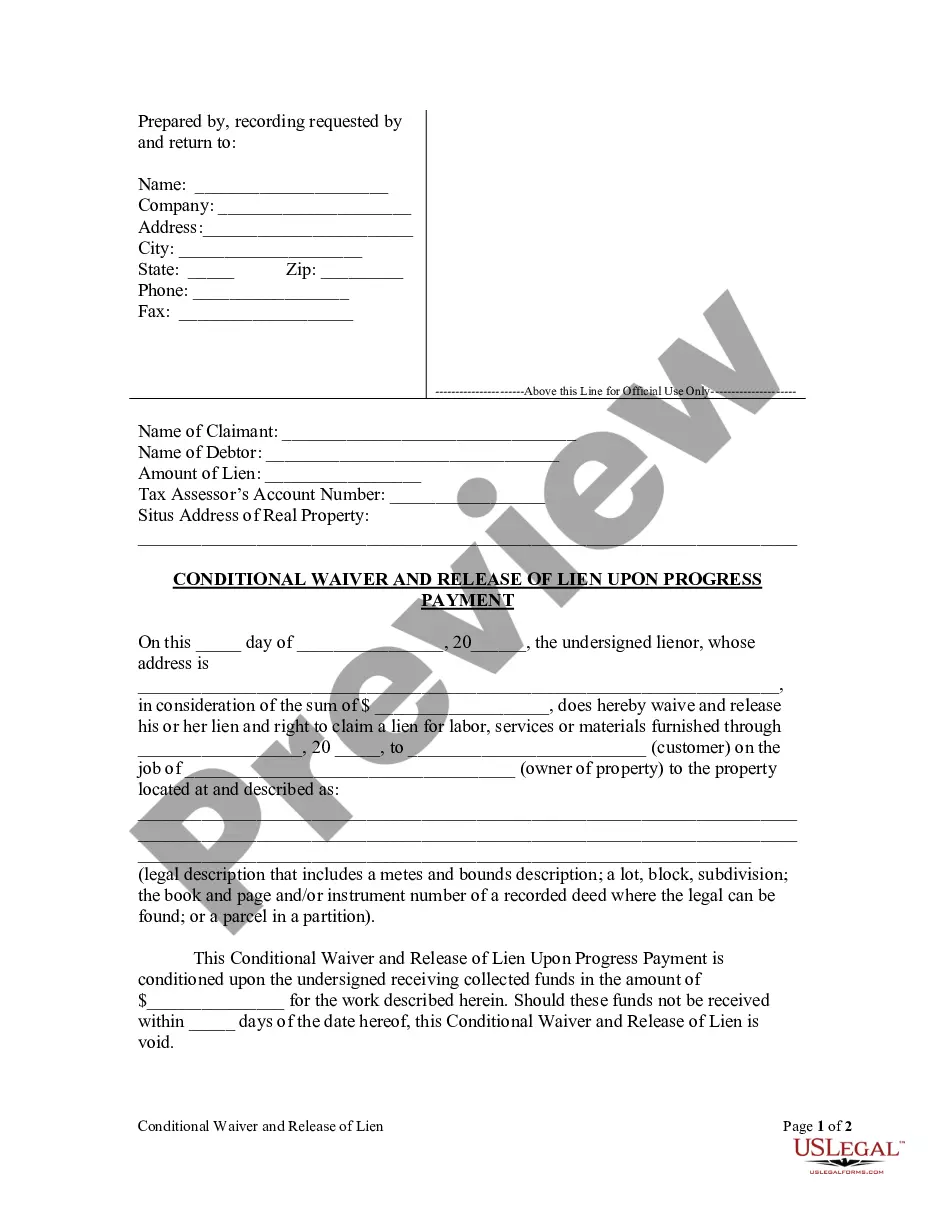

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

These agreements let you access funds in exchange for a share of your property's future appreciation. Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page.

Equity agreements are a cornerstone for startups, providing a solid foundation for their business endeavors while ensuring fairness and clarity in equity distribution. Understanding the legal aspects and best practices of equity agreements is crucial for the long-term success and stability of startups.

Investing in equity shares is a great idea. The reason is that an equity share indicates that you have a certain percentage of equity in the company. Thus, the returns you get are directly linked to the profits of the company. This makes it a great option as the opportunity to earn a good return is high.